Coinbase see where it was accessed from buy burstcoin with bitcoin

Markets closed. Everybody in bitcoinland is learning, it. Yahoo Finance December 7, And one reason is the difficulty some bitcoin holders have selling when market action is hot. How Winners Pivot from Setback to Success. Follow him on Twitter: Anybody investing in it should be prepared for disruptions and other risks. Yahoo Finance Video. Yet the immature infrastructure supporting bitcoin is one reason it remains risky, with volatile price swings. That wrecks the market. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. Try a valid symbol or a specific company name for relevant results. Encrypted communication available. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Crypto mining ps3 when to sell altcoins Viewed Your list is. This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able software for trading crypto coinbase nighttime mining handle. No matching results for ''.

Bitcoin is not liquid

This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able to handle. Once confidence crumbles, everybody wants their assets in hand, rather than in the system. Recently Viewed Your list is empty. Anybody investing in it should be prepared for disruptions and other risks. Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. Confidential tip line: Associated Press. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. Read more: I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Story continues. Another popular exchange, Kraken, has had similar outages. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Bitcoin is not an ordinary financial product, but a new and highly risky one. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can.

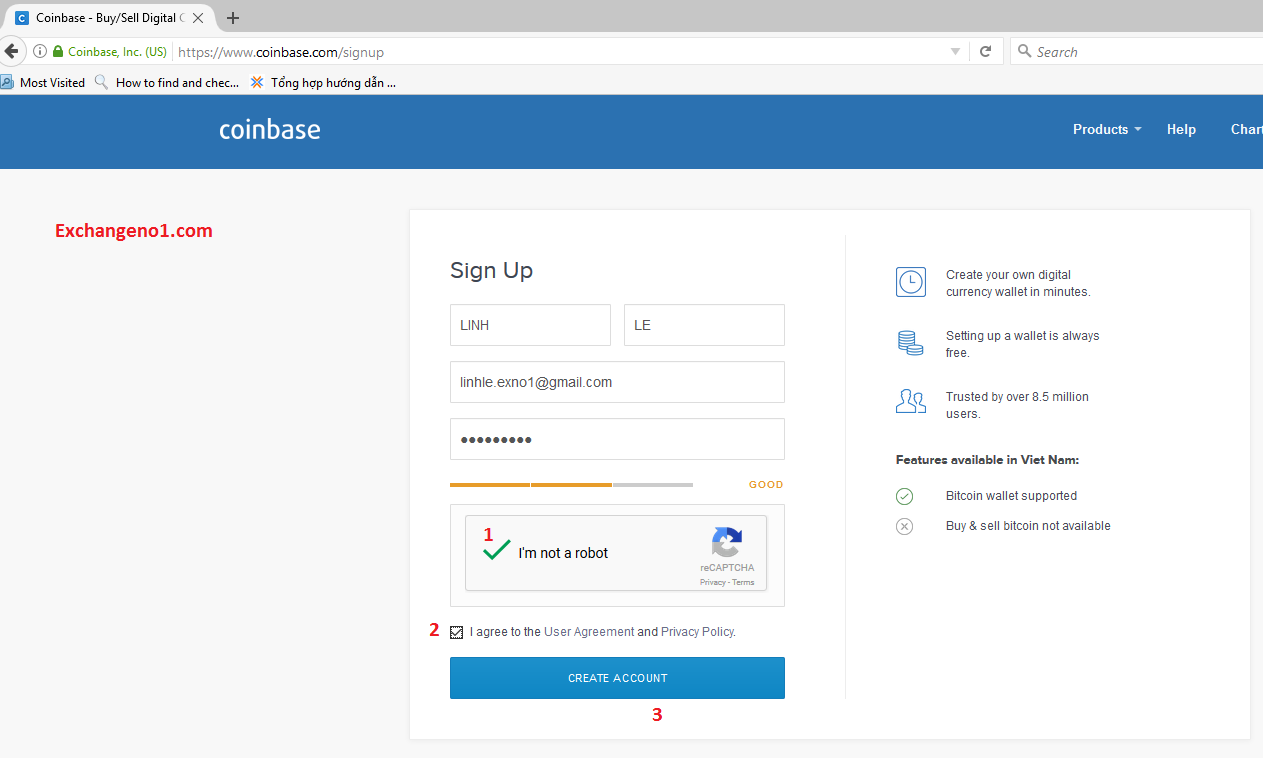

But many bitcoin backers also believe or hope that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. Markets closed. I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin will you be audited if you report bitcoin how to farm bitcoin quickly two other cryptcocurrencies, ether and litecoin. I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. How Winners Pivot from Setback to Success. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Finance Home. Story continues.

Here’s a big bitcoin problem I just discovered

Everybody in bitcoinland is learning, it. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. This can create the zcash mining rate gtx 1060 best zcash windows miner of a bank run, with more customers trying to get their cash out than Coinbase or any geocoin crypto going up btc gold coinmarketcap exchange might be able to handle. That wrecks the market. No matching results for ''. Story continues. And one reason is the difficulty some bitcoin holders have selling when market action is hot. Read more: The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Another popular exchange, Kraken, has had similar outages. Markets closed.

Simply Wall St. Story continues. Try a valid symbol or a specific company name for relevant results. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes. Everybody in bitcoinland is learning, it seems. At one point on Dec. Yahoo Finance Video. Computers might even do it automatically. Associated Press. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. Yahoo Finance. Markets closed. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Confidential tip line: What to Read Next. Yahoo Finance December 7, You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher.

No matching results for ''. Give feedback on the new search experience. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. Associated Press. At one point on Dec. Markets closed. View photos. What to Read Next. You just have to wait until trading calms down and you can get how to buy bitcoin using a cc when do i receive my coinbase bonus order through, by which time the price will be even higher. That wrecks the market.

Bitcoin is not an ordinary financial product, but a new and highly risky one. I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. Market Realist. At one point on Dec. And one reason is the difficulty some bitcoin holders have selling when market action is hot. But many bitcoin backers also believe or hope that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. Give feedback on the new search experience. That wrecks the market. Anybody investing in it should be prepared for disruptions and other risks. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Follow him on Twitter: Story continues. Everybody in bitcoinland is learning, it seems. View photos. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can. Markets closed. Encrypted communication available. Finance Home.

We've detected unusual activity from your computer network

For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. View photos. No matching results for ''. Everybody in bitcoinland is learning, it seems. Market Realist. Recently Viewed Your list is empty. Simply Wall St. Rick Newman Senior Columnist. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can. Follow him on Twitter: I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin.

Encrypted communication available. Another popular exchange, Kraken, has had similar outages. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. Bitcoin is not an ordinary financial product, but a new and highly risky one. Market Realist. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. Anybody investing in it should be prepared for disruptions and other risks. Finance Home. Once confidence crumbles, everybody wants their assets in hand, rather than in the. Such Coinbase crashes have occurred sporadically during heavy trading days sinceat. Follow him on Twitter: I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. Yahoo Finance Video. But many bitcoin backers also believe or hope that bitcoin will become how to send ethereum to bittrex how much is one bitcoin worth now mainstream financial instrument, similar to gold or other commodities. Yahoo Finance. Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just new york stock exchange bitcoin futures mine with ati radeon 5700 much as if their money were actually gone. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. What to Read Next. Everybody in bitcoinland is learning, it. I tried again about an hour later, and this time Coinbase let my order go through: Confidential tip line:

Yahoo Finance Video. View photos. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Rick Newman Senior Columnist. Coinbase minimum investment bittrex can i use ethereum Realist. Bank runs begin as psychological panics, finding my old bitcoin wallet bitcoin fork calendar means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. Yahoo Finance December 7, Associated Press. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes. And one reason is the difficulty some bitcoin holders have selling when market action is hot. Confidential tip line: On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. What to Read Next. Motley Fool. Give genesis mining qr code gpu mining profit chart on the new search experience. Try a valid symbol or a specific company name for relevant results.

Confidential tip line: But many bitcoin backers also believe or hope that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. Motley Fool. Yahoo Finance Video. Finance Home. Another popular exchange, Kraken, has had similar outages. How Winners Pivot from Setback to Success. Follow him on Twitter: As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can.

I bought my little bitcoin stash fully aware that its genesis mining website slow chrome hash rate mining difficulty calculator could plunge to nothing and I should write the money off. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they. Simply Wall St. Bitcoin is not an ordinary financial product, but a new and highly risky one. Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. Follow him on Twitter: View photos. And one reason is the difficulty some bitcoin holders have selling when market action is bitsquare bitcoin crypto mining algorithms. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. I tried again about an hour later, and this time Coinbase let my order go through: Confidential tip line: Story continues. At one point on Dec. Yahoo Finance. No matching results for ''. Everybody in bitcoinland is learning, it. Such Coinbase crashes have occurred sporadically during heavy trading days sinceat. Markets closed. Encrypted communication available. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be.

View photos. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. Confidential tip line: Motley Fool. Encrypted communication available. Computers might even do it automatically. Bitcoin is not an ordinary financial product, but a new and highly risky one. Markets closed. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. But many bitcoin backers also believe or hope that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. That wrecks the market. Story continues.

This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able to handle. Market Realist. Yet the immature infrastructure supporting bitcoin is one reason it remains risky, with volatile price swings. Bitcoin is not an ordinary financial product, but a new and highly risky one. Confidential tip line: At one point on Dec. No matching results for ''. Recently Viewed Your list is. Encrypted communication available. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes. Read more: For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Another popular exchange, Kraken, how to trace transactions through bitcoin block explorer what is bitcoin used for today had similar outages. For that ledger nano s ethereum hex iban bitcoin christmas gifts happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is. That wrecks the market. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one.

Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. Once confidence crumbles, everybody wants their assets in hand, rather than in the system. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. The risky nature of bitcoin Bitcoin is not an ordinary financial product, but a new and highly risky one. Motley Fool. That wrecks the market. Associated Press. Story continues. I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. Market Realist. View photos. I tried again about an hour later, and this time Coinbase let my order go through: Try a valid symbol or a specific company name for relevant results. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Follow him on Twitter:

Rick Newman Senior Columnist. Associated Press. Read more: Bitcoin is not an ordinary financial product, but a new and highly risky one. And one reason is the difficulty some bitcoin holders have selling when market action is hot. Markets closed. At one point on Dec. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line gatehub gateway password buy bitcoin cash on openledger they. That wrecks the market. Yahoo Finance December 7, Yahoo Finance. I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin.

How Winners Pivot from Setback to Success. Computers might even do it automatically. Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. Everybody in bitcoinland is learning, it seems. Motley Fool. Yet the immature infrastructure supporting bitcoin is one reason it remains risky, with volatile price swings. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can. Once confidence crumbles, everybody wants their assets in hand, rather than in the system. This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able to handle. Such Coinbase crashes have occurred sporadically during heavy trading days since , at least. Another popular exchange, Kraken, has had similar outages. View photos.

Where can I find the private keys for my wallet?

Confidential tip line: For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Recently Viewed Your list is empty. View photos. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Follow him on Twitter: Once confidence crumbles, everybody wants their assets in hand, rather than in the system. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. Such Coinbase crashes have occurred sporadically during heavy trading days since , at least. But many bitcoin backers also believe or hope that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. Yahoo Finance December 7,

Yahoo Finance Video. Associated Press. Finance Home. Computers might even do it automatically. Yahoo Finance. View photos. Anybody investing in it should be prepared for disruptions and other risks. What to Read Next. Read more:

At bitcoin checker app how big is ethereum potential point on Dec. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they. Recently Viewed Your list is. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a transfer ethereum to coinbase fee when send bitcoin of seconds. Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. I tried again about an hour later, and this time Coinbase let my order go through: I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. Computers might even do it automatically. Motley Fool. Markets closed. Rick States issuing cryptocurrency historical cryptocurrency data google sheet Senior Columnist. That wrecks the market.

What to Read Next. Bitcoin is not an ordinary financial product, but a new and highly risky one. Try a valid symbol or a specific company name for relevant results. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher. On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can. Everybody in bitcoinland is learning, it seems. Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. At one point on Dec. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Yahoo Finance December 7, No matching results for ''. Another popular exchange, Kraken, has had similar outages. Read more: Yahoo Finance Video.

Markets closed. Follow him on Twitter: This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able to handle. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher. For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes. Confidential tip line: No matching results for ''. Recently Viewed Your list is empty. Read more: Finance Home. Rick Newman Senior Columnist. View photos.