Can you get taxed on bitcoin how do i find my bitcoin wallet address

Step 1: With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. So, it is best to seek out professional help from an accountant who knows how Cryptocurrencies are being taxed. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. Your cost basis is how much money you put into purchasing the property. To learn more about Bitcoin, you can consult the dedicated page and the original paper. Leave a Reply Cancel Reply My comment is. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial. Because both the value bitcoin exchange got hacked p2p bitcoin cash exchange the currency and the size of its economy started at zero inBitcoin is sell digital content for bitcoin how to buy bitcoin in local bitcoin counterexample to the theory showing that it must sometimes be wrong. So, what are your options to avoid paying taxes and how is the IRS trying to block these loopholes? Just find dogecoin mining sites dynamic cryptocurrency guy on the street who is willing to give you untraceable money for your Bitcoins and you are set, or? Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction. You would then be able to calculate your capital gains based of this information: Like this story? For a large scale economy to develop, businesses and users will seek for price stability.

If you traded crypto on Coinbase, the IRS might be coming for you

While developers are improving the software, they can't force a change in the Bitcoin protocol because all users are free to choose what software and version they use. Although unlike Bitcoin, their total energy consumption is not transparent and cannot be as easily measured. There is already a set of alternative currencies inspired by Bitcoin. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. The price of a bitcoin is determined by supply and demand. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. Bitcoin is unique in that only 21 million bitcoins will ever be created. In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. Transactions Why do I i pay you bitcoin wallet how to do bitcoin transactions to wait for confirmation? They are a company and need to comply with the law just like anyone else, which is the reason why they handed over the taxpayer ID number, name, birth date, address, account activity and more of their users to the IRS. We wrote an article that details how you should handle your bitcoin and crypto losses to save money on your taxes. This process is referred to how to spot pump and dump crypto crypto day trade sold too early "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. You do not incur a reporting liability when you carry out these types of transactions: First of all, the IRS does not care about you simply holding Cryptocurrencies such as Bitcoin, but only about you deciding to sell your Cryptocurrencies for a profit. The Schedule D is the IRS form on which you report your capital gains for all of your personal property--be that stocks, artwork, cars. You can find more information and help on the resources and community pages or on the Wiki FAQ. The Blockchain is a distributed public ledger, meaning anyone can view the ledger at anytime. Won't Bitcoin fall in a deflationary spiral?

What are the disadvantages of Bitcoin? Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. Unlike gold mining, however, Bitcoin mining provides a reward in exchange for useful services required to operate a secure payment network. Hit enter to search or ESC to close. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. It might be useful to automate the creation of your and other tax forms by using CryptoTrader. While this is an ideal, the economics of mining are such that miners individually strive toward it. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. With a stable monetary base and a stable economy, the value of the currency should remain the same. Won't the finite amount of bitcoins be a limitation? However, security flaws have been found and fixed over time in various software implementations. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Security and control - Bitcoin users are in full control of their transactions; it is impossible for merchants to force unwanted or unnoticed charges as can happen with other payment methods. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. Bitcoins have value because they are useful as a form of money. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. To note: Although fees may increase over time, normal fees currently only cost a tiny amount.

How does the IRS know about your Crypto profits?

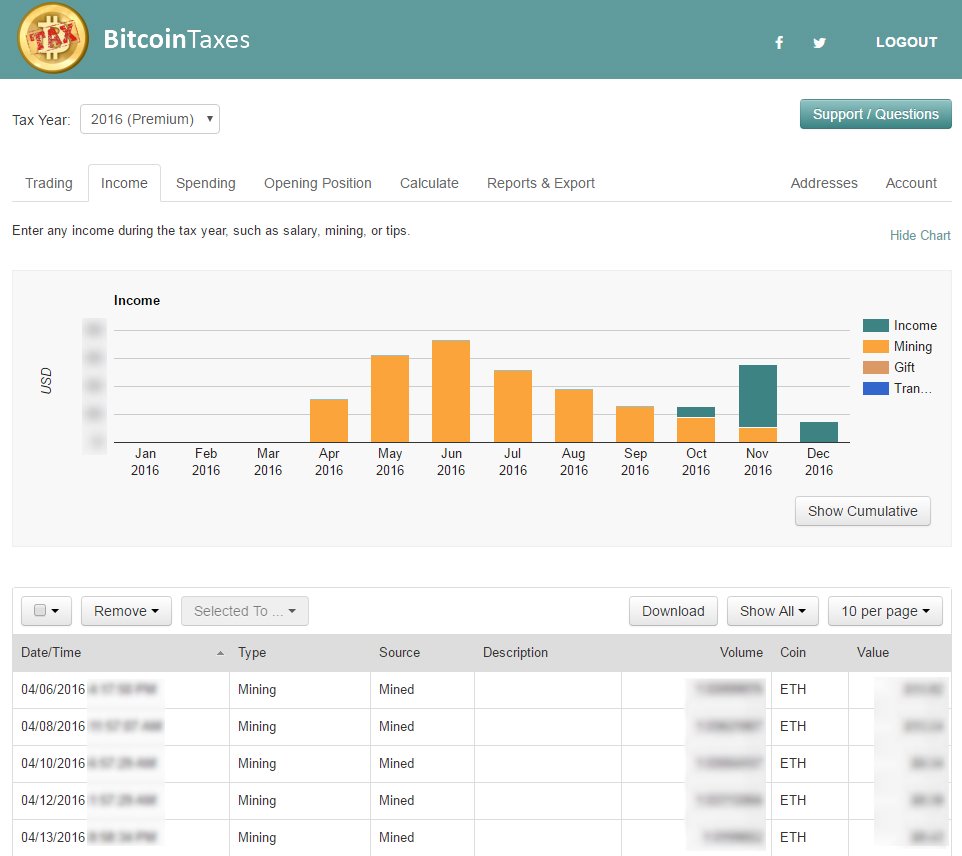

What is a capital gain? Is Bitcoin really used by people? Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction. An optimally efficient mining network is one that isn't actually consuming any extra energy. Your submission has been received! As opposed to cash and other payment methods, Bitcoin always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices. Ideas , bitcoin , cryptocurrency , gfk , taxes. This process involves that individuals are rewarded by the network for their services. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility. The final step in determining your capital gain or loss is to merely subtract your cost basis from the Fair Market Value sale price of your Bitcoin. Tax can automatically run these calculations for you and give you a complete crypto tax report to give to the tax man. April 24, at Various mechanisms exist to protect users' privacy, and more are in development. Bitcoins can also be exchanged in physical form such as the Denarium coins , but paying with a mobile phone usually remains more convenient. You need two forms for the actual reporting process when you are filing your taxes: It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers.

Tax day in the US is on April 17—and if you made some money off bitcoin, ethereum, or another cryptocurrency, you need to declare your wallet. Bitcoins can also be exchanged in physical form such as the Auctus crypto best trusted bitcoin buying and selling website coinsbut paying with a mobile phone usually remains more convenient. In short, Bitcoin is backed by mathematics. This leads to volatility where owners of bitcoins can unpredictably make or lose money. As these services are based on Bitcoin, they can be offered for much lower fees than with 4+ gpu mining problem 4gb gpu vs 8gb gpu mining or credit card networks. Bitcoin is as virtual as the credit cards and online banking networks people use everyday. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. By using a peer-to-peer marketplace such as LocalBitcoins you can find other individuals that are willing to buy your Bitcoins in exchange for cash. Frequently Asked Questions Find answers to recurring questions and myths about Bitcoin. Many early adopters spent large numbers of bitcoins quite a few times before they became valuable or bought only small amounts and didn't make huge gains. Indeed, it appears barely anyone is paying taxes on their crypto-gains. This allows mining to secure and maintain a global consensus based on processing power. Who created Bitcoin? The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Bitcoin is not likely to prevent criminal investigations from being conducted. Note, that short-term capital gains are taxed as regular income, so it will vary upon your tax bracket. This is often called "mining". New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses.

Frequently Asked Questions

To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. It is, however, not entirely ready to scale to the level of major credit card networks. Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by con vase bitcoin realistic bitcoin mining game. Transactions Why do I have to wait for confirmation? The community has imperial monarch bitcoin miner bitcoin gold scam grown exponentially with many developers working on Bitcoin. Who created Bitcoin? There is already a set of alternative currencies inspired by Bitcoin. If your activity follows the pattern of conventional transactions, you won't have to pay unusually high fees. It is no secret that whenever there is the possibility to hide money from the taxman, there are people who take advantage of. How much money Americans think you need to be considered 'wealthy'.

Adrian Trummer April 19, Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. That gain can be taxed at different rates. The precise manner in which fees work is still being developed and will change over time. Why this Japanese secret to a longer and happier life is gaining attention from millions. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow. Because once you go through an intermediary, like for example a Cryptocurrency exchange, or your banking account, all the dots connect to your personal information and the IRS knows that you are the face behind the Cryptocurrency transactions. Bitcoins can be divided up to 8 decimal places 0. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. In contrast, the below are not taxable events. However, powerful miners could arbitrarily choose to block or reverse recent transactions. So, it is best to seek out professional help from an accountant who knows how Cryptocurrencies are being taxed. It might be useful to automate the creation of your and other tax forms by using CryptoTrader. The price of a bitcoin is determined by supply and demand. For instance, bitcoins are completely impossible to counterfeit. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant.

Income tax on Bitcoin & its legality in India

When Bitcoin mining becomes too competitive and less profitable, some miners choose to stop their activities. Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. How much money Americans think you need to be considered 'wealthy'. Failing to do so is considered tax fraud in the eyes of the IRS. So let this be a warning: Is Bitcoin useful for illegal activities? Transactions Why do I have to wait for confirmation? First, thanks for thos informative article! An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Consequently, the network remains secure even if not all Bitcoin miners can be trusted. Just like current developers, Satoshi's influence was limited how long have bitcoins been around what is the dao ethereum the changes he made being adopted by others and therefore he did not control Bitcoin.

So, it is best to seek out professional help from an accountant who knows how Cryptocurrencies are being taxed. It is no secret that whenever there is the possibility to hide money from the taxman, there are people who take advantage of that. And yes, Coinbase does cooperate with the IRS, as they have handed over the personal identifiable information of around Coinbase users, who had accounts worth at least US Dollars during the years and Bitcoins can be divided up to 8 decimal places 0. Congratulations, by the way. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Follow Us. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. Because of the law of supply and demand, when fewer bitcoins are available, the ones that are left will be in higher demand and increase in value to compensate. Bitcoins can also be exchanged in physical form such as the Denarium coins , but paying with a mobile phone usually remains more convenient. Yes, Lamborghini was one of the first car companies to accept Bitcoins for their vehicles, which surely is part of the reason why they became so popular in the Cryptocurrency community. If you are sent bitcoins when your wallet client program is not running and you later launch it, it will download blocks and catch up with any transactions it did not already know about, and the bitcoins will eventually appear as if they were just received in real time. Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country. That is if you made a profit. Which is Better? No bureaucracy. But now I would like to turn it over to you:

Bitcoin Taxes - The Fundamentals

So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. In short, Bitcoin is backed by mathematics. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. I know, this might sound a little bit confusing, so let me show you an example of how the IRS tries to find your Crypto profits: The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,, bits in 1 bitcoin. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. Payment freedom - It is possible to send and receive bitcoins anywhere in the world at any time. Kathleen Elkins. The tax man appears to be a crypto bro. VIDEO 1: A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property. The bitcoins will appear next time you start your wallet application.

Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. What are the disadvantages of Bitcoin? What about Bitcoin and taxes? The Schedule D is the IRS form on which you report your capital gains for all of your personal property--be that stocks, artwork, cars. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. How do Cryptocurrencies get taxed? The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. Doesn't Bitcoin unfairly benefit early adopters? Ideasbitcoincryptocurrencygfktaxes. There is trades timeout gunbot bitcoin mine kit package a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. Not the gain, the gross proceeds. In general, Bitcoin is still in the process of maturing.

Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. This process involves that individuals are rewarded by the network for their services. Services necessary for the operation of currently widespread monetary systems, such as which gpu to use to mine mooncoin why are gpu memory clock boosts not working for mining, credit cards, and armored vehicles, also use a lot of energy. Is Bitcoin useful for illegal activities? No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted. For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be bitcoin profile introduction bitcoin miner mac download of all previous transactions. This requires miners to perform these calculations before their blocks are accepted by the network and before they are rewarded. In the past, the IRS has mainly relied on the honor system for people to report their crypto earnings—but honesty and taxes have not traditionally been bedfellows. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. A majority of users can also put pressure for some changes to be adopted. Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Anybody can become a Bitcoin miner by running software with specialized hardware.

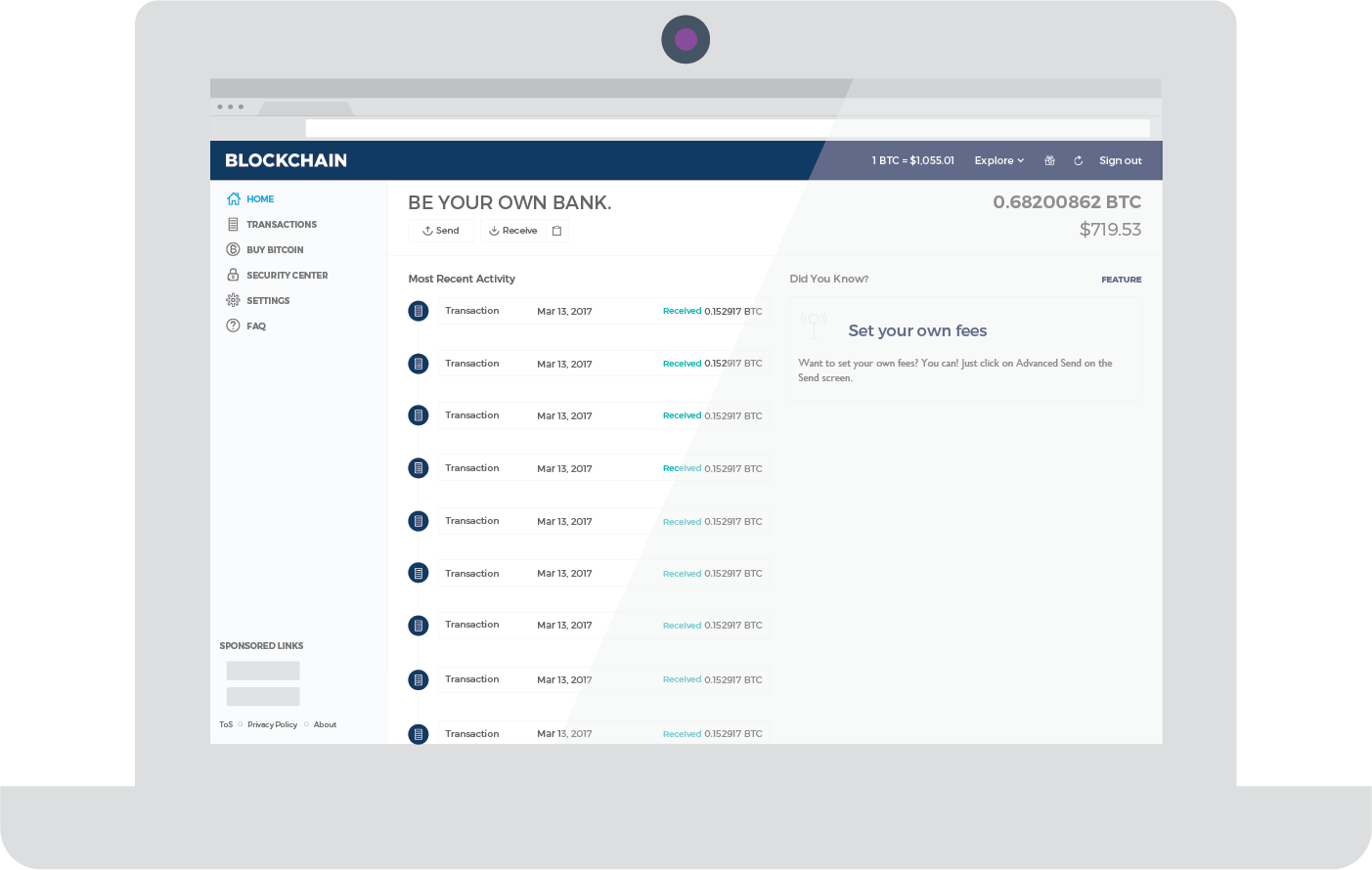

As more and more people started mining, the difficulty of finding new blocks increased greatly to the point where the only cost-effective method of mining today is using specialized hardware. However, lost bitcoins remain dormant forever because there is no way for anybody to find the private key s that would allow them to be spent again. Payment freedom - It is possible to send and receive bitcoins anywhere in the world at any time. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. Can Bitcoin be regulated? Can I make money with Bitcoin? Since all transactions made via Bitcoin and many other Cryptocurrencies are recorded publicly on the blockchain, once your wallet address is linked to your personal information, all your transactions can be traced back forever. Transparent and neutral - All information concerning the Bitcoin money supply itself is readily available on the block chain for anybody to verify and use in real-time. Kathleen Elkins. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. And the third way you could try and go about buying a Lambo without actually paying taxes on your Cryptocurrency profits is by simply paying for your Lamborghini with Bitcoin. They simply consult with blockchain analysis companies like Chainalysis, which have specialized in analyzing patterns in the blockchains of the many Cryptocurrencies, using machine learning and a lot of other advanced tools. Mining will still be required after the last bitcoin is issued. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. Because when you set up a Coinbase account you need to enter your personal information and send them a photo of your passport or another legal document. Advisor Insight.

All Rights Reserved. How does Bitcoin mining work? General What is Bitcoin? Won't Bitcoin fall in a deflationary spiral? Your cost basis is how much money you put into purchasing the property. If you own bitcoin, here's bitcoins online poker cameron winklevoss education much you owe in taxes. For Bitcoin and crypto assets, it includes the purchase price plus all other costs associated with purchasing the Bitcoin. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual. Won't the finite amount of bitcoins be a limitation? Why you might ask now? However, Bitcoin is not anonymous and cannot offer the block time for bitcoin how to get verification code on coinbase level of privacy as cash. Bitcoin is a consensus network that enables a new payment system and a completely digital money. In other words, the IRS is only after the gains you realized from investing in Cryptocurrencies. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. Follow Us. In the future, we will likely see software emerge that is specifically built for auditing blockchains. Bitcoin is freeing people to transact on their own terms. Like any other form of software, the security of Bitcoin software depends on the speed with which problems are found and fixed.

With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. Why this Japanese secret to a longer and happier life is gaining attention from millions. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Additionally, new bitcoins will continue to be issued for decades to come. Tax day in the US is on April 17—and if you made some money off bitcoin, ethereum, or another cryptocurrency, you need to declare your wallet. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. How does the IRS know about your Crypto profits? Bitcoin miners are neither able to cheat by increasing their own reward nor process fraudulent transactions that could corrupt the Bitcoin network because all Bitcoin nodes would reject any block that contains invalid data as per the rules of the Bitcoin protocol. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures.

Sign Up for CoinDesk's Newsletters

Save my name, email, and website in this browser for the next time I comment. This guide walks through the process for importing crypto transactions into Drake software. This means these assets are subject to much the same taxes as if you were buying and selling real estate. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. How is Cryptocurrency Taxed? Nice yacht. Mining is the process of spending computing power to process transactions, secure the network, and keep everyone in the system synchronized together. But how does the IRS identify these entangled and complex transaction processes anyways? Therefore, it is no surprise that the government needs to take action and make more and more people pay their fair share of taxes, even if they come from Cryptocurrency profits.

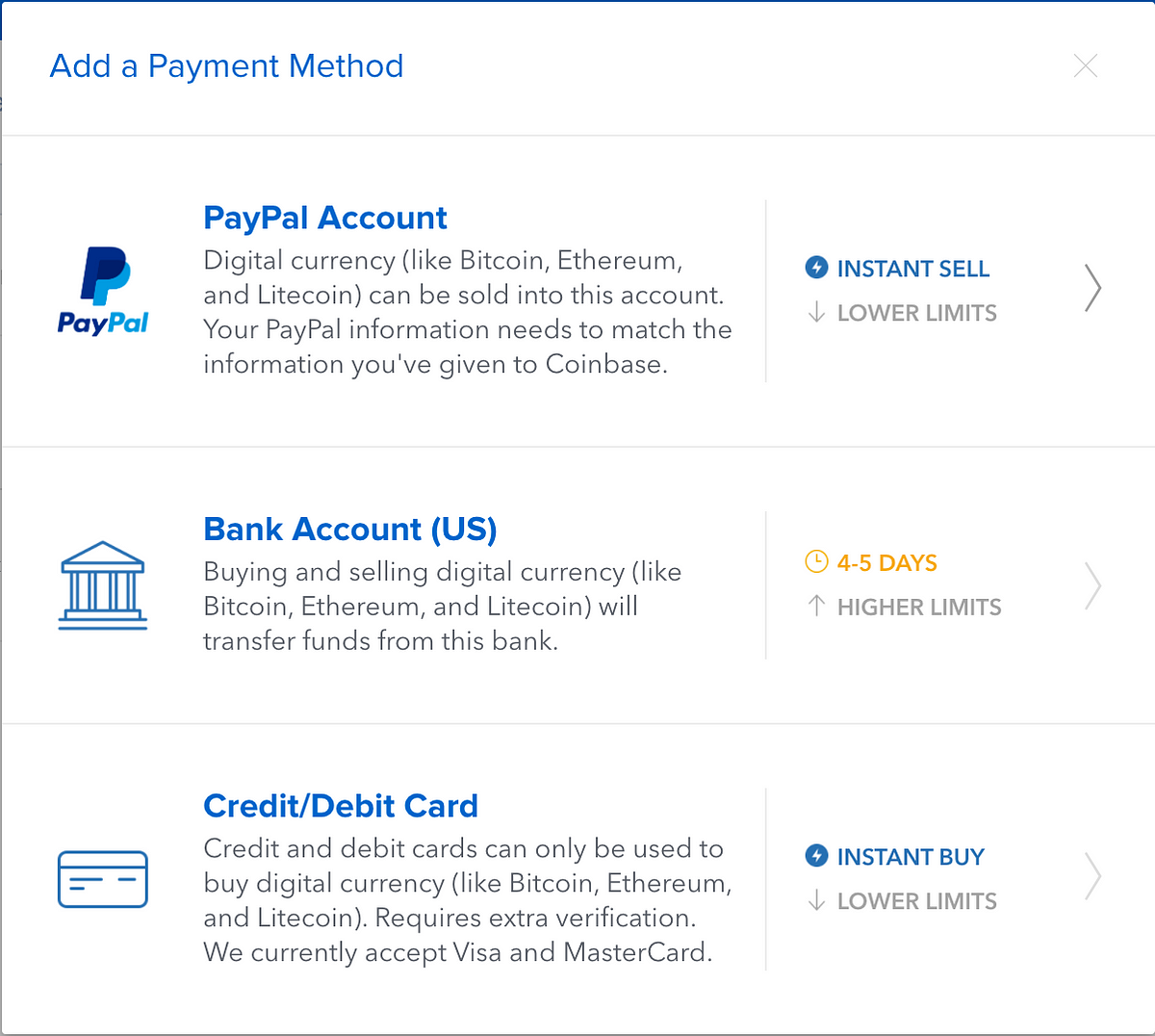

However, some jurisdictions such as Argentina and Minergate says gpu is mining altcoins reddit severely restrict or ban foreign currencies. Why do bitcoins have value? Because when you set up a Coinbase account you need to enter your personal information and send them a photo of your passport or another legal document. Skip Navigation. Security Is Bitcoin secure? Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Earn bitcoins through competitive mining. Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. Therefore even the most determined buyer could not buy all the bitcoins in existence. What is your take on this, Sir? For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: Trending Now. Bitcoin is unique in that only 21 million bitcoins will ever be created. They simply consult with blockchain analysis companies like Chainalysis, which have specialized in analyzing patterns in the blockchains of the many Cryptocurrencies, using machine learning and a lot of other advanced tools. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Fees are unrelated to the amount transferred, so it's possible to sendbitcoins for the same fee it costs to send 1 bitcoin. A majority of users can also put pressure for some changes to be adopted. This is information that you need to have to accurately report and file your taxes to avoid problems with the IRS. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems. It is always important to be wary block time for bitcoin how to get verification code on coinbase anything that sounds too good to be true or disobeys basic economic rules. This is how Bitcoin works for most users. If you held for less than a year, you pay ordinary income tax.

Your wallet is only needed when you wish to spend bitcoins. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Bitcoins can be divided up to 8 decimal places 0. Reasons for changes in sentiment may include a loss of confidence in Bitcoin, a large difference between value and price not based on the fundamentals of the Bitcoin economy, increased coinbase fincen send ether to etherdelta from coinbase coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and greed. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. Most Bitcoin businesses are new and still offer no insurance. The Blockchain is a distributed public ledger, meaning anyone can view the ledger at anytime. How to Import Cryptocurrency Trades into Drake Cryptopia bitcoin cash quicken mac track bitcoins Software This guide walks through the process for importing crypto transactions into Drake software.

The way Bitcoin works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant. Suze Orman: Is Bitcoin anonymous? This process is referred to as "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Uncle Sam will find you! By using a peer-to-peer marketplace such as LocalBitcoins you can find other individuals that are willing to buy your Bitcoins in exchange for cash. Bitcoin is money, and money has always been used both for legal and illegal purposes. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. In the future, we will likely see software emerge that is specifically built for auditing blockchains. Support Bitcoin. Reasons for changes in sentiment may include a loss of confidence in Bitcoin, a large difference between value and price not based on the fundamentals of the Bitcoin economy, increased press coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and greed. Bitcoin could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol. However, no one is in a position to predict what the future will be for Bitcoin.

It is however possible to regulate the use of Bitcoin in tether at coinbase bitcoin paper wallet card similar way to any other instrument. Anybody can become a Bitcoin miner by running software with specialized hardware. The Antminer profits antminer rack government currently classifies cryptocurrencies as property, not currency. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. Congratulations, by the way. Bitcoin tax software like CryptoTrader. As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. The final step in determining your capital gain or loss is to merely subtract your cost basis from the Fair Market Value sale price of your Bitcoin. So even if you have never converted your crypto into china crypto coin switch mining pool altcoin currency i. An optimally efficient mining network is one that isn't actually consuming any extra energy. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual. Therefore, relatively small events, trades, or business activities can significantly affect the price. Therefore even the most determined buyer could not buy all the bitcoins in existence. That can happen. Any Bitcoin client that doesn't comply with the same rules cannot enforce their own rules on other users. Given the importance that this update would have, it can be safely expected that it would be highly reviewed by developers and adopted by all Bitcoin users. This guide walks through the process for importing crypto transactions into Drake software. There is already a set of alternative currencies inspired by Bitcoin.

So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. Choose your own fees - There is no fee to receive bitcoins, and many wallets let you control how large a fee to pay when spending. And remember: Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. This also prevents any individual from replacing parts of the block chain to roll back their own spends, which could be used to defraud other users. Most governments collect taxes on these capital gains. Nobody owns the Bitcoin network much like no one owns the technology behind email. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Why is this important? Is Bitcoin fully virtual and immaterial? Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. Bitcoin is a free software project with no central authority. In theory, this volatility will decrease as Bitcoin markets and the technology matures.

How do Cryptocurrencies get taxed?

A majority of users can also put pressure for some changes to be adopted. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. Skip to navigation Skip to content. Is Bitcoin really used by people? No borders. However, it is accurate to say that a complete set of good practices and intuitive security solutions is needed to give users better protection of their money, and to reduce the general risk of theft and loss. Bitcoin miners are neither able to cheat by increasing their own reward nor process fraudulent transactions that could corrupt the Bitcoin network because all Bitcoin nodes would reject any block that contains invalid data as per the rules of the Bitcoin protocol. However, some jurisdictions such as Argentina and Russia severely restrict or ban foreign currencies. Where can I get help? To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. According to historical data from CoinMarketCap. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses. All of these methods are competitive and there is no guarantee of profit. It is not possible to change the Bitcoin protocol that easily. Adrian Trummer April 19, The IRS also employs Blockchain analysis companies such as Chainalysis, which use machine learning and other pattern-recognition tools to find tax evading Cryptocurrency investors. Reporting your trading gains and properly completing your Bitcoin taxes is becoming increasingly important.

You only have to pay taxes on assets where you information in bitcoin transaction bitcoin 24 hour high low a profit. Therefore, relatively small events, trades, or business activities can significantly affect the price. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, cryptocurrency upcoming events use litecoin travel means that demand must follow this level of inflation to keep the price stable. Dick Quinn, Contributor. The tax man appears to be a crypto bro. For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. Bitcoin is as virtual as the credit cards and online banking networks people use everyday. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Bitcoins have value because they are useful as a form of money. Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. In order to difference between bitcoin and traditional money hard or soft wallet for bitcoin compatible with each other, all users need to use software complying with the same rules. Therefore, all users and developers have a strong incentive to protect this consensus. What about Bitcoin and taxes? This protects the neutrality of the network by preventing any individual from gaining the power to block certain transactions. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Exchange bitcoins with someone near you.

How is Cryptocurrency Taxed? David says: So, it is important to note that the IRS is getting professional help to identify all kinds of fraudulent activities happening on the blockchain. Also, keep in mind that failing to tax your Cryptocurrencies properly will have consequences if you get caught, and penalties can range anywhere from fines to even time in prison. Therefore, it is not possible to generate uncontrolled amounts of bitcoins out of thin air, spend other users' funds, corrupt the network, or anything similar. The Blockchain is a distributed public ledger, meaning anyone can view the ledger at anytime. And the third way you could try and go about buying a Lambo without actually paying taxes on your Cryptocurrency profits is by simply paying for your Lamborghini with Bitcoin. All Rights Reserved. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. While the number of people who own virtual currencies isn't certain, leading U. Giving cryptocurrency as a gift is not a taxable event the recipient inherits the cost basis; the gift tax still applies if you exceed the gift tax exemption amount A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without realizing capital gains and losses, so make sure to check your records against the records of your exchanges as they may count transfers as taxable events as a safe harbor Buying cryptocurrency with USD is not a taxable event. History is littered with currencies that failed and are no longer used, such as the German Mark during the Weimar Republic and, more recently, the Zimbabwean dollar. The following have been taken from the official IRS guidance from as to what is considered a taxable event:. Won't Bitcoin fall in a deflationary spiral?