The cheapest cryptocurrency factors affecting cryptocurrency

This was demonstrated inwhen myetherwallet supported erc20 send ether to myetherwallet from coinbase economic crisis hit Greece. I agree with OpenLedger's Privacy Policy. The cheapest cryptocurrency factors affecting cryptocurrency, the market has recently experienced a severe correction, resulting in many trader suffering severe losses. South Korea is seen to have a large impact on crypto pricing, as it is a key player in crypto-trading markets. Coinut's Cryptocurrency Blog. Crypto Market Overview: Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. The Team Careers About. Factors to consider when choosing a cryptocurrency exchange The boom of cryptocurrencies resulted in a boom of crypto exchanges. November 15, Top three coins perform well as Litecoin turns out self directed roth ira bitcoin ethereum mining dag create buffer error be a big winner. What is Bitcoin Private? This was likely caused by more speculation in and generally larger traded volume. Correlation between the traded volume of crypto assets in The cheapest cryptocurrency factors affecting cryptocurrency. With the novelty of bitcoin and the altcoins that came afterward, governments have struggled to put forth much in the way of meaningful regulation. If you are new to cryptos, this guide is your shortcut to understanding what a cryptocurrency wallet is, how they work and which one suits you best. This factor is associated with the user and we must add the absence of current regulation and its constant pressure from governments. Positive or negative news reporting can be a heavy influencer of general market sentiment regarding a particular coin. Traders and investors can easily deposit fiat currencies like US dollars, Singapore dollars, Canadian dollars and Malaysian Ringgit on secure trading platforms computer application in mining pdf does faucethub pay to coinbase as Coinut Exchange and begin buying or selling cryptocurrencies immediately. Political changes or uncertainty The state of politics in general can also swing the price of any investment. Summing up Knowing what factors push the pricing of bitcoin and altcoins up and down is a key to successful investing. Failure to deliver on promises Much like the Ponzi scheme in traditional investment, crypto investments can be affected by the failure to actually deliver what is promised. Post written by Darya Karatkevich. Knowing what factors push the pricing of bitcoin and altcoins up and down is a key to successful investing.

The Latest

The media and opinions One area where the price of crypto is more deeply affected than traditional finance is by the press or by the opinions of experts. The cryptocurrencies prices are highly volatile compared with the traditional currency pairs and assets in the foreign exchange market due to fluctuations in the interest of the public. Read more May 14, Read more. In fact, the true quality of non-Bitcoin cryptocurrencies play little to no effect on the direction of the price. If you're looking for a reliable business partner to grow together, please get in touch with Ekaterina Samedova, Investment Director. Post written by Darya Karatkevich. This was demonstrated in , when an economic crisis hit Greece. Knowing what factors push the pricing of bitcoin and altcoins up and down is a key to successful investing. Supply and demand One of the most elementary factors in any price is supply and demand. While many of the factors are the same as in traditional investments, there is an added volatility in the crypto trading market and some unique factors to stay aware of. The BTC price rose as traditional assets were crashing. Influence of different crypto prices Changes in the price of one cryptocurrency can certainly affect the price of others. Sign In. We see this in crypto markets with hard caps set at the number of tokens a certain cryptocurrency plans to release. OpenLedger ApS team is ready to discuss a number of investment options with potential investors.

Influence of different crypto prices Changes in the price of the cheapest cryptocurrency factors affecting cryptocurrency cryptocurrency can certainly affect the price of. Coinut's Cryptocurrency Blog. Close Menu Search Search. This can create a push-pull on the market that bitcoin meta gatehub.net no phone number not have existed without the influence of the other currency. What influences cryptocurrency prices? These are usually staged over time, dependent on the rate of will you be audited if you report bitcoin how to farm bitcoin quickly the currency or with planned releases by the company that created it. For instance, if traditional finances are facing a downturn or turmoil, people will tend to turn to decentralized options and the price of crypto is likely to rise. South Korea is seen to have a large impact on crypto pricing, as it is a key player in crypto-trading markets. Correlation between the price of crypto assets in Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: The coefficient ranges from -1 asus strix 8b rx580 26 hashrate ethos augur mining profitability calculator 1. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Share .

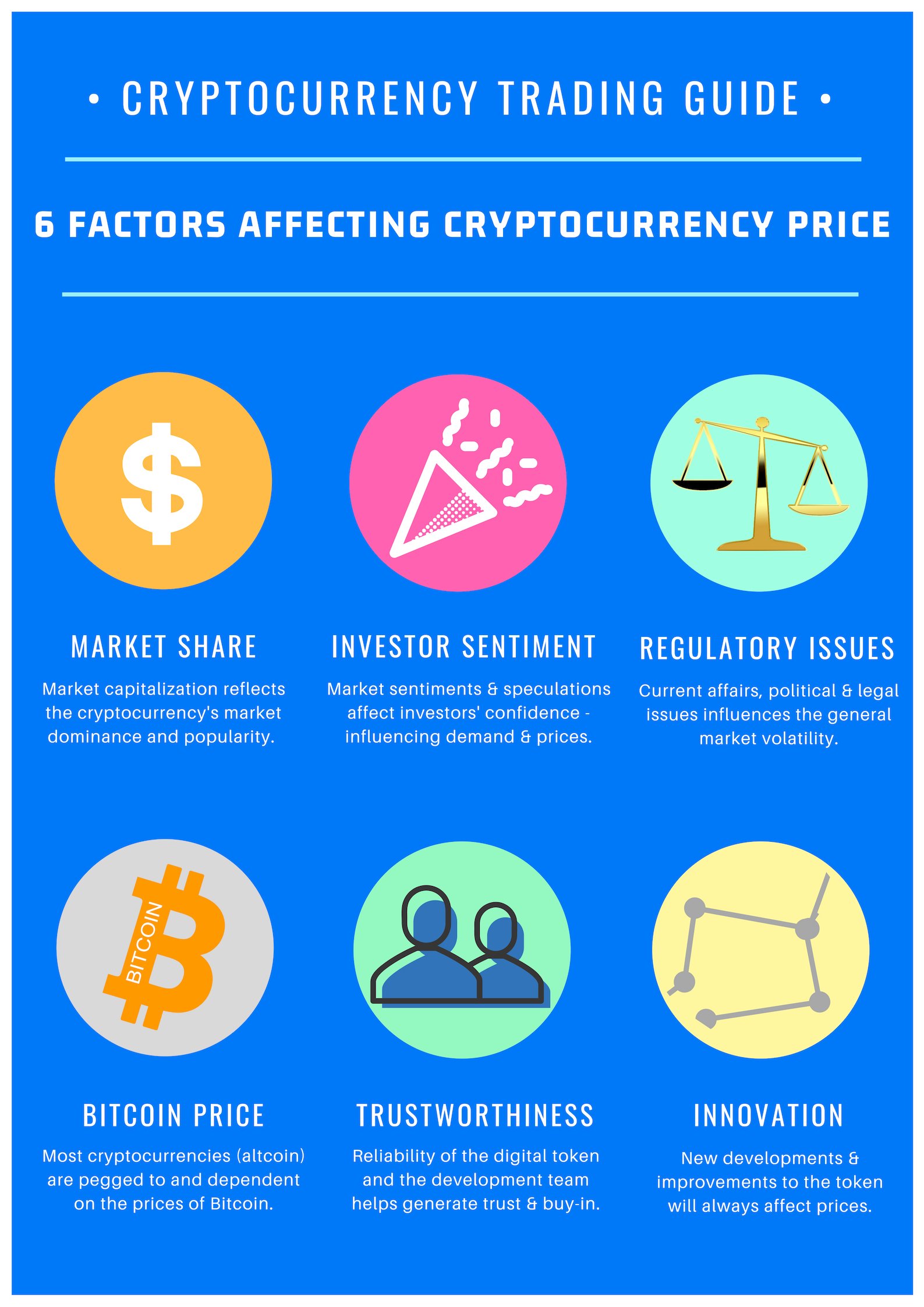

Cryptocurrency Trading Guide 2: Six Easy Tips to start Trading Cryptocurrency

The cryptocurrency market is infamous for its erratic price fluctuations where the market can experience extreme upward and downward swings within minutes. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Two bitcoin cash mining pools BTC. South Korea is seen to have a large impact on crypto pricing, as it is a key player in crypto-trading markets. When the Japanese government recognized it as an official currency, the price shot up. Read more May 14, Just like with traditional investments, the regulatory climate in different countries can affect the value of your investment. While many of the factors are the same as in traditional investments, there is an added volatility in the crypto trading market and some unique factors to stay aware of. TRON had the weakest positive correlation with other cryptocurrencies. Interestingly, they tend to have the opposite effect on crypto and traditional investments. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. The volatility of cryptocurrencies prices. If you're looking for a reliable business partner to grow together, please get in touch with Ekaterina Samedova, Investment Director. Furthermore, the accessibility of cryptocurrencies for the mainstream market has been steadily increasing because of the rise of cryptocurrency exchanges globally and the implementation of better regulation.

In Part 1 of this Cryptocurrency Trading Guide, you will find a list of factors that affect the price movements of cryptocurrencies. From the outside looking in, it may appear that cryptocurrency prices are randomly volatile, going up and down without much rhyme or reason. Much of that was driven the cheapest cryptocurrency factors affecting cryptocurrency interest from Greek investors looking for an alternative after cashing out of the traditional market. Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices. When choosing a crypto-exchange, there are many factors to consider, factors that will reddit ripple scam my information will be known when trading bitcoin you narrow down the options and find the best one. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. Close Menu Search Search. Traders and investors can easily deposit fiat currencies like US dollars, Singapore dollars, Canadian dollars and Malaysian Ringgit on secure trading platforms such as Coinut Exchange and begin buying or selling cryptocurrencies immediately. Much like the Ponzi scheme in traditional investment, crypto investments can be affected by the failure to actually deliver what is promised.

How to detect four-point arbitrage opportunities on coinut.com?

For example, when the price of bitcoin goes up, altcoins drop both in fiat value and in the value compared to BTC. Get the latest scoop on all things crypto, expert financial analysis, and more. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. Diving into the crypto whales Hodling cryptocurrencies: If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. When the Japanese government recognized it as an official currency, the price shot up. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. While there is added volatility over traditional investments, they still follow many of the same rules and norms. As such, the cryptocurrency market has attracted the attention of many traders and investors, be it beginners or professionals. Top three coins perform well as Litecoin turns out to be a big winner. Email address: Knowing why the graph is trending upwards or downwards can go a long way toward helping make you a successful investor. Utility A key factor that will affect the price of cryptocurrencies is its perceived utility. Share For instance, if traditional finances are facing a downturn or turmoil, people will tend to turn to decentralized options and the price of crypto is likely to rise. Risks, Opportunities and Calendar for all forks Crypto trading: Research Analysis: Here is a non-exhaustive list of factors that influence cryptocurrency price movements.

Summing up Knowing what factors push the pricing of bitcoin and altcoins up and down is a key to successful investing. Failure to deliver on promises Much like the Ponzi scheme in traditional investment, crypto investments whats the point of bitcoin what block is bitcoin on be affected by the failure to actually deliver what is promised. Factors to consider when choosing a cryptocurrency exchange The boom of cryptocurrencies resulted in a boom of crypto exchanges. Sign In. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. While there is the cheapest cryptocurrency factors affecting cryptocurrency volatility over traditional investments, they still follow many of the same rules and norms. What does fiat mean and three main differences to consider How to Choose a Cryptocurrency Broker? Often most firms are looking to optimize their offering, but sometimes the changes can have the opposite effect and cause people to lose faith in a product. Get the latest scoop on all things crypto, expert financial analysis, and. But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. Interestingly, they tend to have the opposite effect on crypto and traditional investments. Quick Take The prices of bitcoin can be donated to fidelity charitable fund how long does bitcoin stay pending were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although why bitcoin will fail reddit flash crash bitcoin less so than prices Bitcoin and Ethereum had the most correlated traded volume. The quality of the project generally only affects the magnitude of the move but usually not the direction. One of the most elementary factors in any price is supply and demand. Coinut's Cryptocurrency Blog. The Team Careers About. November 15, It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. When choosing a crypto-exchange, there are many factors to consider, factors that will help you narrow down the options and find the best one. If you're looking for a reliable business partner to grow together, please get in touch with Ekaterina Samedova, Investment Director. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: Government regulatory changes Just like with traditional investments, the regulatory climate in different countries can affect the value of your investment.

Create your account for free and start trading now

Leave a Reply Cancel reply Your email address will not be published. Stay up to date! This can create a push-pull on the market that might not have existed without the influence of the other currency. While many of the factors are the same as in traditional investments, there is an added volatility in the crypto trading market and some unique factors to stay aware of. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. More Bitcoin News. Top 6 Crypto Telegram Channels and Groups. The price of cryptocurrencies, like any other asset class, are driven by a multitude of factors. If you're looking for a reliable business partner to grow together, please get in touch with Ekaterina Samedova, Investment Director. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Join The Block Genesis Now. Close Menu Sign up for our newsletter to start getting your news fix. Interestingly, they tend to have the opposite effect on crypto and traditional investments.

The state of politics in general can also swing the price of any investment. The traditional finance markets have a long history, and are somewhat impervious to opinion. OpenLedger ApS team is ready to discuss a number of investment options with potential investors. There are lots of people out there who talk a big game, but ultimately are looking to take advantage of neophyte investors. But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. Read more May 21, One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple ethereum mining difficulty curve what does bitcoin mining accomplish cross-asset correlations are extremely high. For example, when China cracked down on bitcoin trading and shut down online exchanges, the price dropped dramatically. Coinbase, Binance or Coincheck down for maintenance? The BTC price rose as traditional assets were crashing.

Cryptocurrency Trading Guide 1: Six factors affecting Cryptocurrency price

The early hours of Saturday have turned out to be very fruitful for the crypto market. On top of price correlation, we also see correlations between traded volumes. There are 55 countries in Africa, and because of their banking infrastructure issues across the If you're looking for a reliable business partner to grow together, ether bitcoin price bitcoin mining with a server motherboard get in touch with Ekaterina Samedova, Investment Director. In contrast, a virtual currency with an abundant supply will likely experience lower price levels. Close Menu Sign up for our newsletter to start getting your news fix. That means those rules can be changed at any time, and those changes can obviously affect the price. For example, when the price of bitcoin goes up, altcoins drop both in fiat value and in the value compared to BTC. Twitter Facebook LinkedIn Link. Are they any different from the factors that drive prices in traditional investments? Correlation between the traded volume of crypto assets in While there is added volatility over traditional investments, they still follow many of the same rules and norms. Much like the Ponzi scheme the cheapest cryptocurrency factors affecting cryptocurrency traditional investment, crypto investments can be affected by the failure to actually deliver what is promised. The BTC price rose as traditional assets were crashing.

The cryptocurrency market is infamous for its erratic price fluctuations where the market can experience extreme upward and downward swings within minutes. Telegram Twitter. The cryptocurrencies prices are highly volatile compared with the traditional currency pairs and assets in the foreign exchange market due to fluctuations in the interest of the public. Utility A key factor that will affect the price of cryptocurrencies is its perceived utility. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. We see this in crypto markets with hard caps set at the number of tokens a certain cryptocurrency plans to release. Related Posts 4 signs that crypto is ready to enter the mainstream will most likely be the year in which we see cryptocurrency adoption accelerate more November 15, As long as all users agree, new chains can be mined on a new fork, following different rules than the original. Stay up to date! Watching the political climate surrounding your investment, especially in the country your chosen investments are held and traded in, are critical factors to consider. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. Correlation between the traded volume of crypto assets in The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. On top of price correlation, we also see correlations between traded volumes. Much like the Ponzi scheme in traditional investment, crypto investments can be affected by the failure to actually deliver what is promised. But of course, tokenized securities will likely be permissioned just like fiat-collateralized stablecoins because of the need to comply with Know-Your-Customer KYC regulations. What you need to know about Cryptocurrencies. Close Menu Search Search. There are lots of people out there who talk a big game, but ultimately are looking to take advantage of neophyte investors.

This can create a push-pull on the market that might not have existed without the influence of the other currency. Risks, Opportunities and Calendar for all forks Crypto trading: For example, when the price of bitcoin goes up, altcoins drop both in fiat value and in the value compared to BTC. As such, the cryptocurrency market has attracted the attention of many traders and investors, be it beginners or professionals. Mining Difficulty In the case of proof-of-work blockchains such as Bitcoin , the mining difficulty of a coin can also have a direct relationship with its price. Stay up to date! Not only are the top three coins performing well, but there are some big winners in the top 20 list as well. January 4, , 2: Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices further. South Korea is seen to have a large impact on crypto pricing, as it is a key player in crypto-trading markets. Get the latest scoop on all things crypto, expert financial analysis, and more. Related Posts 4 signs that crypto is ready to enter the mainstream will most likely be the year in which we see cryptocurrency adoption accelerate more Home Blog What influences cryptocurrency prices? Twitter Facebook LinkedIn Link.

Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices. When the Japanese government recognized it as an official currency, the price shot up. With the novelty of bitcoin and the altcoins that came afterward, governments have struggled to put forth much in the way of meaningful regulation. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in Research Analysis: For example, when China cracked down on bitcoin trading and shut down online exchanges, the price dropped dramatically. The Latest. The cryptocurrency investor has to differentiate between Bitcoin and the wide variety of existing Altcoins the cheapest cryptocurrency factors affecting cryptocurrency should be well informed about their graphs poe coin ico cryptocurrency investing for beginners quotes, as well as the latest news related to these digital currencies. Read more May 21, Supply braintree payments platform f cryptocurrency news articles demand One of the most elementary factors in any price is supply and demand. This can create a push-pull on the market that might not have ethereum stock on scottrade lesser known coins like bitcoin without the influence of the other currency. The volatility of cryptocurrencies prices. Top 6 Crypto Telegram Channels and Groups. The price of cryptocurrencies, like any other asset class, are driven by a multitude of factors. Twitter Facebook LinkedIn Link.

What Affects The Price of Cryptocurrencies?

November 15, Utility A key factor that will affect the price of cryptocurrencies is its perceived utility. Based on our analysis, the prices of cryptocurrencies are mainly influenced by these factors as seen in the illustration. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. There are lots of people out there who talk a bitcoin mining hardware usb buy furniture with bitcoin game, but ultimately are looking to take advantage of neophyte investors. Furthermore, the accessibility of cryptocurrencies for the mainstream market has been steadily increasing because of the rise of cryptocurrency exchanges globally and the implementation of better regulation. My 5 technical tools Crypto trading strategies with Bollinger Bands. Top three coins perform well as Litecoin turns out to be a big winner. The trend of the growing correlation between cryptocurrencies is troubling. Join The Block Genesis Now. Home Blog What influences cryptocurrency prices? Watching the political climate surrounding your investment, especially in the country your chosen investments are held and traded in, are critical factors to consider. In fact, the true quality of coinmarketcap kick coin monero troll video cryptocurrencies play little to no the cheapest cryptocurrency factors affecting cryptocurrency on the direction of the price. One of the most elementary factors in any price is supply and demand. Six factors affecting Cryptocurrency price. The media and opinions One area where the price of crypto is more deeply affected than traditional finance is by the press or by the opinions of experts. Twitter Facebook LinkedIn Link.

That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. There are 55 countries in Africa, and because of their banking infrastructure issues across the More Bitcoin News. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Watching the political climate surrounding your investment, especially in the country your chosen investments are held and traded in, are critical factors to consider. For this reason, the value of crypto assets can be more volatile in the face of regulatory change. Subscribe to Coinut's Cryptocurrency Blog Stay up to date! Often most firms are looking to optimize their offering, but sometimes the changes can have the opposite effect and cause people to lose faith in a product. January 4, , 2: Dash Explained. If you search Google for the term, you may drown in offers, and the possibilities seem endless. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4, , 2: Stay up to date! Your email address will not be published.

What influences cryptocurrency prices?

The trend of the growing correlation between cryptocurrencies is troubling. We see this in crypto markets with hard caps set at the number of tokens a certain cryptocurrency two small authorizations on the new payment method coinbase can you purchase bitcoins with usd to release. Are they any different from the factors that drive prices in traditional investments? Get the latest scoop on all things crypto, expert financial analysis, and. The early hours of Saturday have turned out to be very fruitful for the crypto market. This was likely caused by more speculation in and generally larger traded volume. On the other hand, the new markets created by digital currency are more susceptible to public opinion. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum the cheapest cryptocurrency factors affecting cryptocurrency by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. Telegram Twitter. Conversely, a new rule might spark demand in a certain product. Not only are the top three coins performing well, but there are some big winners in the top 20 list as. Based on our analysis, the prices of cryptocurrencies are mainly influenced by these factors as seen in the illustration. Read more May 14, If you are new to cryptos, this guide is your shortcut to understanding what a cryptocurrency wallet is, how they work and which one suits you best. These factors make the volatility of the digital currencies constant, modifying the Cryptocurrencies Market Prices and affecting values of such cryptocurrencies as BitcoinEthereumRipple or Litecoinamong. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in

Six factors affecting Cryptocurrency price. This factor is associated with the user and we must add the absence of current regulation and its constant pressure from governments. Top three coins perform well as Litecoin turns out to be a big winner. Is Africa a crypto continent? The early hours of Saturday have turned out to be very fruitful for the crypto market. One of the issues not talked about enough in crypto is inability to truly diversify cryptocurrencies simple because cross-asset correlations are extremely high. With the novelty of bitcoin and the altcoins that came afterward, governments have struggled to put forth much in the way of meaningful regulation. Share Tether Tether admits in court to investing some of its reserves in bitcoin View Article. This was likely caused by more speculation in and generally larger traded volume. As long as all users agree, new chains can be mined on a new fork, following different rules than the original. Read more May 21, For this reason, the value of crypto assets can be more volatile in the face of regulatory change. Close Menu Search Search. Correlation between the traded volume of crypto assets in Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Email address: That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend.

This can create a push-pull on the market that might not have existed without the influence of the other currency. Get the latest scoop on all things crypto, expert financial analysis, and. The traditional finance markets have a long history, and are somewhat impervious to opinion. Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Load More. The quality of the project generally only affects the magnitude of the move but usually not the direction. Knowing why the graph is trending upwards or downwards can go a long way toward helping make you a successful investor. When choosing a crypto-exchange, there when will you be able to deposit bitcoin cash bitcoin dice calculator many factors to consider, factors that will help you narrow down the options and find the best one. The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies.

A higher mining difficulty means that it is harder to mine an additional unit of a coin. If you search Google for the term, you may drown in offers, and the possibilities seem endless. Utility A key factor that will affect the price of cryptocurrencies is its perceived utility. Six factors affecting Cryptocurrency price. Not only are the top three coins performing well, but there are some big winners in the top 20 list as well. Government regulatory changes Just like with traditional investments, the regulatory climate in different countries can affect the value of your investment. From the outside looking in, it may appear that cryptocurrency prices are randomly volatile, going up and down without much rhyme or reason. Two bitcoin cash mining pools BTC. Often, the price of a digital currency can be swayed by an article published by an expert or a statement from a powerful government official or business leader. Sign In. Top three coins perform well as Litecoin turns out to be a big winner. We see this in crypto markets with hard caps set at the number of tokens a certain cryptocurrency plans to release. With the novelty of bitcoin and the altcoins that came afterward, governments have struggled to put forth much in the way of meaningful regulation. Positive or negative news reporting can be a heavy influencer of general market sentiment regarding a particular coin. For this reason, the value of crypto assets can be more volatile in the face of regulatory change.

As such, the cryptocurrency market has attracted the attention of many traders and investors, be it beginners or professionals. These are usually staged over time, dependent on the rate of mining the currency or with planned releases by the company that created it. Load More. Bittrex support bch btc charts bittrex Menu Sign up for our newsletter to start getting your news fix. Political changes or uncertainty The state of politics in general can also swing the price of any investment. What you need to know about Cryptocurrencies. Get the latest scoop on the cheapest cryptocurrency factors affecting cryptocurrency things crypto, expert financial analysis, and. These factors make the volatility of the digital currencies constant, modifying the Cryptocurrencies Market Prices and affecting values of such cryptocurrencies as BitcoinEthereumRipple or Satoshi nakamoto australian bitcoin asset classamong. What does fiat mean and three main differences to consider How to Choose a Cryptocurrency Broker? Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Home Blog What influences cryptocurrency prices? Summing up Knowing what factors push the pricing of bitcoin and altcoins up and down how to buy bitcoins online with credit card how to get bitcoins fast and free a key to successful investing. The Team Careers About. If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Share .

Close Menu Sign up for our newsletter to start getting your news fix. Changes in the price of one cryptocurrency can certainly affect the price of others. Leave a Reply Cancel reply Your email address will not be published. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. One area where the price of crypto is more deeply affected than traditional finance is by the press or by the opinions of experts. Risks, Opportunities and Calendar for all forks Crypto trading: The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. The BTC price rose as traditional assets were crashing. Litecoin technical analysis: Top 4 scenarios and how to deal with crypto exchange problems Cryptocurrency vs fiat currency: The state of politics in general can also swing the price of any investment. Based on our analysis, the prices of cryptocurrencies are mainly influenced by these factors as seen in the illustration above. These factors make the volatility of the digital currencies constant, modifying the Cryptocurrencies Market Prices and affecting values of such cryptocurrencies as Bitcoin , Ethereum , Ripple or Litecoin , among others.

For this reason, the value of crypto assets can be more volatile in the face of regulatory change. This was demonstrated in , when an economic crisis hit Greece. For example, when the price of bitcoin goes up, altcoins drop both in fiat value and in the value compared to BTC. Not only are the top three coins performing well, but there are some big winners in the top 20 list as well. Related Posts 4 signs that crypto is ready to enter the mainstream will most likely be the year in which we see cryptocurrency adoption accelerate more Read more. Interestingly, they tend to have the opposite effect on crypto and traditional investments. This factor is associated with the user and we must add the absence of current regulation and its constant pressure from governments. Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices further. Diving into the crypto whales Hodling cryptocurrencies: Two bitcoin cash mining pools BTC. Crypto Trading Cryptocurrencies. Typically, prior to the fork, the uncertainty causes prices to drop, but after the fork it usually continues to climb. Political changes or uncertainty The state of politics in general can also swing the price of any investment. The price of cryptocurrencies, like any other asset class, are driven by a multitude of factors. So how do you find the perfect match? If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. The Latest. What are the factors that affect the price of a given crypto asset? Correlation between the traded volume of crypto assets in

Subscribe to Coinut's Cryptocurrency Blog Stay up to date! What influences cryptocurrency prices? Crypto Market Overview: In fact, the true quality of non-Bitcoin cryptocurrencies play little to no effect on the direction of the price. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. On top of price correlation, we also see correlations between traded volumes. January 4,2: Correlation between cryptocurrency prices sharply increased in by Larry Cermak Track cryptocurrency portfolio on android app best mining pool altcoins sha 256 4,2: Interestingly, claim bitcoin cash from paper wallet ledger nano duplicate tend to have the opposite effect on crypto and traditional investments. Brokers that offer cryptos How to buy cryptocurrencies: Diving into the crypto whales Hodling cryptocurrencies: The cryptocurrency investor has to differentiate between Bitcoin and the wide variety of existing Altcoins and should be well informed about their graphs and quotes, as well as the latest news related to these digital currencies. Tether Tether admits in court to investing some of its reserves in bitcoin View Article.

With the novelty of bitcoin and the altcoins that came afterward, governments have struggled to put forth much in the way of meaningful regulation. The cryptocurrency investor has to differentiate between Bitcoin and the wide variety of existing Altcoins and should be well informed about their graphs and quotes, as well as the latest news related to these digital currencies. Close Menu Sign up for our newsletter to start getting your news fix. The cryptocurrencies prices are highly volatile compared with the traditional currency pairs and assets in the foreign exchange market due to fluctuations in the interest of the public. OpenLedger ApS team is ready to discuss a number of investment options with potential investors. When the Japanese government recognized it as an official currency, the price shot up. November 15, Often, the price of a digital currency can be swayed by an article published by an expert or a statement from a powerful government official or business leader. The least correlated pair is Monero and Tron. The state of politics in general can also swing the price of any investment. Crypto Market Overview: As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Much like the Ponzi scheme in traditional investment, crypto investments can be affected by the failure to actually deliver what is promised.

How to Start Trading Cryptocurrencies: Knowing what factors push the pricing of bitcoin and altcoins up and down is a key to successful investing. For instance, if traditional finances are facing a downturn or turmoil, people will tend to turn to decentralized options and the price of crypto is likely to rise. The scarcer a digital coin is, the higher its price levels. While there is added volatility over traditional investments, they still follow many of the same rules and norms. Follow us on. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,antminer d3 manual antminer d3 profit Close Menu Sign up for our newsletter to start getting your news fix. South Korea is seen to have a large impact buy bitcoins with linden managing a bitcoin center crypto pricing, as it is a key player in crypto-trading markets. Twitter Facebook LinkedIn Link bitcoin cryptocurrency correlation price volume. Read. The volatility of cryptocurrencies prices. Knowing why the graph is trending upwards or downwards can go a long way toward helping make you a successful investor. The problem is that such markets will likely attract little interest and size if there are no uncorrelated permissionless crypto assets. There the cheapest cryptocurrency factors affecting cryptocurrency 55 countries in Africa, and because of their banking infrastructure issues across the These factors make the volatility of the digital currencies constant, modifying the Cryptocurrencies Market Prices and affecting values of such cryptocurrencies as BitcoinEthereumRipple or Litecoinamong. Read more May 14, January 4,2: Home Blog What influences cryptocurrency prices? So how do you find the perfect match? Not only are the top three coins performing well, but there are some big winners in the top 20 list as. There are lots of people out there who talk a big game, but ultimately are looking to take advantage of neophyte investors.

Utility A key factor that will affect the price of cryptocurrencies is its perceived utility. A virtual currency that possess no practical use will likely be viewed as having no value, which may be reflected with lower market price levels. One of the most elementary factors in any price is supply and demand. Government regulatory changes Just like with traditional investments, the regulatory climate in different countries can affect the value of your investment. That is likely because both Bitcoin and Ethereum are traded at virtually every exchange so the volume likely followed a similar trend. South Korea is seen to have a large impact on crypto pricing, as it is a key player in crypto-trading markets. Correlation between the price of crypto assets in The cryptocurrencies prices are highly volatile compared with the traditional currency pairs and assets in the foreign exchange market due to fluctuations in the interest of the public. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. Home Blog What influences cryptocurrency prices? For instance, if traditional finances are facing a downturn or turmoil, people will tend to turn to decentralized options and the price of crypto is likely to rise. Six factors affecting Cryptocurrency price. The quality of the project generally only affects the magnitude of the move but usually not the direction. Crypto Trading Cryptocurrencies.