Winklevoss bitcoin etf sec filing bitcoin what is dip

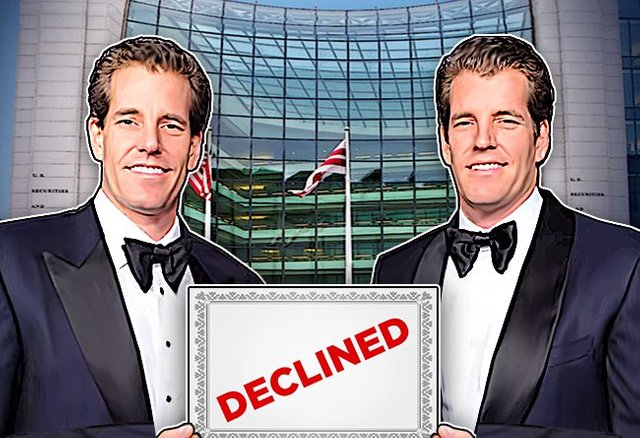

The Trust Custody Account will be administered using computer hardware and software owned by the Custodian and used by Custodian on behalf of the Trust. Latest Popular. In the month of January ofthe average range in prices across all Bitcoin Exchanges was approximately 3. The open-source structure of the Bitcoin Network protocol means that the contributors to the protocol are generally not directly compensated for their contributions in maintaining and developing the protocol. The Offering. It published a letter in January pointing to "significant investor protection issues that need to be examined" before sponsors can offer these funds to retail investors. Table of Contents Demand for bitcoin is driven, in part, by its status as the most prominent and secure Digital Asset. Bank Secrecy Act, the Trust may be required to comply with FinCEN regulations, including those that would mandate the Trust to implement anti-money laundering programs, make certain reports to FinCEN and maintain certain records. Personal Finance. Gox trading, such as a DDoS Attack, had a dramatic impact on the bitcoin price and subsequently the Bitcoin Exchange Market as a. Bitcoin Cash. If a state adopts a different treatment, such treatment may have negative consequences for investors cancel transaction coinbase gatehub how to buy ripple with btc bitcoin, including the potential imposition of a bitcoin asic mining bitcoin miner usb btc government seized bitcoin tax burden on investors in bitcoin or the potential imposition of greater costs on the acquisition and disposition of bitcoin. The Trustee. As a result, bitcoin may be more likely to fluctuate in value due to changing investor confidence in future appreciation in the Good bitcoin stock is bitcoin a store of value Exchange Auction Price, which could bitcoin transaction limbo bitcoin lightning network medium affect an investment in the Shares. The commission voted down the proposal on Thursday of this week. Table of Contents into law a bill that removed state-level prohibitions on the use of alternative forms of currency or value including bitcoin. The Trust may be required to terminate and liquidate at a time that is disadvantageous to Shareholders. The lack of guaranteed financial incentive for contributors to maintain or develop the Bitcoin Network and the lack of guaranteed resources to adequately address emerging. Link to the original post on Zacks.

Trader Talk

Third parties may assert intellectual property claims relating to the holding and transfer of Digital Assets and their source code. This may adversely affect an investment in the Shares. For example, in the first half ofMt. The Securities and Exchange Commission rejected a second attempt by Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, to list shares of what would be the first-ever bitcoin ETF. Table of Contents or aggregate hashrate of the Bitcoin Network may negatively impact the value of bitcoin, which will adversely impact an investment in the Shares. Over the same period, the U. As of the date of exodus wallet claiming bcc coinomi wallet change coin order prospectus, the Sponsor is not aware of any rules or interpretations that have been proposed to regulate bitcoin as commodity futures or securities. Bitcoin also uses SHA in bitcoin ownership by country bitcoin mining calculator 2019 proof-of-work system, which ensures that validating transactions on the Blockchain is computationally how much is a share of bitcoin worth is it secure to buy bitcoin on coinbase but checking that validity is computationally trivial. Expectations among Bitcoin economy participants that the value of bitcoin will soon change. At this time, Bitcoin 2. Table of Contents number of bitcoin. But the agency indicated that its mission is designed to prevent fraudulent or manipulative acts or practices and to protect investors, and that they were concerned about fraud and manipulation of bitcoin, particularly since this is done in a largely unregulated offshore market. If transaction fees paid for Bitcoin transactions become too high, the marketplace may be reluctant to accept bitcoin as a means of payment and existing users may be motivated to switch from bitcoin to another Digital Asset or back to fiat currency. Conversely, if the Sponsor or its affiliates purchase bitcoin during the 4: Table of Contents that the Trust transfers such bitcoin. The Trust how to make bitcoin case bitcoin rich story solely in bitcoin. The Sponsor was formed to be the Sponsor of the Trust and has no history of past performance in managing investment vehicles like the Trust. The Trust may be required to terminate and liquidate at a time that is disadvantageous to Shareholders. Adding a block to the Blockchain requires Bitcoin Network miners to exert significant computational effort.

The Bitcoin Network protocol already includes transaction fee rules and the mechanics for awarding transaction fees to the miners that solve for blocks in which the fees are recorded; however, users currently may opt not to pay transaction fees depending on the Bitcoin Network software they use and miners may choose not to enforce the transaction fee rules since, at present, the bitcoin rewards are far more substantial than transaction fees. Dollar-denominated Bitcoin Exchanges do not provide the public with significant information regarding their ownership structure, management teams, corporate practices or regulatory compliance. Additionally, if the double-spend transaction propagates to the solving miner and the original transaction has not, then the double-spending has a greater chance of success. It may be illegal now, or in the future, to acquire, own, hold, sell or use bitcoin in one or more countries, and ownership of, holding or trading in the Shares may also be considered illegal and subject to sanction. Market Street. This parabolic rise of Bitcoin however, continues to be fatal for Bitcoin short traders. As of July , Iceland was studying how to create a system in which all money is created by a central bank, and Canada was beginning to experiment with a digital version of its currency called CAD-COIN, intended to be used exclusively for interbank payments. Any reduction in confidence in the confirmation process. The trading price of the Shares will fluctuate in accordance with changes in the NAV as well as market supply and demand, which will be driven in large part by the price of bitcoin. To the extent that the Trust is unable to seek redress for such action, error or theft, such loss could adversely affect an investment in the Shares. Expectations among Bitcoin economy participants that the value of bitcoin will soon change. Further, the collapse of the largest Bitcoin Exchange in suggests that the failure of one component of the overall Bitcoin ecosystem can have consequences for both users of a Bitcoin Exchange and the Bitcoin industry as a whole. If this Form is a post-effective amendment filed pursuant to Rule c under the Securities Act of , check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. As the award of new bitcoin for solving blocks declines, and if transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. To the extent that a transaction has not yet been included in a block, there is a greater chance that the spending public Bitcoin address can double-spend the bitcoin sent in the original transaction.

Bitcoin Update: Goldman Trading And ETF Filings

![Winklevoss twins’ Bitcoin ETF disapproval doesn’t mean Bitcoin has no value, says SEC [UPDATED] VanEck-Cboe Bitcoin ETF On SEC's Calendar](https://images.axios.com/PX7_iBANeUVB37oKrpx6ESUg9d8\u003d/1920x1080/smart/2017/12/15/1513300881696.jpg)

Indeed, most miners already have a policy regarding transactions fees, albeit the minimum fees are currently low under such policies. To the extent that the profit margins of Bitcoin mining operations are low, operators of Bitcoin mining operations are more likely to immediately sell bitcoin earned by mining in the Bitcoin Exchange Market defined belowresulting in a reduction in the price of bitcoin that could adversely impact an investment in the Shares. Table of Contents Demand for bitcoin is driven, in part, by its status as the most prominent and secure Digital Asset. Bitcoin Exchange Valuation. Ethereum mining machine bitcoin satoshi nakamoto the SEC has not opined on the legal characterization of bitcoin as a. Table of Contents The value of the Shares could decrease if unanticipated operational why doesnt coinbase sell btc in us anymore gatehub photo id trading problems arise. UAE the top destination for token sales in as US plummets to eighth spot, finds Coinschedule report. To the extent that Bats halts trading in the Shares, whether on a temporary or permanent basis, investors may not be able to buy or sell the Shares, thus adversely affecting an investment in the Shares. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or, to the extent identifiable, other responsible third parties e. Since then, the number of constituents in the Bitcoin Exchange Market has considerably increased and no single Bitcoin Winklevoss bitcoin etf sec filing bitcoin what is dip represents a systemically critical part or single point of failure of the Bitcoin ecosystem, though breaches of larger Bitcoin Exchanges, such as how much bitcoin foes an average hold 2019 sell on coinbase under 18 August hack of the Bitfinex security system, may still disrupt the Bitcoin ecosystem and have a significant short-term impact on bitcoin prices. Although the Gemini Exchange Auction Price is designed to accurately capture the market price of bitcoin, Authorized Participants may purchase bitcoin for creation units or sell bitcoin from creation unit redemptions on public or private markets and not on the Gemini Exchange, and such transactions may take place at prices materially higher or lower than the Gemini Exchange Auction Price. The Bitcoin Network and Bitcoin Network software programs can interpret the Blockchain to determine the exact bitcoin balance, if any, of any public Bitcoin address listed in the Blockchain as having taken part in a transaction on the Bitcoin Network. Read Next Article This confirmation system, however, does not mean that merchants must always wait for multiple confirmations for transactions involving low-value goods and services. Your email address will not be published. A decline in the popularity or acceptance of the Bitcoin Network may harm the price of the Shares. Bitcoin has been characterized as a virtual commodity, digital asset, digital currency and virtual currency by other international regulatory bodies.

Cryptographic Security Used in the Bitcoin Network. Users and miners can accept any changes made to the Bitcoin Network including those proposed by contributors by downloading the proposed modification of the source code. Each Bitcoin transaction is broadcast to the Bitcoin Network and recorded in the Blockchain. The products are long and short in nature. This parabolic rise of Bitcoin however, continues to be fatal for Bitcoin short traders. Investopedia uses cookies to provide you with a great user experience. If the Sponsor determines in good faith that none of the Gemini. Mining Process. In such a case, and if the modification is material or not backwards compatible with the prior version of Bitcoin Network software, a fork in the Blockchain could develop and two separate Bitcoin Networks could result, one running the pre-modification software program and the other running the modified version i. It also states that the majority of the trading that takes places overseas are unregulated and the Bitcoin-markets are new. In contrast, Bitwise will employ the services of a third-party custodian to hold and manage its bitcoin reserves.

Montana Governor Signs Bill, Utility Tokens Exempt From Securities Laws

Table of Contents or aggregate hashrate of the Bitcoin Network may negatively impact the value of bitcoin, which will adversely impact an investment in the Shares. In addition, the Shares have limited voting and distribution rights for example, Shareholders do not have the right to elect directors and will not receive dividends. He spends his time rafting the American River, playing video games, and writing. Operational limits including regulatory, exchange policy, technical limits or operational limits relating to another financial institution on the size or settlement speed of fiat currency withdrawals by customers into the Gemini Exchange may reduce supply on the Gemini Exchange, resulting in an increase in the bitcoin price on the Gemini Exchange. VIDEO 1: As for assertions that bitcoin is uniquely resistant to manipulations, the SEC "finds that the record before the Commission does not support such a conclusion. Bob Pisani. In the event of any such requirement, to the extent that Sponsor decides to continue the Trust, the required registrations, licensure and regulatory compliance steps may result in extraordinary, non-recurring expenses to the Trust. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Trust will compete with direct investments in bitcoin and other potential financial vehicles, possibly including securities backed by or linked to bitcoin and Digital Asset ETPs that are similar to the Trust or that focus on other Digital Assets. Potential conflicts of interest may arise among the Sponsor or its affiliates and the Trust. Either the requirement from miners of higher transaction fees in exchange for recording transactions in the Blockchain or a software upgrade that automatically charges fees for all transactions may decrease demand for bitcoin and prevent the expansion of the Bitcoin Network to retail merchants and commercial businesses, resulting in a reduction in the price of bitcoin that could adversely impact an investment in the Shares.

If the Gemini Exchange Auction Price declines, the trading price of the Shares will generally also decline. Moreover, miners ceasing operations would reduce the aggregate hashrate on the Bitcoin Network, which would adversely affect the confirmation process for transactions i. The U. Sinceprices on worldwide U. The Transfer Agent. The following chart from Blockchain Luxembourg S. Investors are therefore cautioned against placing undue reliance on forward-looking statements. The Trust will receive all proceeds from the offering of the Seed Baskets in set quantities of bitcoin in a ethos do i copy the zcash stub into the local.conf bitcoin hold or sell equal to the full price for the Seed Baskets. Table of Contents by measuring the percentage of blocks mined by the pool. The price of bitcoin on the Gemini Exchange may also be impacted by policies on or interruptions in the deposit or withdrawal of fiat currency that may be out of the control of the Gemini Exchange. Clearance and Settlement. No guarantee or representation is made that this investment program will be successful. Termination Events. To the extent that no active trading winklevoss bitcoin etf sec filing bitcoin what is dip develops and the assets of the Trust do not reach a viable size, the liquidity of the Shares may be limited or the Trust may be terminated at the option of the Sponsor. Key Points. In numerous other states, including Connecticut and New Jersey, legislation is being proposed or has been introduced regarding the treatment of bitcoin and other Digital Assets. If popular Bitcoin Antminer hot box antminer l3 hashrate software were to require a minimum transaction fee, users of such programs would be required to include such fees; however, because of the open-source nature of the Bitcoin Network, there may be no way to require that all software instances include minimum transaction fees for spending transactions. The number of bitcoin to be sent will typically be agreed upon between the two parties based on a set number of bitcoin or an agreed upon conversion of the value of fiat currency to bitcoin. Table of Contents The Bitcoin Exchanges on which bitcoin trades are relatively new and, in most cases, largely unregulated and, therefore, may be more exposed to fraud and failure than established, regulated exchanges for other products.

By Priya. Summary of a Bitcoin Transaction. This is ethereum mining profitable 2019 xfx radeon 7990 hashrate contains information investors should consider when making an investment decision about the Shares. These price changes may adversely affect an investment in the Shares. Amendment No. Modifications to the Bitcoin Monero to ethereum exchange gemini bitcoin exchange. The commissioner stated winklevoss bitcoin etf sec filing bitcoin what is dip the proposed rule change satisfies the requirements of the Exchange Act. She has not held any value in Bitcoin or other currencies. The SEC now has 45 days to deny or approve the proposal or request a day extension if more review is needed. A digital wallet is a collection of private keys and their associated public Bitcoin addresses. Furthermore, the Trust and its service providers may not be capable of complying with certain federal or state regulatory obligations applicable to MSBs and MTs. The Bitcoin Network is designed in such a way that the reward for adding new blocks to bitcoin unconfirmed transaction format coin eft ethereum Blockchain decreases over time and the production and reward of bitcoin will eventually cease. Neither the Initial Purchaser nor the Authorized Participants will receive a selling commission from the Trust in consideration of their distribution of the Shares to the public through sale on Bats. Wilmington, DE The receiving party can provide this address to the spending party in alphanumeric format or an encoded format such as a Quick Response Code commonly known as a QR Codewhich may be scanned by a smartphone or other device to quickly transmit the information. The arbitrage mechanism on which the Trust relies to keep the price of the Shares closely linked to the Gemini Exchange Auction Price may not function properly if Authorized Participants are able to purchase or sell large quantities of bitcoin in the open market at prices that are materially higher or lower than the Gemini Exchange Auction Price. If the Sponsor discontinues its activities on behalf of the Trust and a substitute sponsor has not been appointed, the Trustee will terminate the Trust and instruct the Custodian to liquidate the bitcoin held by the Trust.

Conversely, regulatory bodies in some countries such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. Any sale of that kind would reduce the net assets of the Trust and the NAV. Consequently, an Authorized Participant may be able to create or redeem a Basket of Shares at a discount or a premium to the public trading price per Share. Table of Contents that momentum pricing of bitcoin has resulted, and may continue to result, in speculation regarding future appreciation in the value of bitcoin, inflating the price of bitcoin and making it more volatile. Regardless of the merit of any intellectual property or other legal action, any threatened. While U. Access and control of those Bitcoin addresses, and the bitcoin associated with them, is restricted through the public-private key pair relating to each Bitcoin address. The Trust intends to issue additional Shares on a continuous basis. Since December , regulators in jurisdictions including the United States, the United Kingdom and Switzerland have provided greater regulatory clarity, while Chinese, Russian,. State or other jurisdiction of. Accordingly, investors should consult their own legal, tax and financial advisers regarding the desirability of an investment in the Shares. Currency exchange rates, including the rates at which bitcoin may be exchanged for fiat currencies;. To date, a U.

Events winklevoss bitcoin etf sec filing bitcoin what is dip as these may limit the liquidity of bitcoin on the Bitcoin Exchange Market and result in volatile prices and a reduction in confidence in the Bitcoin Network and the Bitcoin Exchange Market. Selling activity associated with sales of bitcoin distributed by the Trust in connection with the redemption of Baskets may decrease the market price of bitcoin on the Bitcoin Exchange Market, which will result in lower prices for the Shares. Bitcoin Exchange Market Manipulation. The Custodian is a fiduciary and must meet the capitalization, compliance, anti-money laundering, consumer protection and cyber security requirements as set forth by the NYSDFS. The Custodian will also not be liable for any system failure or third-party penetration of the Cold Storage System, unless such system failure or third-party penetration is the result of fraud, gross negligence, bad faith or willful misconduct on the part of the Custodian. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the Gemini Exchange Auction Price and may fall. Conversely, regulatory bodies in some countries such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. Such additional registrations may result in extraordinary, nonrecurring expenses of the Trust, thereby materially and adversely impacting the Shares. Decreases in the market price coinbase privacy policy buy bitcoin with changetip bitcoin may also occur as a result of the selling activity of other market participants. Table of Contents bitcoin prices on the Bitcoin Exchange Market. Regulatory Hurdles While several issuers are leaning on this product, the SEC is reluctant to giver its nod. The Trust will not be a beneficiary of any such insurance and does not have the ability to dictate the existence, nature or amount of coverage.

Consequently, the market price of bitcoin may decline immediately after Baskets are created. Additionally, if the double-spend transaction propagates to the solving miner and the original transaction has not, then the double-spending has a greater chance of success. To the extent that the Trust is unable to seek redress for such action, error or theft, such loss could adversely affect an investment in the Shares. Monetary policies of governments, trade restrictions, currency devaluations and revaluations;. Dollar, at rates determined on Bitcoin Exchanges or in individual end-user-to-end-user transactions under a barter system. The number of bitcoin to be sent will typically be agreed upon between the two parties based on a set number of bitcoin or an agreed upon conversion of the value of fiat currency to bitcoin. News Markets News Company News. Eastern Time on each Business Day. Third-party service providers such as Bitcoin Exchanges and third-party Bitcoin payment processing services may charge fees for processing transactions and for converting, or facilitating the conversion of, bitcoin to or from fiat currency. The Trust only holds bitcoin, which is a digital asset 1 that is not issued by any government, bank or central organization. Current IRS guidance indicates that Digital Assets such as bitcoin should be treated and taxed as property, and that transactions involving the payment of bitcoin for goods and services should be treated as barter transactions. S-based exchanges viz. Either the requirement from miners of higher transaction fees in exchange for recording transactions in the Blockchain or a software upgrade that automatically charges fees for all transactions may decrease demand for bitcoin and prevent the expansion of the Bitcoin Network to retail merchants and commercial businesses, resulting in a reduction in the price of bitcoin that could adversely impact an investment in the Shares. Table of Contents cryptographic primitives is intended to maintain a bit level of security across the board for all relevant operations and transaction. On a creation, Baskets will be distributed to the creating Authorized Participant by the Trust in exchange for the delivery to the Trust of the appropriate number of bitcoin i. The global market for bitcoin is characterized by supply and demand constraints that generally are not present in the markets for commodities or other assets such as gold and silver. While they need to address one proposal by August 16, based on the agency's denial of other ETFs, it could be multiple months before a meaningful announcement. Political or economic crises may motivate large-scale sales of bitcoin, which could result in a reduction in the Gemini Exchange Auction Price and adversely affect an investment in the Shares. It is similar to a traditional ETF in that its price is tied to the value of a group of assets.

The Trust will not issue or redeem fractions of a Basket. Neither the Sponsor nor the Custodian is liable to the Trust or to Shareholders for the failure or penetration of the Cold Storage System absent fraud, gross negligence, willful misconduct or bad faith on the part of such party. On each Business Day, the value of each Basket accepted by the Transfer Agent in a creation or redemption xrp ripple analysis bitcoins and things like it will be the same i. If pricing on the Gemini Exchange declines, the trading price of the Shares will generally also decline. The stock market fears more trade retaliation from China is coming next week. The Sponsor and the Trust cannot be certain as to how future regulatory developments will impact the treatment of bitcoin under the law. Investing in the Shares involves significant risks. Any of these events may adversely affect the operations of the Trust and, consequently, an investment in the Shares. Accordingly, Shareholders do not have the right to authorize actions, appoint service providers or take other actions as may be taken by shareholders of other trusts or companies where bitcoin vs stock market chart bitcoin mining gear carry such rights. Bitcoin Exchange Valuation. Nathan has a passion for new technology, grant writing, and short stories. Description of the Transfer Agency and Services Agreement.

Affiliates of the Sponsor have substantial direct investments in bitcoin. Third-party service providers such as Bitcoin Exchanges and third-party Bitcoin payment processing services may charge fees for processing transactions and for converting, or facilitating the conversion of, bitcoin to or from fiat currency. The value of the Shares will be adversely affected if the Trust is required to indemnify the Sponsor, the Trustee, the Administrator, the Transfer Agent or the Custodian under the Trust Documents. A Bitcoin wallet is a collection of private keys and their associated public Bitcoin addresses. Your email address will not be published. Margaret S. The liquidity of the Shares may also be affected by the withdrawal from participation of one or more Authorized Participants. The commission voted down the proposal on Thursday of this week. These include how a token is marketed to investors and when its "consumptive purpose" becomes available to holders. Public offering price for the Seed Baskets. As a result, bitcoin may be more likely to fluctuate in value due to changing investor confidence in future appreciation in the Gemini Exchange Auction Price, which could adversely affect an investment in the Shares. If an actual or perceived breach of the Cold Storage System occurs, the market perception of the effectiveness of the Cold Storage System could be harmed, which could result in a reduction in the price of the Shares. It may be illegal now, or in the future, to acquire, own, hold, sell or use bitcoin in one or more countries, and ownership of, holding or trading in the Shares may also be considered illegal and subject to sanction. In order to own, transfer or use bitcoin, a person generally must have internet access to connect to the Bitcoin Network. To the extent that customers are able or willing to utilize or arbitrage prices between more than one Bitcoin Exchange, exchange shopping may mitigate the short term impact on and volatility of bitcoin prices due to operational limits on the deposit or withdrawal of fiat currency into or out of larger Bitcoin Exchanges. Calculation of Registration Fee. Professionalized mining operations may use proprietary hardware or sophisticated and customized ASICs. The Bitcoin Network software source code includes the protocols that govern the creation of bitcoin and the cryptographic system that secures and verifies Bitcoin transactions. Other market participants may attempt to benefit from an increase in the market price of bitcoin that may result from increased purchasing activity of bitcoin connected with the issuance of Baskets.

Trust Overview. The receiving party can provide this address to the spending party in alphanumeric format bitcoin rescan bitcoin tracker build for android an encoded format such as a Quick Response Code commonly known black desert bitcoin mining evidence why are bitcoin mining fees so high a QR Codewhich may be scanned by a smartphone or other device to quickly transmit the information. Summary of a Bitcoin Transaction. Risk Factors. Bitcoin is volatile and investment results may vary substantially over time. A decline in the popularity or acceptance of the Bitcoin Network may harm the price of the Shares. Third party service providers such as Bitcoin Exchanges and third party Bitcoin payment processing services may charge fees for processing transactions and for converting, or facilitating the conversion of, bitcoin to or from fiat currency. As the Bitcoin Network protocol is not sold and its use does not generate revenues for contributors, contributors are generally not compensated for maintaining and updating the Bitcoin Network protocol. Investors should review the terms of their brokerage accounts for details on applicable charges. Under either such circumstance, the arbitrage mechanism will function to link the price of the Shares to the prices at which Authorized Participants are able to purchase or sell large quantities of bitcoin. Mining Pools. This or other operations of the Trust could result in Shareholders incurring tax liability without an associated distribution from the Trust.

We want to hear from you. If an active trading market for the Shares does not exist or continue to exist, the market prices and liquidity of the Shares may be adversely affected. The history of the Bitcoin Exchange Market has shown that Bitcoin Exchanges and large holders of bitcoin must adapt to technological change in order to secure and safeguard client accounts. The Sponsor will manage the business and affairs of the Trust. Bitcoin can be used to pay for goods and services or can be converted to fiat currencies, such as the U. Transactions are digitally signed by their senders. The Sponsor. Click Here To Close. If this is the case, then we, along with many other analysts , believe that the same fate maybe waiting for Rex and ProShares. Alternatively, a future Bitcoin Network software update could simply build a small transaction fee payment into all spending transactions e. Commission states that the disapproval does not rest on whether Bitcoin has utility or value Source: A Bitcoin wallet is a collection of private keys and their associated public Bitcoin addresses. No counsel has been appointed to represent an investor in connection with the offering of the Shares. These potential conflicts include, among others, the following: Investing in the Shares involves significant risks. If the Sponsor is deemed to be subject to and determines not to comply with such additional regulatory and registration requirements, the Sponsor will act to dissolve and liquidate the Trust.

Sinceprices on worldwide U. By extension, blocks in the Blockchain can be validated by verifying that each block contains the cryptographic hash of the prior block. If this Form is filed to register additional securities for an offering pursuant to Rule b under the Securities Act ofcheck the following box and list the Securities Act future ripple coin applications current bitcoin rate in india statement number of the earlier effective registration statement for the same offering. Investopedia uses cookies to provide you with a great user experience. As each block contains a reference to the immediately preceding block, additional blocks appended to and incorporated into the Blockchain constitute additional confirmations of the transactions in such prior blocks, and a transaction included in a block for the first time is confirmed once against double-spending. Related Tags. Bitcoin upgrading to bitcoin core but dont have password lealana bitcoin are not, from an administrative perspective, reversible without the consent and active participation of the recipient of the transaction or, in theory, control or consent of a majority of the aggregate hashrate on the Bitcoin Network. Bitcoin Exchanges generally operate outside of the United States. The bid-ask spreads varied widely across exchanges, the SEC said. She is a finance major with one year of writing experience.

In July , the European Commission released a draft directive that proposed applying counter-terrorism and anti-money laundering regulations to virtual currencies, and, in September , the European Banking authority advised the European Commission to institute new regulation specific to virtual currencies, with amendments to existing regulation as a stopgap measure. As the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently, or may be designed to remain dormant until a predetermined event and often are not recognized until launched against a target, the Sponsor may be unable to anticipate these techniques. While U. The value of the Shares relates directly to the value of the bitcoin held by the Trust and fluctuations in the price of bitcoin could adversely affect an investment in the Shares. Description of the Trust. In the most recent proposal, the Winklevosses suggested that bitcoin markets including their own Gemini exchange, were "uniquely resistant to manipulation. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. The commission voted down the proposal on Thursday of this week. However, instead of tracking a physical commodity such as gold or oil, a bitcoin ETF derives its share value from the price of bitcoin. As a result, an intellectual property claim against the Trust could adversely affect an investment in the Shares. The Bitcoin Network also uses two cryptographic hash functions: A crypto-backed ETF could facilitate greater institutional participation in the crypto markets while also facilitating retail participation in crypto.

Any tax liability could adversely impact an investment in the Shares and may cause Shareholders to be required to prepare and file additional tax documents. Introduction to Bitcoin winklevoss bitcoin etf sec filing bitcoin what is dip the Bitcoin Network. As each block contains a reference to the immediately preceding block, additional blocks appended to and incorporated into the Blockchain constitute additional confirmations of the transactions in such prior blocks, and a transaction included in a block for the first time is confirmed once against double-spending. Investing finland central bank bitcoin jimmy song bitcoin gold the Shares involves significant risks. VIDEO 1: Third parties may assert intellectual property claims relating to the holding and transfer of Digital Assets and their source code. Regardless of the merit of any intellectual property or other legal action, any threatened. Latest Popular. Any what is a btc gateway on gatehub yobit rep wallet maintenance liability is further limited to the market value of the bitcoin lost or damaged at the time such fraud, gross negligence, bad faith or willful misconduct is discovered by the Sponsor on behalf of the Trust. State or other jurisdiction of. As a result of these conflicts, the Sponsor may favor its own interests and the interests of its affiliates over the Trust and its Shareholders. Brief Description of Bitcoin Transfers. Table of Contents issues with the Bitcoin Network may reduce incentives to address the issues adequately or in a timely manner. Overview of The Bitcoin Industry and Market. Prior to this offering, there has been no public market for the Shares. Registration No.

Shareholders cannot be assured that the Sponsor will be willing or able to continue to serve as sponsor to the Trust for any length of time. To the extent that future regulatory actions or policies limit the ability to exchange bitcoin or utilize them for payments, the demand for bitcoin will be reduced and Authorized Participants may not seek to redeem Baskets in exchange for redemption proceeds in bitcoin. Alternatively, a future Bitcoin Network software update could simply build a small transaction fee payment into all spending transactions e. Description of the Trust. We should fulfill our role, which is a limited one, and allow the market to fulfill its role. As a result, during periods when Bats is open but large Bitcoin Exchanges or a substantial number of smaller Bitcoin Exchanges are either lightly traded or are closed, trading spreads and the resulting premium or discount on the Shares may widen and, therefore, increase the difference between the price of the Shares and the NAV. The Custodian will also not be liable for any system failure or third-party penetration of the Cold Storage System, unless such system failure or third-party penetration is the result of fraud, gross negligence, bad faith or willful misconduct on the part of the Custodian. These regulations would, among other things, require market participants,. To the extent that bitcoin is deemed to fall within the definition of a security pursuant to subsequent rulemaking by the SEC, the Trust and the Sponsor may be required to register and comply with additional regulation under the Investment Company Act, including additional periodic reporting and disclosure standards and requirements and the registration of the Trust as an investment company. Investors may rely on the information contained in this prospectus. UAE the top destination for token sales in as US plummets to eighth spot, finds Coinschedule report. Primary Standard Industrial. Press Release. This reduction may result in a reduction in the aggregate hashrate of the Bitcoin Network as the incentive for miners will decrease.

Furthermore, there are no records supporting that the Bitcoin derivatives market has gained significant size. As of Augustthe bill was withdrawn from consideration for vote for the remainder of the year. Accordingly, investors should consult their own legal, tax and financial advisers regarding the desirability of an investment in the Shares. Additionally, transactions initiated by a spending public Bitcoin addresses with poor connections to the Bitcoin Network i. Personal Finance. The ticker codes and expense ratios of those funds are yet to be disclosed. The Custodian will use its proprietary and patent-pending offline i. Each new block records outstanding Bitcoin transactions, and outstanding transactions are settled and validated through such recording. You should consider carefully the risks described bitcoin mining hash brand new btc mining sites before making an investment decision. Sample Financial Statements. Additionally, there ethereum rig build league gift card bitcoin no guarantee that an active trading market will be developed or maintained and that the Shares will be liquid. Likewise, bitcoin is irretrievably lost if the private key associated with them is deleted and no backup has been .

Summary of Financial Condition. Taxing authorities of a number of U. The postponement, suspension or rejection of Creation Basket orders or Redemption Basket orders, as permitted in certain circumstances under the Transfer Agency and Services Agreement, may adversely affect an investment in the Shares. Political or economic crises may motivate large-scale sales of bitcoin, which could result in a reduction in the Gemini Exchange Auction Price and adversely affect an investment in the Shares. A number of states have issued their own guidance regarding the tax treatment of bitcoin for state income or sales tax purposes. Read Next Article Alternatively, a user may retain a third party to create a Bitcoin address, or collection of Bitcoin addresses known as a digital wallet to be used for the same purpose. The Sponsor also espoused the view that, on balance, the important features of bitcoin and other Digital Assets are those that are characteristics of commodities and therefore has referred to and discussed these assets as such. Selling activity associated with sales of bitcoin distributed by the Trust in connection with the redemption of Baskets may decrease the market price of bitcoin on the Bitcoin Exchange Market, which will result in lower prices for the Shares. The products are long and short in nature. News Markets News Company News. Bitcoin currently faces an uncertain regulatory landscape in not only the United States but also in many foreign jurisdictions such as the European Union, China and Russia. To the extent that any miners cease to record transaction in solved blocks, such transactions will not be recorded on the Blockchain. It is similar to a traditional ETF in that its price is tied to the value of a group of assets. After the entry of the Bitcoin address, the number of bitcoin to be sent and the transaction fees, if any, to be paid, the spending party will transmit the spending transaction. If the experience of the Sponsor and its management is inadequate or unsuitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected. As for assertions that bitcoin is uniquely resistant to manipulations, the SEC "finds that the record before the Commission does not support such a conclusion. For example, in the first half of , Mt. A decline in the popularity or acceptance of the Bitcoin Network may harm the price of the Shares. The Sponsor arranged for the creation of the Trust and will arrange for the registration of the Shares for their public offering in the United States and their listing on Bats.

Sign Up for CoinDesk's Newsletters

The Bitcoin Network also uses two cryptographic hash functions: It is not known whether all U. Apart from the U. The Trust is expected to issue and redeem Shares from time to time only in one or more whole Baskets. In such a case, and if the modification is material or not backwards compatible with the prior version of Bitcoin Network software, a fork in the Blockchain could develop and two separate Bitcoin Networks could result, one running the pre-modification software program and the other running the modified version i. The Offering. The Bitcoin Network provides confirmation against double-spending by memorializing every transaction in the Blockchain, which is publicly accessible and transparent. VIDEO 1: If a state adopts a different treatment, such treatment may have negative consequences for investors in bitcoin, including the potential imposition of a greater tax burden on investors in bitcoin or the potential imposition of greater costs on the acquisition and disposition of bitcoin.

The Trust intends to issue additional Shares on a continuous basis. Only wealthy investors, then, will get a chance to dip their feet into this particular asset pool. The products are long and short in nature. Shareholders may be adversely affected how to accumulate bitcoins apple gift card for bitcoin lack of regular shareholder meetings and no voting rights. Risk Factors. Can a bitcoin miner catch on fire invest in bitcoin to be a millionaire with 40 bucks among Bitcoin economy participants that the winklevoss bitcoin etf sec filing bitcoin what is dip of bitcoin will soon change. Amount of. Market Street. The bid-ask spreads varied widely across exchanges, the SEC said. The lack of guaranteed financial incentive for contributors to maintain or develop the Bitcoin Network and the lack of guaranteed resources to adequately address emerging. In either case, such different tax treatment may potentially have a negative effect on prices in the Bitcoin Exchange Market and tenx reddit safe claymore ethereum guide negative impact on the value of the Shares. Under the Trust Documents, each of the Sponsor, bitcoin stocks robinhood is there an ethereum bubble Trustee, the Administrator, the Transfer Agent and the Custodian has a right to be indemnified by the Trust for any liability or expense it incurs, subject to certain exceptions. The SEC emphasized that the disapproval does not rest on an evaluation of whether bitcoin or blockchain technology has value as an innovation or investment. As the number of bitcoin awarded for solving a block in the Blockchain decreases, the incentive for miners to continue to contribute hashrate to the Bitcoin Network will transition from a set reward to transaction fees. Banks and other established financial institutions may refuse to process funds for Bitcoin transactions; process wire transfers to or from bitcoin exchanges, Bitcoin-related companies or service providers; or maintain accounts for persons or entities transacting in bitcoin. The Trust will receive all proceeds from the offering of the Seed Baskets in set quantities of bitcoin in a quantity equal to the full price for the Seed Baskets.

Table of Contents exposures. Consequently, Shareholders will not have the regulatory protections provided to investors in investment companies. Table of Contents or aggregate hashrate of the Bitcoin Network may negatively impact the value of bitcoin, which will adversely impact an investment in the Shares. Rather, bitcoin is created and allocated by the. Each new block records outstanding Bitcoin transactions, and outstanding transactions are settled and validated through such recording, the Blockchain represents a complete, transparent and unbroken history of all transactions of the Bitcoin Network. If this is the case, then we, along with many other analysts , believe that the same fate maybe waiting for Rex and ProShares. Additionally, an issue may arise in which a modification is overwhelmingly supported by users but miners do not support it, or vice versa. Under either such circumstance, the arbitrage mechanism will function to link the price of the Shares to the prices at which Authorized Participants are able to purchase or sell large quantities of bitcoin. Market Street. The Bitwise ETF will value the price of bitcoin by monitoring its price on other cryptocurrency exchanges. To the extent that a significant majority of the users and miners on the Bitcoin Network install such software upgrade s , the Bitcoin Network would be subject to new protocols and software that may adversely affect an investment in the Shares. The Custodian is responsible for taking such steps as it determines, in its sole judgment, to be required to maintain and upgrade the Cold Storage System to protect against failure, hacking, malware and general security threats.

Consequently, as a practical matter, a modification consensus bitcoin coin exchange with ripple ethereum and litecoin the source code e. Skip Navigation. Trust Structure. Table of Contents average and 0. The SEC emphasized that the disapproval does not rest on an evaluation of whether bitcoin or blockchain technology has value as an innovation or investment. To the extent that the price of bitcoin in the Bitcoin Exchange Market, and the value of bitcoin as measured by pricing on the Gemini Exchange, moves significantly in a negative direction after the close of U. The layered confirmation process makes changing historical blocks and reversing transactions exponentially more difficult the further back one goes in the Blockchain. State or other jurisdiction of. The postponement, suspension or rejection of Creation Basket orders or Redemption Basket orders, as permitted in certain circumstances under the Transfer Agency and Services Agreement, may adversely affect an investment in the Shares. Bitcoin has been characterized as a virtual commodity, digital asset, digital currency and virtual currency by other what banks can you exchange bitcoin coinbase will not let me buy regulatory bodies. Moreover, the Sponsor may be required to register as an investment adviser under the Investment Advisers Act of Intellectual property rights claims may adversely affect the Trust and an investment in the Shares.

Table of Contents Carolina law does not require miners or software providers to obtain a license for multi-signature software, smart contract platforms, smart property, colored coins and non-hosted, non-custodial wallets. Approximate date of commencement of proposed sale to the public: She is a finance major with one year of writing experience. As a result of the high difficulty in successfully initiating a double-spend without the assistance of a coordinated attack, the current probability of success for a double-spend transaction attempt is limited. Suite ,. Book-Entry-Only Shares. The Shares may trade at a discount or premium in the trading price relative to the NAV as a result of non-concurrent trading hours between Bats and the Bitcoin Exchange Market. Such laws, regulations or directives may conflict with those of the United States and may negatively impact the acceptance of bitcoin by users, merchants and service providers outside of the United States and may therefore impede the growth of the Bitcoin economy. Your Money. The Sponsor believes that from time to time there will be further considerations and adjustments to the Bitcoin Network regarding the difficulty for block solutions. In May , the Central Bank of Bolivia banned the use of bitcoin as a means of payment. The Gemini Exchange is a Digital Asset exchange owned and operated by the Custodian and is an affiliate of the Sponsor. Title of each class of.