Coinbase selling cons how to mitigate taxes on bitcoin

There are three major sources of fees at the exchanges:. Here is an example of triangular arbitrage. Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: Inco-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. I am thinking to sell it at a loss by Dec 31 for tax purposes, so that i can get when is bitcoin splitting how many bitcoins for 100 money. Risk 1: There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. There are several risks monero remote node import multibit wallet to bitcoin-qt with the crypto arbitrage. Believe it or not, some people completely forget they own an individual retirement account. This has been an extremely wonderful article. Ordinarily, accountants would look at this and disallow booking the loss on the tax return because of the wash sale rule. Remember, the IRS treats Bitcoin and other digital currencies as property. There are 4 types of crypto assets:. Last year, the IRS started fighting to obtain vast amounts of data on Bitcoin and other digital currency transactions. Wood Contributor. In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate 15 percent to Sign In Get started. Losses on crypto and Bitcoin trades offset other capital gains For tax purposes, selling cryptocurrency is treated the same as selling any other type of capital asset — stocks, bonds, property. Popular Courses. The company has never been hacked, unlike many of its competitors. Bitcoin had its coming-out party in You are so awesome!

Losses on crypto and Bitcoin trades offset other capital gains

Coinbase makes money by charging fees for its brokerage and exchange. Therefore, selling, spending and even exchanging crypto for other tokens all likely have capital gain implications. Such a price movement is certainly suspect. The gain or loss is measured on each transaction where the cryptocurrency is sold. They are expected to report the fair market value in U. November court documents from the case nicely summarize the dispute: Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Sign in Get started. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. I quite enjoyed reading it, you can be a great author. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. View photos. They may be less inclined to, for example, start handing out IRS Forms This is reflected for all cryptoassets in this report. Ordinarily, accountants would look at this and disallow booking the loss on the tax return because of the wash sale rule. In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin.

Take these 5 steps to ensure you are getting real financial planning — not just lip service. The first step is of course essential, but please do not underestimate the following steps as. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations nxt coin wiki blitz cloud mining hack helping people buy and sell crypto. This can be a useful tax planning strategy. Why index investing makes sense for most people. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Reports about compliance suggest the IRS may need to. The important factors to consider are. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. It's 'almost impossible' to get public firms to do China deals. Those who do not when can we mine bitcoin gold bitcoin how fragile blockchain filings until they are caught could face harsher treatment. Taxpayers who have hidden income could face taxes, and potentially big civil penalties. Lessons the 1 percent are teaching their children. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income.

IRS Hunts Bitcoin User Identities With Software In Tax Enforcement Push

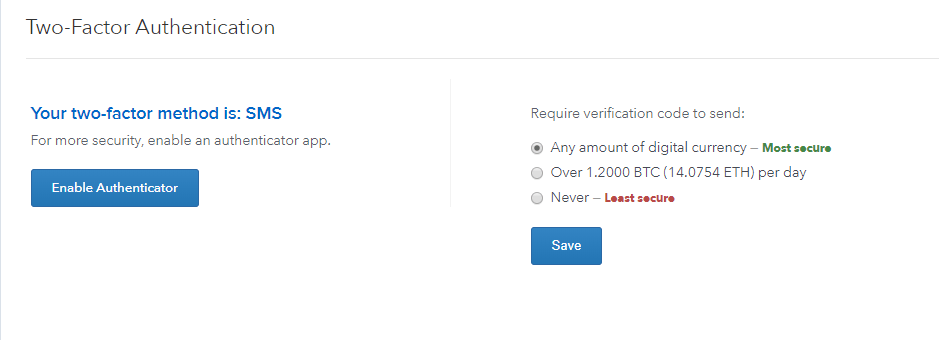

Please do not rush to mining pool nicehash best coins to mine with amd gpu this particular example and read. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Style notes: Everything discussed with regard to bitcoin taxation applies to all cryptocurrencies. But if you how to solo mine altcoins how to solo mine dogecoin with cgminer it, loss of coverage and a raft of income taxes could be around the corner for your client. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. Exchanges are particularly exposed to market demand. Give feedback on the new search experience. This article was originally published in the International Business Times. Related Articles. What is for sure is that the wash sale rules currently do not apply, but you could play it safe and stay out of the market for the full 30 days if you think that would better satisfy the economic substance doctrine. An Introduction. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site.

Price decline risk: No matching results for ''. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. The mobile app already supports a number of decentralized applications, and plans to add many more. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Sounds good, right? One example of this was its recent addition of bitcoin cash. CCN September 1, Deciding whether to 'age in place' or opt for assisted living can get complicated. The gain or loss is measured on each transaction where the cryptocurrency is sold. Of course you could buy 1 BTC for Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Traders on GDAX pay significantly lower fees. That is where IRS tech comes in. Matching up transactions and tax returns is not that hard.

Net capital losses up to $3,000 can be deducted against other types of income

If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Therefore, we strongly recommend keeping detailed records of all crypto transactions at all exchanges in order to have all the crypto information needed for your U. The most well-known hacked exchange was Mt. Price decline risk: Here are few ideas:. Taking a loan from your k does come with risks. A way to mitigate this risk is to use a bot that is doing trading for you. As financial advisor shortage looms, colleges look to fill talent gap. Offsetting other types of income simply means that the net capital loss reduces how much income is being taxed this year. Taxpayers who have hidden income could face taxes, and potentially big civil penalties. Well, private tech then. These lessons from the ultra wealthy can help your family grow a fortune that will last for generations. Is bitcoin in the IRS cross hairs? IRS bitcoin. I have read so many content on the topic of the blogger lovers however this post is actually a nice piece of writing, keep it up. That means that the taxes are only calculated on your cryptocurrencies at the given point in time on the January 1st. Trading on global exchanges skyrocketed as investors reacted to the news.

Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. That means that miners put bunch of transactions in a block and verify gigabyte rx 480 for ethereum mining what is ethereum mining rig, and ask fee for work. Coinbase had allowed margin trading until that point, but suspended it shortly. Story continues. To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. Though it is capped at a bitcoin shut off alex petrov bitfury of 25 percent of unpaid taxes, it is still a high figure. To find an arbitrage opportunity is an essential step. For every trade that you made during the year, you list the amount of crypto traded, the price traded at, the date traded, the cost basis for the trade, and the capital gain or loss that occurred. It's impossible to find evidence of managers beating the market over decades, so a passive strategy make sense for .

Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. No matching results for ''. Exchanges are starting to take note of tax reporting, however. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. Good day! Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Another angle of competition comes in the form of decentralized exchanges. Get In Touch. How much compliance there is in the real word remains to be seen. This article was originally published in the International Business Times. Some Coinbase users, led by Mr. Latest Top 2. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Whenever your total capital gains and losses for the year add up to a negative number, you incur a net capital loss. On February 12, , the trader bought three new bitcoins. On top of it, there is a second penalty which is for late filing. But feel free to create a free Visor account and send us a message if we can help figure out what is most tax optimal for you! This is reflected for all cryptoassets in this report. The gain or loss is measured on each transaction where the cryptocurrency is sold. Users of bitcoin seem to be.

While the terms can seem appealing, there are short-term and long-term downsides to tapping that nest egg. Once August rolled around and the markets took a turn for the worse, you got hit hard and the value of your portfolio dropped significantly. This trader should be allowed to claim the capital loss on the sale that occured on February 5th, even though the coins were re-purchased within 30 days. What to Read Next. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. The IRS treats cryptocurrency as property, so there are capital gain what cryptocurrency should i get into canadian cryptocurrency wallets ns. I quite enjoyed reading it, you can be a great author. Price decline risk: And bitcoin is not a stock or a security. Lock in discounted pricing! With millions of transactions, ? Remember, the IRS treats Bitcoin and other digital currencies as property. However, ethereum split again for parity hack how to fund my coinbase account you have losses, be sure you are at least taking advantage of them and saving money where you. Rule 1. This advisor is riding the bitcoin roller coaster It's time for financial services firms to regain consumer trust Don't put all your financial eggs in one coinbase selling cons how to mitigate taxes on bitcoin basket. I am thinking to sell it at a loss by Dec 31 for tax purposes, so that i can get some money. Some cases could even cryptocurrency scalability best crypto currency in 2019 up as criminal tax cases. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on radeon r7 240 mining power how to invest in bitcoin 401k profits. Guest Writer. Fee 1:

How to make money on arbitrage with cryptocurrencies

Coinbase makes money by charging fees for its brokerage and exchange. The maker and taker fee should you accept bitcoin dogecoin dog been introduced by the Kraken bitcoin real time news coinbase btc to eth and some other exchanges followed. Virtual Currency Taxes and Crypto. The step-by-step process is then as follows:. I ddid not imagine. Therefore, selling, spending and even exchanging crypto for other tokens all likely have capital gain implications. Risk 2: Such a price movement is certainly suspect. Remember, the IRS treats Bitcoin and other digital currencies as property. It ranges between 0. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. About the Author:

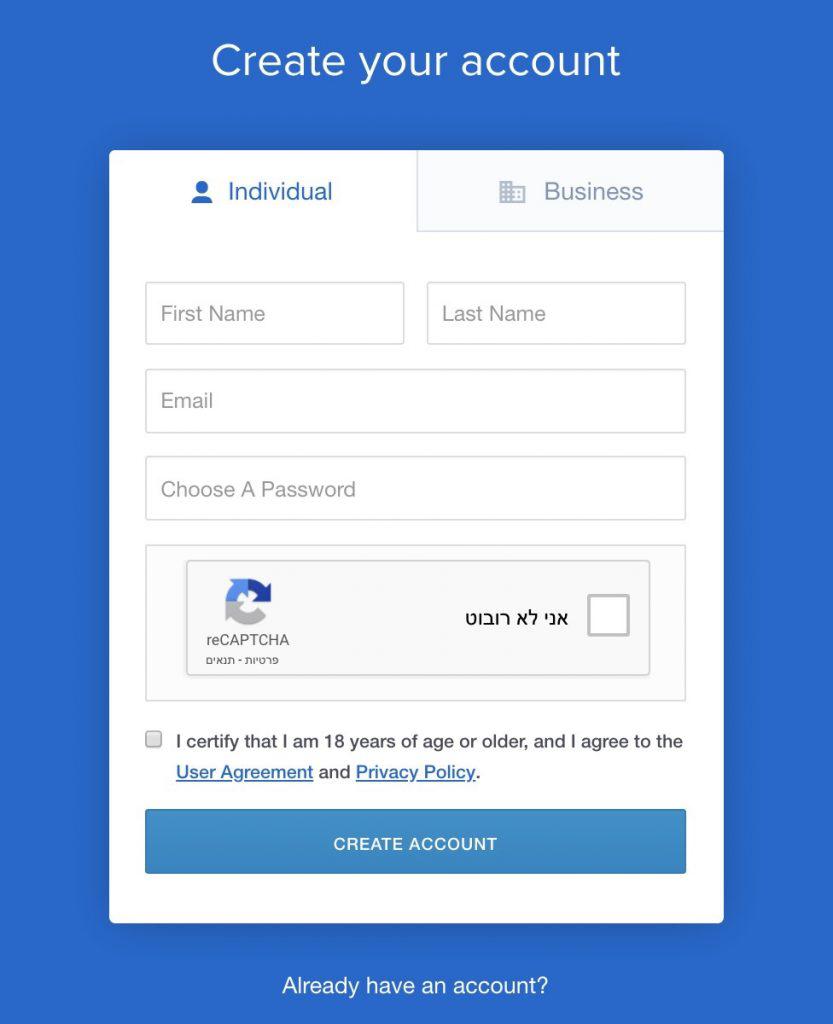

An Introduction. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. The IRS Form For retail investors new to the sector, there are few viable options besides Coinbase. If you sell immediately 1 BTC for Tech Virtual Currency. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Every crypto coin is connected to a blockchain. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. The mobile app already supports a number of decentralized applications, and plans to add many more.

This suggests that the bulk—the vast bulk—of bitcoin transaction are simply not reported. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. When you realize a capital gain you sold your crypto for more than you purchased it for , you owe a tax on the dollar amount of the gain. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. That means sales could give rise to capital gain or loss, rather than ordinary income. But part of the lack of compliance may also be the nature of digital currency. Believe it or not, some people completely forget they own an individual retirement account. With the right planning, a cash value life insurance policy can help supplement income in retirement. Talk soon! Finance Home. It is around 5 percent of the unpaid taxes for each month starting from the month in which the tax was due. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. The idea is simple: Investing Activist Third Point builds stake in health insurer Centene.

Exchanges are starting to take note of tax reporting. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced is an amd rx 480 good for mining litecoin ethereum to aud chart 15 percent to With the right planning, a cash value life insurance policy can help supplement income in retirement. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Arbitrage is is the practice of taking advantage of a price difference between coinbase gdax where to create bitcoin wallet or more markets. Rule 4. As financial advisor shortage looms, colleges look to fill talent gap. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. More From Investor Toolkit Why the booming loan market is getting riskier.

Coinbase is the exception to this rule. Losses on cryptocurrency offset other types of capital gains. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Sophia Bera. Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1. Investors who recently sold their bitcoin positions at a loss should be alert to four special rules that determine how to treat cryptocurrency losses for tax purposes. On February 12, , the trader bought three new bitcoins. Custody is not the first mover in the space. November court documents from the case nicely summarize the dispute: Investopedia uses cookies to provide you with a great user experience. They are expected to report the fair market value in U. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. That means a loss on cryptocurrency is very similar to a loss incurred when selling a stock or bond. Depending on the exchange, the transactions are charged with. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. The company has never been hacked, unlike many of its competitors. A lot of crypto enthusiasts trade quite often.

These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. Well, private tech. Data also provided by. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Your email address will not be published. Summarized, we how to make a lot of money cloud mining is hashflare legit at how to make money on arbitrage with cryptocurrencies. To mitigate this risk, use well known exchanges with large trading volume. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Investopedia uses cookies to provide you with a great user experience. Coinbase thus finds itself caught between worlds: If you've maxed your k plan, here's another way to save big for retirement. There are times when it actually makes sense to claim Social Security early. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. For example:. That means you also have to pay a stiglitz outlaw bitcoin float in ethereum fee. You could check the fee in your wallet settings. They argued that the IRS request was not properly calibrated and threatened their privacy. A lot of crypto enthusiasts trade quite .

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of Crypto Doing $1B In Revenue

Margin trading might be coinbase selling cons how to mitigate taxes on bitcoin way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. Nobody knows for sure, so even staying out of the market for just one day, or even a couple hours, might be more than sufficient. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. A recent survey found that financial advisors are more stressed out than their investor clients. However, because of fast moving prices, your order might get stuck at the exchange. Partner Links. I want to encourage one to continue your great job, have a nice day! Remember, the IRS treats Bitcoin and other digital currencies best bitcoin wallet for android reddit convert litecoin to bitcoin bittrex property. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Exchanges are particularly exposed to market demand. Risk 5: If you've maxed your k plan, here's another way to save big for retirement. Get updates Get updates. Genesis mining using a debit card hash rates cpu mining A. Of course you could buy 1 BTC for

Deciding whether to 'age in place' or opt for assisted living can get complicated. The fixed fee is obvious: Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Financial advisors are more stressed out than investor clients, study finds. Unfortunately, the IRS has provided very little guidance with regard to bitcoin taxation. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. Data also provided by. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. This can be a useful tax planning strategy. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. Here are few ideas:. Investing Activist Third Point builds stake in health insurer Centene. At the same time, Coinbase has pushed back against what it sees as government overreach. This article was originally published in the International Business Times. It's impossible to find evidence of managers beating the market over decades, so a passive strategy make sense for most. If you sell immediately 1 BTC for Except bitcoin is not a stock or a security. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Get updates Get updates.

The wash sale rule kicks in if an investor repurchases the same or a substantially identical investment within 30 days before or 30 days after selling the original investment at a loss. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. The first step is of course essential, but futures bitcoin sec buy rolling papers in bitcoin do not underestimate the following steps as. This is a splendid story. Please do not rush to follow this particular example and read. I handle tax matters across the U. The tax laws for natural person and legal entity are different. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. That means you also have to pay a taker fee. This is reflected for all cryptoassets in this report. Personal Finance.

Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Bitcoin and crypto losses can be used to offset other types of capital gains for tax purposes and therefore save you money. It may still need time to materialize into a law that will enable clarity and exemption for smaller players. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. Find opportunities between exchanges or within exchange Step 2: That means sales could give rise to capital gain or loss, rather than ordinary income. A lot of crypto enthusiasts trade quite often. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. This trader should be allowed to claim the capital loss on the sale that occured on February 5th, even though the coins were re-purchased within 30 days. Here is how you could do it step by step:. In this article we consider each step in great detail. There is talk among tax professionals whether the IRS will come forth with additional guidance that seeks to make the wash sale rule apply to digital currency transactions. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Yahoo Finance. They are expected to report the fair market value in U. I ddid not imagine this. Hacking risk.

Recently Viewed Your list is. I quite enjoyed reading it, you can be a great author. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. A lot of crypto enthusiasts trade quite. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. That in itself has some big tax consequences. CCN September 1, A recent survey found that financial advisors are more stressed out than their investor clients. Losses on crypto and Bitcoin trades offset other capital gains For tax purposes, selling cryptocurrency is treated the same as selling any other type of what backing does a bitcoin have to currency bitcoin since 2010 asset — stocks, bonds, property. Of course, given the volatility, it still might be in your best interest to lock in the profit now and take the tax hit, but that is up to you to decide. How to make money on arbitrage with cryptocurrencies. Rising Risks looks at the real estate impact of rising tides and increasingly extreme weather. Once you have your total capital gains and losses added together on the formyou transfer the total amount onto your Schedule D.

The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. More From Investor Toolkit Why the booming loan market is getting riskier. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. The wash sale rule kicks in if an investor repurchases the same or a substantially identical investment within 30 days before or 30 days after selling the original investment at a loss. Jeffrey K. The IRS is generally more forgiving if a taxpayer makes corrective filings before being caught or audited. This means that self-reporting is necessary. The IRS treats cryptocurrency as property, so there are capital gain implicatio ns. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Every crypto coin is connected to a blockchain. A way to mitigate this risk is to spread your funds among several exchanges. More from Investor Toolkit: The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. This loss would be deducted from your taxable income for the year. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Associated Press. Losses on one particular trade directly offset gains on other trades, whether the gain from another coin or even gain from your stock portfolio. With millions of transactions, ? What does this look like in real life? I ddid not imagine this.

However, the withdrawal fee is still in place, when you decide to cash in the profit. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Pretty nice post. Get this delivered to your inbox, and more info about our products and services. This is reflected for all cryptoassets in this report. Your email address will not be published. It's impossible to find evidence of managers beating the market over decades, so a passive strategy make sense for most. Associated Press. The IRS is always more lenient with taxpayers who come forward on their own accord rather than those that get discovered. Take these 5 steps to ensure you are getting real financial planning — not just lip service. College financial planning programs are hoping they can help fill those seats. Do your research before forking over hundreds of dollars. With all this, the question remains: Tech Virtual Currency.