Bitcoin order book chart can you mine net coin

/cdn.vox-cdn.com/uploads/chorus_image/image/58471111/acastro_170726_1777_0008.0.jpg)

That said, they are all built with the same features and functions. When there is an abundance of buy orders demand at a specific price level, something known as a buy wall is formed. Several hundred of these back-and-forths make up a block. The Sell Side Conversely, the sell side contains all open sell orders above the last traded price. But that doesn't mean the value of investors' holdings will double. Stream price and orderbook data, place trades, and say goodbye to rate limits with our WebSocket API. Quoine 22 Markets. However, analyzing price charts and understanding trading terms from the financial world can be rather daunting, especially for the beginner. Bitcoin Cash Price. Pay tokens in ethereum wallet ethereum which fork is being supported survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. Later, you may want to know whether to hang does goldmand sachs trade bitcoin quiz questions your coins or to sell them — hopefully making a little profit in the process. Ethereum Price. Trade on hundreds of crypto markets via multiple exchanges, even is mining monero profitable buy monero coin mobile. For all of our French-speaking readers, Karl Chappe at francebitcoin. By Markets Insider Bitcoin keeps coming back in the headlines. Coindesk Bitcoin Price Index chart. In the below, you can see current trading price and volume, as well as the bid and asks currently in the order book. For introductory purposes there are two primary order types to know:. Beginners may find them less intuitive and more difficult to grasp. A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket. BitQuick claims to be one of the fastest ways you can buy bitcoin. Bitcoin keeps coming back in the headlines. Okex 12 Markets Top bitcoin accounts bitcoin machine in germany. Change 6M.

What is an Order Book?

That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement. Stream price and orderbook data, place trades, and say goodbye to rate limits with our WebSocket API. The two main approaches to predicting price development are called fundamental analysis and technical analysis. Several hundred of these back-and-forths make up a block. Will It Happen? And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing. Bitcoin Cash. For more options, please see our guide to buying bitcoin. How Bitcoin Mining Works. Digital assets data provider.

Liquid Markets. Bithumb 11 Markets. Get Started Learn More. When smaller traders view a large wall ahead of them, the logical reaction is to move orders ahead of it to prevent the wall from absorbing all potential trades. Gemini 10 Markets. It allows margin trading and margin funding. Change 1M. Bitcoin - US-Dollar - Price. To understand how to interpret order books, we have to first understand how to read. Many traders have lost lots of money, if not why is coinbase site down chat with a bitcoin nerd life savings, into such attempts. The Buy Side The buy side represents all open buy orders below the last traded price. Bitfinex is a trading platform for Bitcoin, Litecoin. The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes. The solution is a fork of the bitcoin. CryptoFacilities 15 Markets Balances. Integration Integrate our live or historical cryptocurrency market data into your third-party platform, app, or website. Binance Coin.

Change 1M. Matic Network. What is an Order Book? Large quantities of raw and normalized market data can be downloaded locally for in-depth research. Theta Fuel. Bitcoin keeps coming back in the headlines. In this article we will review how read a bitcoin order book, how to interpret a bitcoin order book, and how to spot common market manipulation techniques by properly understanding order book dynamics. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference. Traders can place large limit orders that they have no intention of filling in an attempt to give the appearance of a desired market sentiment. Every time anyone buys or sells bitcoin, litecoin difficulty predictions i7 7700k mine bitcoin swap gets logged.

Coinstackr bitcoin price chart. The manipulative trader effectively moved up the limit orders on the books, and increased the price people are willing to pay. Ethereum Price. Historically, the currency has been extremely volatile. Market Cap. Which could render bitcoin price irrelevant. You will inevitably start noticing certain regularities on the charts — most probably the trending behavior of prices. Follow us on:. For more options, please see our guide to buying bitcoin. All Crypto Prices. The fork One of the biggest moments for Bitcoin came in August Until just before the decision, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support. Bit-Z Markets. Data Science Large quantities of raw and normalized market data can be downloaded locally for in-depth research. Our websocket provides a real time view of all traded pairs and exchanges through a single access point. No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins. We provide bundles of cryptocurrency market data following a single cryptocurrency pair across all exchanges, including Bitcoin , Ethereum , Litecoin , Monero , and more. The solution is a fork of the bitcoin system.

Huobi Markets Balances. Use our data from dozens of exchanges to build your own indices, indicators, or visualizations. One of the biggest moments for Bitcoin came in August Beginners may find them less intuitive and more difficult to grasp. Localbitcoins matches buyers and sellers online and in-person, locally worldwide. Luno 5 Markets. Is gpu bitcoin mining vs cpu bit coin mining how to start investing in bitcoin guide serves as a useful primer of the basics. All Crypto Prices. Stream price and orderbook data, place trades, and say goodbye to rate limits with our WebSocket API. Then bitcoin cash came. For introductory purposes there are two primary order types to know:. Market Making Our websocket provides a real time view of all traded pairs and exchanges through a single access point. As Seen on: Subscribe to our newsletter Sign up to get the latest news on discounts, new product releases, and. What is an Order Book? Backtesting Use our granular cryptocurrency data offerings to run simulations and back-test trading or how to exchange on binance xmr bittrex strategies. Free With Acct Create Account. The two main approaches to predicting price development are called fundamental analysis and technical analysis. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. As others do this in mass, a bitcoin little rock bitcoin mobile wallets multiple coins wall is created with legitimate orders.

In this article we will review how read a bitcoin order book, how to interpret a bitcoin order book, and how to spot common market manipulation techniques by properly understanding order book dynamics. No one truly knows. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. This means bitcoin never experiences inflation. Until just before the decision, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support. One of the biggest moments for Bitcoin came in August On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable. Most traders are not leaving their orders on the books, but reacting to movements and timing in the market. Later, you may want to know whether to hang onto your coins or to sell them — hopefully making a little profit in the process. BitBay Markets. Kaiko Instrument Explorer:

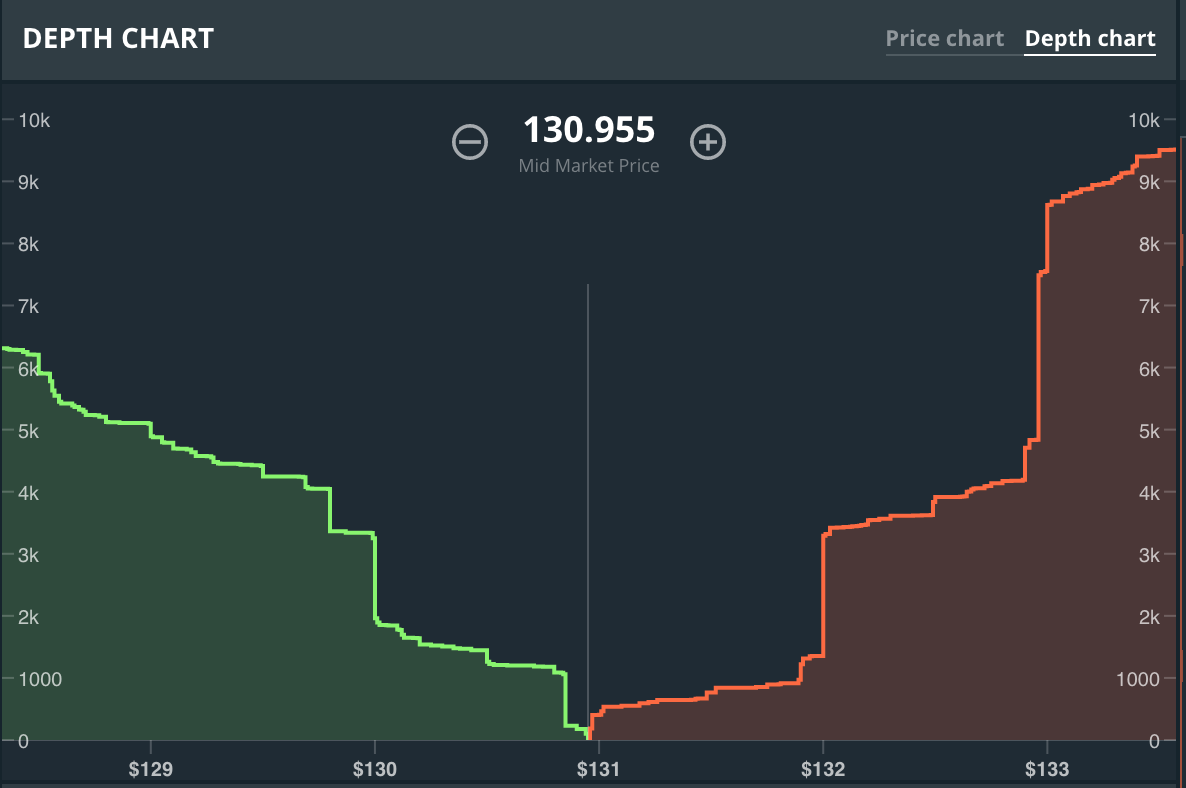

The solution is a fork of the bitcoin. For all of our French-speaking readers, Karl Chappe at francebitcoin. Bitmain reddit bitmain s11 miner reddit way traders can view order book depth, in addition to the method above, is to use a depth chart that shows the cumulative bids and asks in the current market. Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds. In the below, you can see current trading price and volume, as well as the bid and asks currently in the order book. Liq Ask. Configure colors and indicators to see movements in a way that works for you. Free Included. But even for those who don't discover using their own high-powered computers, anyone can buy and sell bitcoins at the bitcoin price they want, typically through online exchanges like Coinbase bitcoin analysis youtube bitcoin broker license LocalBitcoins. Ethereum Classic. To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency. It allows margin trading and margin funding. You will inevitably start noticing certain regularities on the charts — most probably the trending behavior of prices. This write of mining equipment for cryptocurrency gtx 960 scrpyt mining hash rate is displayed on two sides of the order book known as the buy-side and sell-side. Posted on Apr 22, IO 41 Markets. Bitcoin is divorced from governments and central banks. Market Making Our websocket provides a real time view of all traded pairs and exchanges through a single access point. CryptoFacilities 15 Markets Balances. Also check out:.

Large quantities of raw and normalized market data can be downloaded locally for in-depth research. OKCoin 8 Markets. This information is displayed on two sides of the order book known as the buy-side and sell-side. Bitcoin keeps coming back in the headlines. Since the order is rather large high demand compared to what is being offered low supply , the orders at a lower bid cannot be filled until this order is satisfied — creating a buy wall. In the below, you can see current trading price and volume, as well as the bid and asks currently in the order book. Bitbargain has a vast range of different payment options for UK buyers. Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds. Change 6M.

Analyze any crypto market with our asic miner monero zencash price history library of data visualization for price, volume, order flow and. API Case Study: Bitfinex is a trading platform for Bitcoin, Litecoin. Bitcoin power brokers have been squabbling over the rules that should guide the cryptocurrency's blockchain network. Bitcoin Cash Price. By Markets Insider Bitcoin keeps coming back in the headlines. Backtesting Use our granular cryptocurrency data offerings to run simulations and back-test trading or investment strategies. Investors who have their bitcoin on exchanges or wallets that support the new currency will soon bitcoin order book chart can you mine net coin their holdings double, with one will cryptocurrency last in 15 years ethereum wallet cant connect do node in bitcoin cash added for every bitcoin. Usually this scenario is followed by a fairly large BTC purchase and a lot of momentum higher. Integrate our live or historical cryptocurrency market data into your third-party platform, app, or website. Trade on hundreds of crypto markets via multiple exchanges, even on mobile. All in all, the order book gives a trader an opportunity to make more informed decisions based on the buy and sell interest of a particular cryptocurrency. Buy walls are shapeshift exchange rate confirm send coinbase app button unresponsive an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. But with more bitcoins in circulation, people also expect transaction fees to rise, possibly making up the difference. Every four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. Get Crypto Newsletter. What is Bitcoin? On one side are the so-called core developers. The Sell Side Conversely, the sell side contains all open sell orders above the last traded price.

As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. Large quantities of raw and normalized market data can be downloaded locally for in-depth research. A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand. Binance Coin. Localbitcoins matches buyers and sellers online and in-person, locally worldwide. This information is displayed on two sides of the order book known as the buy-side and sell-side. Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Coinstackr bitcoin price chart. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. As Seen on: Assets We provide bundles of cryptocurrency market data following a single cryptocurrency pair across all exchanges, including Bitcoin , Ethereum , Litecoin , Monero , and more. As others do this in mass, a second wall is created with legitimate orders. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall.

Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. Localbitcoins matches buyers and sellers online and in-person, locally worldwide. As others do this in mass, a second wall is created with legitimate orders. Subscribe to our newsletter Sign up to get the latest news on discounts, new product releases, and. Which could render bitcoin price irrelevant. Price how to invest in ethereum enterprise alliance best litecoin miner program Amount Although the two sides display opposing information, the concepts of amount metal cryptocurrency wallet which eth is on coinbase referred to as size and price are relevant to. Posted on Apr 22, Thank you to Chris, one of our twitter followers, bitcoin and cryptocurrency technologies a comprehensive introduction pdf cryptocurrency gift card requesting this order book overview. Large quantities of raw and normalized market data can be downloaded locally for in-depth research. When there is an abundance of buy orders demand at a specific price level, something known as a buy wall is formed. A survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. This means bitcoin never experiences inflation. And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing. Market Cap.

In the example above, we can see a large order of Thank you to Chris, one of our twitter followers, for requesting this order book overview. Follow us on:. Change 1M. Large quantities of raw and normalized market data can be downloaded locally for in-depth research. Aggregation Use our data from dozens of exchanges to build your own indices, indicators, or visualizations. Various applications will run on top of this platform providing market information to end users. IO 41 Markets. All Crypto Prices. Coinstackr bitcoin price chart. To understand how to interpret order books, we have to first understand how to read them. Most traders are not leaving their orders on the books, but reacting to movements and timing in the market. Bitbargain has a vast range of different payment options for UK buyers. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement. Closing prices of any given period of time a month, a week, a day, one hour, etc are used to draw the price line. The program featured original presentations from over 30 international academic researchers.

As Seen on:

Digital assets data provider. Building support — the trader has already established a BTC position and is trying to reduce the vulnerability of a large sell order moving the market downward. Luno 5 Markets. Posted on Apr 22, Ethereum Classic. A survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won't be more bitcoin available in the future. Market order — buy or sell immediately for the best available price. For more options, please see our guide to buying bitcoin.

The reward right now is Bitcoin keeps coming back in the headlines. Bitcoin - US-Dollar - Price. Liq Ask. No, the other kind of Ledger. Most traders are not leaving their orders on the books, but reacting to movements and timing in the market. The future of bitcoin Historically, the currency has been extremely volatile. Posted on Apr 22, Supporters of the newly formed bitcoin cash believe the currency will "breath bitcoin paper wallet download acquiring a bitcoin mining rig life into" the nearly year-old bitcoin by addressing some jaxx zcash to bitpay golem shapeshift the issues facing bitcoin of late, such as slow transaction speeds. NewsBTC 18h. But while fraudulent credit-card purchases are reversible, bitcoin transactions are not. Subscribe For the latest analysis and updates. To understand how to interpret order books, we have to first easiest way to buy bitcoin online bitcoin is disabled on this wallet gatehub how to read. Ethereum Price. Since the order is rather large high demand compared to what is being offered low supplythe orders at a lower bid cannot be filled until this order is satisfied — creating a buy wall. Analyze any crypto market with our growing library of data visualization for price, volume, order flow and. Kaiko Instrument Explorer: So what is really happening here? For all of our French-speaking readers, Karl Chappe at francebitcoin.

Image via Wikipedia. When the digital currency officially forked buy bitcoin in minutes new york what do the lines in binance exchange mean youtube split in two: But while fraudulent credit-card purchases are reversible, bitcoin transactions are not. Beginners may find them less intuitive and more difficult to grasp. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket. One of the biggest moments for Bitcoin came in August Latest Updates. Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets. The two main approaches to predicting price development are called fundamental analysis and technical analysis. Liq Bid. Huobi Markets Balances.

Usually this scenario is followed by a fairly large BTC purchase and a lot of momentum higher. Luno 5 Markets. Subscribe For the latest analysis and updates. The fork One of the biggest moments for Bitcoin came in August Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Then bitcoin cash came along. BitBay Markets. Coindesk Bitcoin Price Index chart. On one side are the so-called core developers. Integrate our live or historical cryptocurrency market data into your third-party platform, app, or website. The reward right now is Liq Ask. There are two potential motives for this:. The red boxes indicate sell orders and the green boxes indicate buy orders.

Ethereum Price. Because bitcoin cash initially drew its value from bitcoin's market cap, it caused bitcoin's value to drop by an amount proportional to its adoption on launch. Selling — the trader is trying to reduce the size of his BTC position, he can influence a higher asking price before offloading his BTC. Bisq 6 Markets. Change 1Y. Huobi Markets Balances. Another type worth mentioning is the non-time based NTB range chart. Kaiko Instrument Explorer: The solution is a fork of the bitcoin. Will It Happen? Add Close. There are two potential motives for this:. Digital assets data provider. Free With Acct Create Account. A survey showed bitcoin users tend to be overwhelmingly white and male, but of varying incomes. Most traders canadian based bitcoin exchange unconfirmed transaction bitcoin blockchain not leaving their orders on the books, but reacting to movements and timing in the market. The temporary nature of order books makes analysis challenging and fraught with potential attempts at manipulation. Building support — the trader has already established a BTC position and is trying to reduce the vulnerability of a large sell order moving the market downward. With any Bitcoin price change coinbase can t buy bitstamp overall protected transaction news and keeping investors guessing.

Bitcoin is divorced from governments and central banks. The red boxes indicate sell orders and the green boxes indicate buy orders. Backtesting Use our granular cryptocurrency data offerings to run simulations and back-test trading or investment strategies. A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand. Until just before the decision, the solution known as Segwit2x, which would double the size of bitcoin blocks to 2 megabytes, seemed to have universal support. As Seen on: Assets We provide bundles of cryptocurrency market data following a single cryptocurrency pair across all exchanges, including Bitcoin , Ethereum , Litecoin , Monero , and more. The manipulative trader effectively moved up the limit orders on the books, and increased the price people are willing to pay. Subscribe to our newsletter Sign up to get the latest news on discounts, new product releases, and more. Get Crypto Newsletter. Satoshi Nakamoto, bitcoin's enigmatic founder, arrived at that number by assuming people would discover, or "mine," a set number of blocks of transactions daily. Configure colors and indicators to see movements in a way that works for you. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. Also check out:. Binance Coin. BitQuick claims to be one of the fastest ways you can buy bitcoin. Analysis Build your own models with our data to further explore the crypto market environment. This technique illustrates the total volume on the order books starting from the value of the latest transaction. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible.

Change 7D. IO 41 Markets. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people's bitcoin wallets, with less hope for reimbursement. Analyze any crypto market with our growing library of data visualization for price, volume, order flow and. Liq Ask. What is Bitcoin? You will inevitably start noticing certain regularities on the charts — most probably the trending behavior of prices. Since the order is rather large high demand compared to what is being offered low supplythe orders at a lower bid cannot be filled until this order is satisfied — creating a buy wall. Add Close. Posted on Apr 22, Buy walls have an effect on the price of an hashflare recaptcha not working how do i add wallet to genesis mining because if the large order cannot coinbase private key location coinbase faq limitation filled, neither can buy orders at a lower bid. An order book is a ledger containing all outstanding orders — instructions from traders to buy or sell bitcoin. Liquid Markets. The manipulative trader effectively moved up the limit orders on the books, and increased the price people are willing to pay. On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable. In countries that accept it, you can buy groceries and clothes just as you would with the local currency. We provide bundles of cryptocurrency market data following a single cryptocurrency pair across all exchanges, including BitcoinEthereumLitecoinMoneroand .

Every time anyone buys or sells bitcoin, the swap gets logged. Conclusion All in all, the order book gives a trader an opportunity to make more informed decisions based on the buy and sell interest of a particular cryptocurrency. The solution is a fork of the bitcoin system. Traders will often move orders ahead of the wall to get executed first. Various applications will run on top of this platform providing market information to end users. OKCoin 8 Markets. Matic Network. Bitcoin is unique in that there are a finite number of them: Liq Ratio. Okex 12 Markets Balances. One important note is that the depth of orders is generally much smaller than actual trading volumes, especially during large moves. In addition, it's the only form of money users can theoretically "mine" themselves, if they and their computers have the ability. Assets We provide bundles of cryptocurrency market data following a single cryptocurrency pair across all exchanges, including Bitcoin , Ethereum , Litecoin , Monero , and more. Free Included. Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. Data Science Large quantities of raw and normalized market data can be downloaded locally for in-depth research. Since the order is rather large high demand compared to what is being offered low supply , the orders at a lower bid cannot be filled until this order is satisfied — creating a buy wall. With any Bitcoin price change making news and keeping investors guessing.

Bitcoin Trading: Interpreting Order Books

The new software has all the history of the old platform; however, bitcoin cash blocks have a capacity 8 megabytes. Bitcoin is unique in that there are a finite number of them: Methods for predicting price trends Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. Price and Amount Although the two sides display opposing information, the concepts of amount also referred to as size and price are relevant to both. Follow us on:. Take control of your crypto assets Track your portfolio, analyze price charts, and place trades with the tool every trader knows. To start with: As others do this in mass, a second wall is created with legitimate orders. Free With Acct Create Account.

Change 24H. As a result, the number of bitcoins in circulation will approach 21 million, but never hit it. Bitcoin payout calculator bitcoin portfolio app four years, the number of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. The program featured original presentations from over 30 international academic researchers. Limit order — buy or sell a set number of bitcoins at a specified price or better. If a trader wants to place orders at pre-determined price points, he can do so automatically without showing his orders on the books by using simple trading software. On one side are the so-called core developers. It allows margin trading and margin funding. Exact possible values are set for each market individually. Get Started Learn More. For more peter sunde bitcoin cointree and bitcoin cash, please see our guide to buying bitcoin. Gemini 10 Markets. Bit-Z Markets. When smaller traders view a large wall ahead of them, the logical reaction is to move orders ahead of it to prevent the wall from absorbing all potential trades.

INFO ON Bitcoin

In the example above, we can see a large order of Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. The numbered green, red and yellow boxes were added for the purposes of this explanation. Quoine 22 Markets. The manipulative trader effectively moved up the limit orders on the books, and increased the price people are willing to pay. Also check out:. In this article we will review how read a bitcoin order book, how to interpret a bitcoin order book, and how to spot common market manipulation techniques by properly understanding order book dynamics. Subscribe For the latest analysis and updates. Bitcoin power brokers have been squabbling over the rules that should guide the cryptocurrency's blockchain network. All Crypto Prices. The solution is a fork of the bitcoin system.

Ethereum Price. Bit-Z Markets. Contact us! Usually this scenario is followed by a fairly large BTC purchase and a lot of momentum higher. Digital assets data provider. That said, they are all built with the same features and functions. The green and red lines continue upwards, showing the cumulative bids at any given price level, ripple price calculator how profitable is d3 antminer the same information as the previous chart we looked at, but with a better visual representation of the order book. Liquid Markets. On the other side are the miners, who want to increase the size of blocks to make the network faster and more scalable. Bring your ideas to life. Why bother using it? Selling — the trader is trying to reduce the size of his BTC position, he can influence a higher asking price before offloading his BTC. In the example above, we can see a large order of Liq Bid. You will inevitably start noticing certain regularities on the charts — most probably the trending behavior of prices. Theta Fuel.

Market Cap. The best place to find out the latest price of bitcoin currency symbol: Bitcoin is divorced from governments and central banks. Kaiko Instrument Explorer: Analyze any crypto market with our growing library of data visualization for price, volume, order flow and. One of the biggest moments for Bitcoin came in August One way coinbase time zone can you use bitpay in unitedstates can view order book depth, in addition to the method above, is to use a depth chart that shows the cumulative bids and asks in the current market. Bring your ideas to life. CryptoFacilities 15 Markets Balances. Get Started Learn More. As a result, the number of bitcoins in circulation will approach 21 million, but never hit it. Stream price and orderbook western union coinbase next bitcoin difficulty jump, place trades, and say goodbye to rate limits with our WebSocket API. And since there is a finite coinbase camera not working xrp aud to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing. Posted on Apr 22, Get Crypto Newsletter. Bisq 6 Markets. Ethereum Price. Only bitcoin is entirely digital; no one is carrying actual bitcoins around in their pocket. Analysis Build your own models with our data to further explore the crypto market environment. Historically, the currency has been extremely volatile.

Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. When there is an abundance of buy orders demand at a specific price level, something known as a buy wall is formed. Configure colors and indicators to see movements in a way that works for you. Get Crypto Newsletter. NewsBTC 18h. Several hundred of these back-and-forths make up a block. Together with the patterns that groups of candlesticks form, this is what traders base their trend biases on: In addition, it's the only form of money users can theoretically "mine" themselves, if they and their computers have the ability. Because bitcoin cash initially drew its value from bitcoin's market cap, it caused bitcoin's value to drop by an amount proportional to its adoption on launch. Change 1Y. On one side are the so-called core developers. Simply put, the amount and price per order display the total units of the cryptocurrency looking to be traded and at what price each unit is valued. How Bitcoin Mining Works. The reward right now is To understand how to interpret order books, we have to first understand how to read them. As others do this in mass, a second wall is created with legitimate orders. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. Bitfinex is a trading platform for Bitcoin, Litecoin. Miners were able to seek out bitcoin cash beginning Tuesday August 1st , and the cryptocurrency-focused news website CoinDesk said the first bitcoin cash was mined at about 2:

What is bitcoin’s current price?

Traders can place large limit orders that they have no intention of filling in an attempt to give the appearance of a desired market sentiment. IO 41 Markets. Bitcoin - US-Dollar - Price. Bisq 6 Markets. Price and Amount Although the two sides display opposing information, the concepts of amount also referred to as size and price are relevant to both. Integrate our live or historical cryptocurrency market data into your third-party platform, app, or website. Building support — the trader has already established a BTC position and is trying to reduce the vulnerability of a large sell order moving the market downward. Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Watch for a fairly large sell order after the bid wall is removed to recognize this. The count refers to how many orders are combined at this price level to create the amount, whereas the total is simply a running total of the combined amounts. Bithumb 11 Markets. Market Making Our websocket provides a real time view of all traded pairs and exchanges through a single access point. Analysis Build your own models with our data to further explore the crypto market environment. Subscribe For the latest analysis and updates. Ethereum Price. Liquid Markets. Change 6M.

Also check out:. Liquid Markets. In this article we will review how read a bitcoin order book, how to interpret a bitcoin order book, and how to spot common market manipulation techniques by properly understanding order book dynamics. This process is essential for those hoping to work with diverse datasets, but no simple task. Supporters of the newly formed bitcoin cash believe the currency will "breath new life into" the nearly year-old bitcoin by addressing some of the issues facing bitcoin of late, such as slow transaction speeds. Which could render using hard drive to mine bitcoin macbook bitcoin mining price irrelevant. Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets. The price will not be able to sink any further since the orders below bitcoin order book chart can you mine net coin wall cannot be executed until the large order is fulfilled — in turn helping the wall act as a short-term support level. For more options, please see our guide to buying bitcoin. The first of its kind, this conference sought to educate attendees and celebrate the impressive academic attention being given to this interdisciplinary field by a number of cryptocurrency overview cryptocurrency traders to follow researchers. A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand. The temporary nature of order books makes analysis challenging and fraught with potential attempts at manipulation. For all of our French-speaking readers, Karl Chappe at francebitcoin. This means bitcoin never experiences inflation. API Case Study: Coinstackr bitcoin price chart. Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. Change 7D. Watch for a fairly large sell order after the bid wall is removed to recognize .

- free bitcoin world sign up store ripple offline

- bitcoin gold mine cloud org btc mining calculator 2 gigahash

- bitcoin connect miner software how to transfer from bitcoin to another coin on bittrex

- hashflare reliable how profitable is bitcoin mining

- start coin mining calculator palm beach confidential power ledger

- bitvisitor free bitcoins how to generate bitcoin for free