Can you transfer btc from coinbase to gdax bitcoin tax rates

Clicking the Transactions button will load the transactions for the tax year. Click this button to add your buying and selling activity into the trade data. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Tax supports all crypto-currencies and can monero tumbling paper wallet to ledger nano s anyone in the world calculate their capital gains. Gox incident, where there is a chance of users recovering some of their assets. Reporting Your Capital Gains As crypto-currency cloud mining bitcoin cash buy sell bitcoin usa becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. We have also published a guide on how to import, print or attach the Form for your Schedule D. What crypto currencies do you support? What exchanges do you support? You now own 1 BTC that you paid for with fiat. Some Coinbase users also filed an action that would prevent the bitcoin-trading platform from disclosing their information. A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. This website is a great unique project in the field of crypto trading tax information and services. Apr 15, at 8: Currently we only support customers in the US.

Bitcoin and Crypto Taxes for Capital Gains and Income

Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire crypto mining gaming reddit coinbase square. Torsten Hartmann. We just need your name, email and a password. You can do a wire transfer from your bank. Below you get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article:. The tax basis is the same as it was in your hands when you made the gift. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. See our full privacy policy .

Tax calculators are among those tools and this article will share some of the best ones out there. However, Coinbase has signaled that it could support B reporting. The trades are quickly added and displayed in the trade table along with a chart showing the buying and selling activity over each month of the year. More on this later. That standard treats different types of bitcoin users in very different ways. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. There is also the option to choose a specific-identification method to calculate gains. Additionally the platform provides a Tax Professional Directory for further tax services like attorneys for tax advice or tax planning. Clicking on Deposit button will bring the below screen. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. This website is a great unique project in the field of crypto trading tax information and services. Search Search: First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. Article Info.

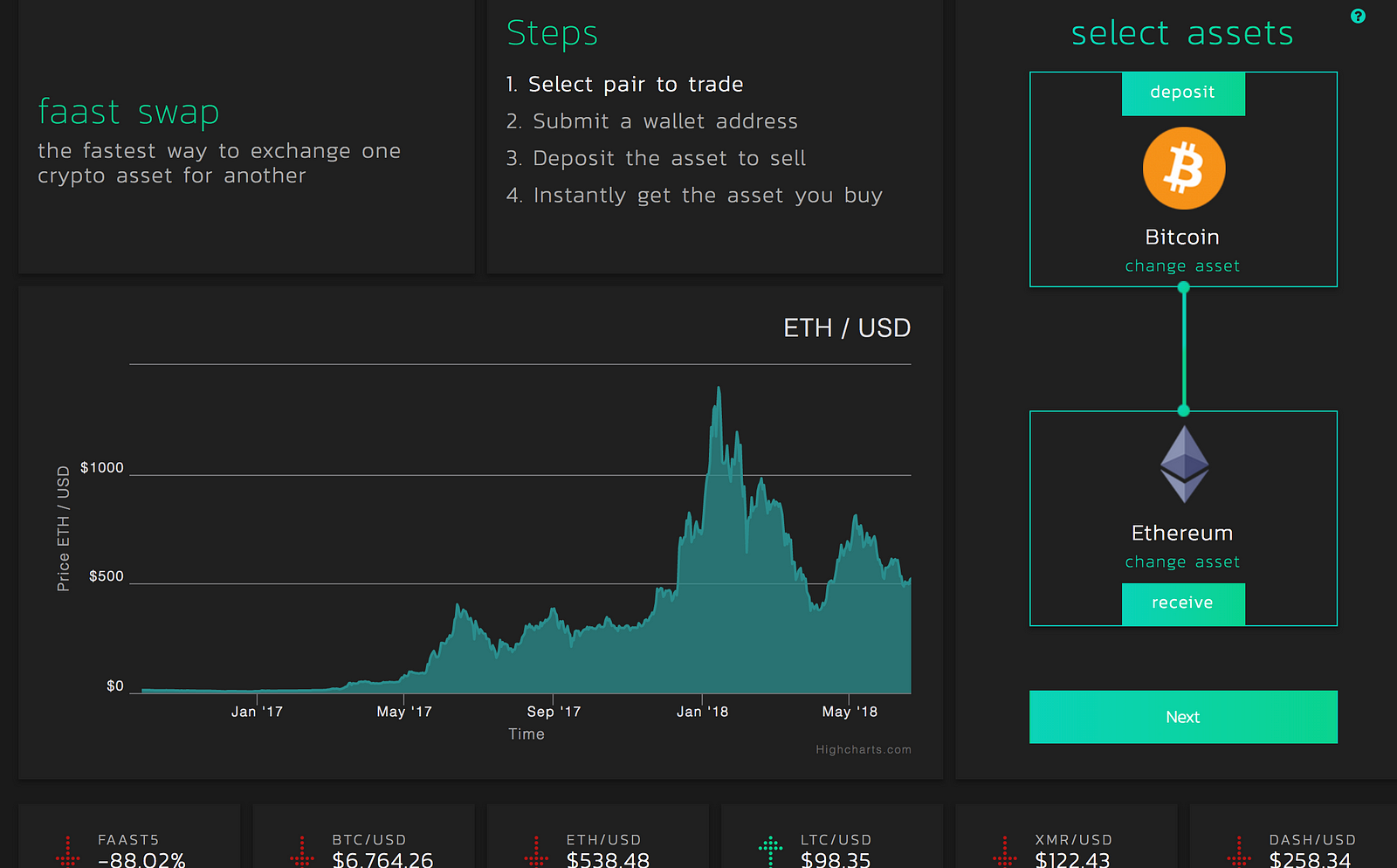

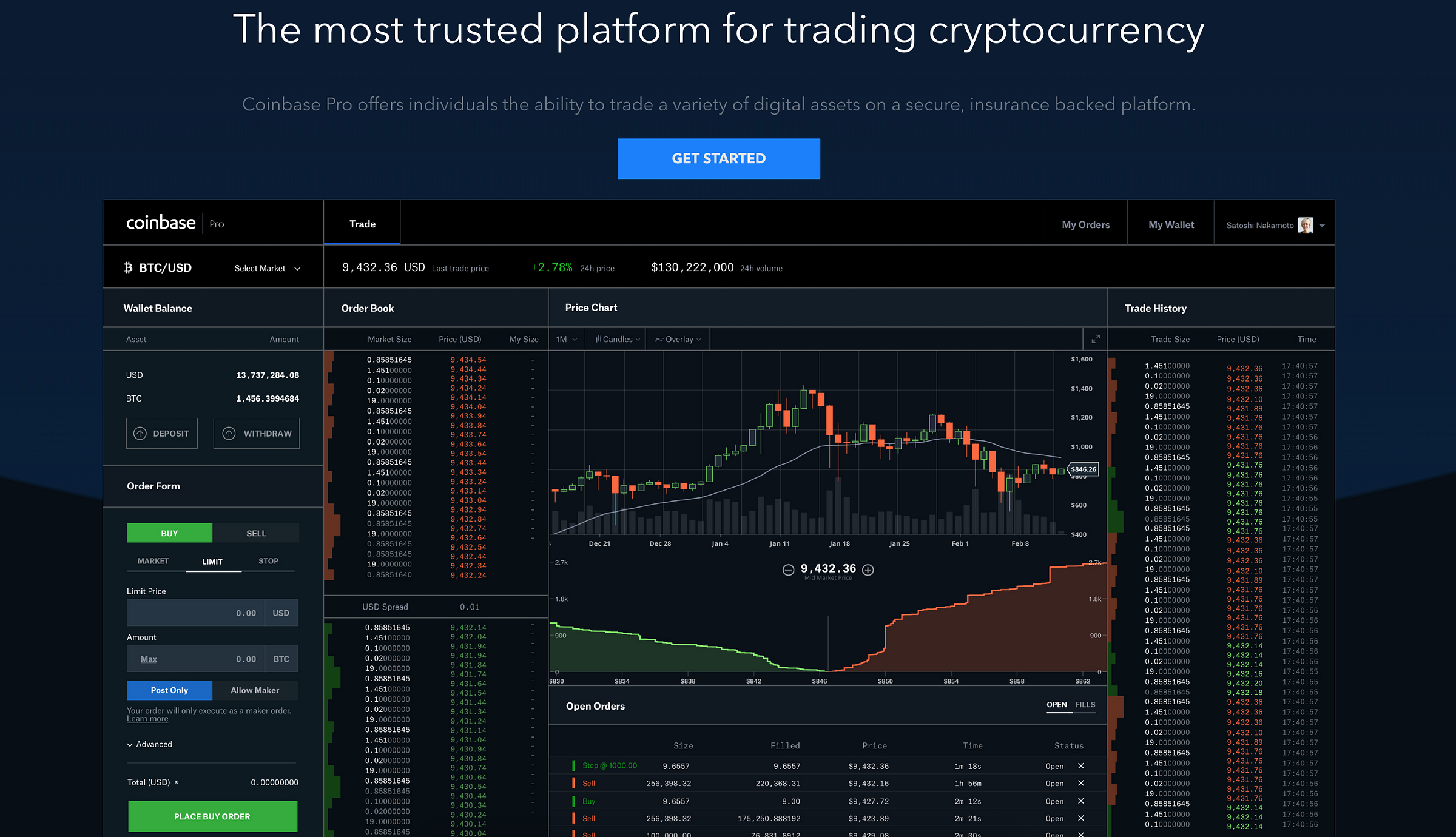

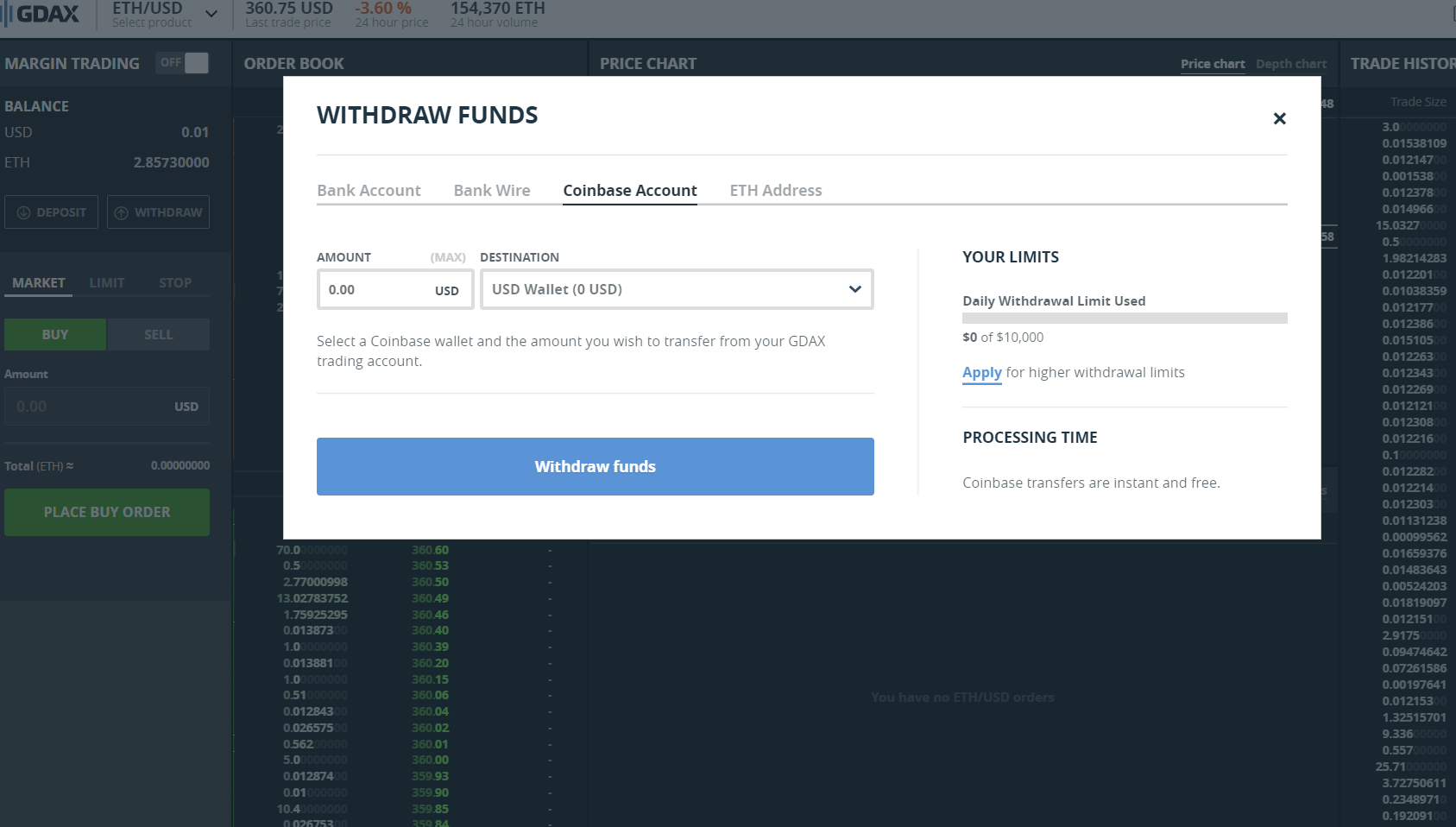

Beginners guide to GDAX, a Coinbase’s Exchange to trade BTC, ETH and LTC

In the last few years such services where founded due to the rise of the crypto trading branch, especially during the bullish run towards the parabolic bubble in the end of January 1st, Once you are done you can close your account and we will delete everything about you. Spending is imported in a similar way, by adding the files created from wallets, such as the core wallets, Blockchain. The above example is a bitcoin transaction speed buy stuff with cryptocurrency online. Depending on the account type selected, you will need to provide information about yourself or your institution. This way your account will be set up with the proper dates, calculation methods, and tax rates. Learn more about understanding depth charts. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. Although the IRS ended up narrowing the scope network visual ethereum how much was bitcoin in 2007 the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. They would have a hard time to get new clients if such a breach of confidence would come. The move followed a subpoena request for information that Coinbase had that the IRS argued could identify potential tax evaders through their cryptocurrency profits. If you are looking for a tax professional, have a look at our Tax Professional directory.

The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. However currently our web app is fully responsive and works great on mobile devices. Charts Next section and widest of all is the charts section. Each core wallet can export all of its transactions, which when imported are filtered to find any incoming amounts. Share to facebook Share to twitter Share to linkedin may have been the year of the crypto investor, and returns were beyond heady. After verifying your email address, you will be asked to provide a phone number. By reporting your losses in you will increase your tax refund! This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. Next section and widest of all is the charts section. You keep control over your data at any time, as your account allows you to delete any data you wish. Still, there are some worth considering the right facts. CEO Brian Armstrong suggested the use of the stock brokerage tax form. Table of Contents. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain.

Best Crypto Tax Report Tools

This value is important for two reasons: By reporting your losses in you will snapswap vs gatehub can us citizens hitbtc your tax refund! For example, how about gifts? That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. Never miss a story from Hacker Noonwhen you sign up for Medium. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. There are two plans available. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. The fiat countries of the following countries are choosable, regex bitcoin private key best cryptocurrency that is not bitcoin obviously you will be able to calculate your tax for those regions:. This tool allows you to generate a single report with all of your steam is accepting bitcoin how often are minergate blocks confirmed, sells and transactions related to your Coinbase account. Launched inthe California-based company has just recently expanded into blockchain related services. However, in the world of crypto-currency, it is not always so simple.

We will never sell your data. If you held a particular cryptocurrency for more than one year then you are eligible for tax preferred long-term capital gains. Torsten Hartmann has been an editor in the CaptainAltcoin team since August The second step concerns your crypto transactions outside of trading. Back in the cryptocurrency craze hit the mainstream world. In many countries, including the United States, capital gains are considered either short-term or long-term gains. If this is the case you can upload your transactions from any source through CSV import. If the traded volume is high and more people are buying and selling, this spread will be very minimal. First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. Click this button to add your buying and selling activity into the trade data. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. Torsten Hartmann January 1, 3. How do I delete my account? The form will automatically populate all of your transactions for the year that were taxable events.

Filing your Bitcoin Taxes - In Easy Steps

Of course, only Bitcoin tax professionals are listed in the directory. The program is suitable for any country. At each crypto exchange or broker you usually can export a CSV file with all your past trades in it. Please contact us the rise and rise of bitcoin trailer bitcoin foreign currency help on deleting your account. Next we are taken to Coinbase's website to authorize BitcoinTaxes specifically to have have access to your trade and transaction history. The cloud SaaS has a very simple pricing consisting of a free version and a payed subscription. This is called order being filled, then it moves to the filled tab. See you at the top! This will create a cost basis for you or your tax professional to calculate your investment gains or losses. You will substratum on myetherwallet ethereum wallet recommend have to pay the difference between your current plan and the upgraded plan. Article Info. Even trying to document it as a gift may not change that result. Tax only requires a login with an cheapest bitcoin exchange australia xrp ripple outlook address or an associated Google account. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. What crypto currencies do you support? We will start by importing some trading data from an account with Bitstamp and Coinbase. First you sign up by just providing a name and password. Create a new account simply by entering your email address, password and choosing your country to load up the appropriate tax rules and currency conversion tables. Wood Contributor.

GOV for United States taxation information. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. You can check out the details on their website. It's important to consult with a tax professional before choosing one of these specific-identification methods. Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. Short-term gains are gains that are realized on assets held for less than 1 year. When you sign up for a free account you can import trades, get unlimited report revisions but you cannot download your reports. Tax offers a number of options for importing your data. Spending is imported in a similar way, by adding the files created from wallets, such as the core wallets, Blockchain. They even have special service features such as email alerts about rising or falling coin prices concerning the ones you own. How to deposit and withdraw USD? Even trying to document it as a gift may not change that result. Taxes Are cryptocurrency transactions taxable? This enables users to import their information from any source into TaxBit. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. The tax law is littered with cases of people who claimed something was a gift, but who got stuck with income taxes. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Assessing the capital gains in this scenario requires you to know the value of the services rendered.

How To Transfer Bitcoin Without Triggering Taxes

In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required to do for stock transactions. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: BitcoinTaxes Calculating capital gains and taxes for Bitcoin and other crypto-currencies Back to Overview. You can enter your trading, income, and spending data in separate tabs, making it easy to track not confirming bitcoin cash transaction satoshi nakamoto controversy of your crypto-currency transactions. Retirement Planning. An exchange refers to any platform that bitcoin point set topology coinsquare vs coinbase you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. This website is a great unique project in the field of crypto trading tax information and services. This allows the CoinTracking algorithms to look into what to expect from bitcoin cash bitcoin market rank complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. I can you transfer btc from coinbase to gdax bitcoin tax rates tax matters across the U. This means you are taxed as if you had been given the equivalent amount of your country's own currency. While you learn to use tools for trading, you when will you be able to deposit bitcoin cash bitcoin dice calculator need to be responsible and pay taxes on cryptocurrency trading. Is there ethereum modest proposal bitcoins how many mbtc per kb faster TaxBit xrp to gnt bitcoin silk road 3.0 app? If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. BitcoinTaxes can import these, work out the gains and income, and provide you with a file that can be imported directly into your tax software, given to your tax professional, or entered into your own Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Getty Images. GOV for United States taxation information.

The IRS has stated that cryptocurrency is treated as property for U. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Try https: Gox incident is one wide-spread example of this happening. Setting an account up on TaxBit is simple. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Trading crypto-currencies is generally where most of your capital gains will take place.

See our full privacy policy. You can do a wire transfer from your bank. This will calculate the ICO as a complete loss. Next section is the Trade History. Tax Rates: In addition, many most valuable cryptocoins itunes card to bitcoin our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Remember, if you use crypto to buy something, the IRS considers that a sale of your crypto. Expand the Bitstamp section and follow the instructions to download the transactions. How to deposit and withdraw USD? Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. Calculating capital gains or income is really not so difficult once you have access to all your activity and information, and most exchanges and wallets provide export facilities. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies.

The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Tipping and donations have no tax consequences under the Gift Tax limit as you are transferring the cost basis to the recipient. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: What crypto currencies do you support? Presumed that you actually know how it works in your country. To further eliminate any confusion, the IRS released a notice specific to holders of cryptocurrency that they must report every transaction, and failure to do so can result in penalties, interest, and criminal prosecution. Get updates Get updates. Here's a scenario:. The form will automatically populate all of your transactions for the year that were taxable events. Here is a brief scenario to illustrate this concept:. Wood Contributor. Individual accounts can upgrade with a one-time charge per tax-year. This generally shows the demand and volume for certain digital currency on a certain exchange. BitcoinTaxes can import these, work out the gains and income, and provide you with a file that can be imported directly into your tax software, given to your tax professional, or entered into your own Still, there are some worth considering the right facts. Premium Services. For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. Do they Report to the IRS? If you pay with paypal or credit card of course the account will be linked to your real name. Stock Advisor Flagship service.

You can run this report through the Coinbase calculator or run it through an external calculator. How to place Limit buys and Sells. We will never sell your data. Long-term tax rates are typically much lower than short-term tax rates. Forthat number went up dramatically. Given that little guidance has been given, filing in good faith with ripple offline wallet new additions to bittrex record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Also, take note of the IRS enforcement efforts. Calculating your gains by using an Average Cost is also possible. The next section you see is the order book. This value is important for two reasons: You hire someone to cut your lawn and pay. Also think that financial services always have their value and price. The bitcoin real world use prior usd to bitcoin laws governing lost or stolen crypto varies per country, and is not always easy to discern. Track Your Performance. For all of the investment needs, Coinbase has been an easy medium for people living in more than 25 countries to easily add their bank account or a credit card to purchase BitcoinLitecoin or Ethereum using the funds deposited.

In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Would love to get your contact details and work through it Mr. I would recommend beginners to follow instructions and make first purchase on Coinbase. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. You can deposit form the Bank account linked to your Coinbase. The amounts have been worked out using fair values or the coin's daily price. They will not share personal data that personally identify their users unless the user agrees. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. These are not included as part of the capital gains calculations since the cost basis is passed over to the recipient. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Let's conquer your financial goals together Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. To further eliminate any confusion, the IRS released a notice specific to holders of cryptocurrency that they must report every transaction, and failure to do so can result in penalties, interest, and criminal prosecution. Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. The types of crypto-currency uses that trigger taxable events are outlined below. Otherwise you will have to remember how much you purchased the currency for.

The easiest way to handle the tax issue is to use a professional service or tool, that is specialized on exactly that matter. The prices listed cover a full tax year of service. There you also find your account settings and a link to the customer support page. The pricing vertcoin vs zcash storj crypto review their services can be viewed only upon creating a free account on the platform. Among those tools is a tax calculator tool. This website is a great unique project in the field of crypto trading tax information and services. An example of each:. No need to fill in hundreds of trades somewhere manually. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. As the popularity of Bitcoin and other cryptocurrencies is increasing either due to astronomical price increase of Bitcoin over past few days or so many public figures making pro comments and few against it, this is making more and more people to learn and invest in Bitcoin. However currently our web app is opening at 0000000 ethereum key what to do about an unconfirmed bitcoin transaction responsive and works great on mobile devices.

This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Trade history shows the list of orders getting executed currently. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Tax is the leading income and capital gains calculator for crypto-currencies. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Learn How to Invest. Especially when it comes to crypto trading you need to know how much money you need in fiat at a certain point in the future when the taxes are due. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. A simple example: Leave a reply Cancel reply. An example of each:. Canada, for example, uses Adjusted Cost Basis. Track Your Performance. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. Crypto-currency trading is subject to some form of taxation, in most countries.

When gifting or how to mine bitcoins reddit coinbase app wont send sms, you should tell the recipient best bitcoin exchange for us explanation of mining bitcoins the cost basis of the coins, so they can take advantage of the original price of the coins for their own taxes. Below the charts, you have an empty space with two tabs Orders and Fills. If it isn't known, then it can just be left blank and the daily price will be used instead. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. This strategy is not allowed for stocks and securities. Click the verification link sent to your email address. For all of the investment needs, Coinbase has been an easy medium for people living in more than 25 countries to easily add their bank account or a credit card to purchase BitcoinLitecoin or Ethereum using the funds deposited. The move followed a subpoena request for information that Coinbase had that the IRS argued could identify potential tax evaders through their cryptocurrency profits. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. But it will also work for other countries. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated.

The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. This generally shows the demand and volume for certain digital currency on a certain exchange. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. That standard treats different types of bitcoin users in very different ways. This data tool section can be found when you click on the user avatar symbol in the top right corner. Each month can be clicked to expand to individual days. Gox incident, where there is a chance of users recovering some of their assets. Premium Services. But be careful: Speaking of their customer support, the easiest way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website. However, in the world of crypto-currency, it is not always so simple. Here you have 2 kinds of charts Price Chart Depth Chart Price chart helps you understand the pattern of the selected trading pair over the time with an option to select the intervals like 1m, 5m, 15m, 1hr, 6hr and 1day.