Bitcoin stock market ticker avoid capital gains tax cryptocurrency

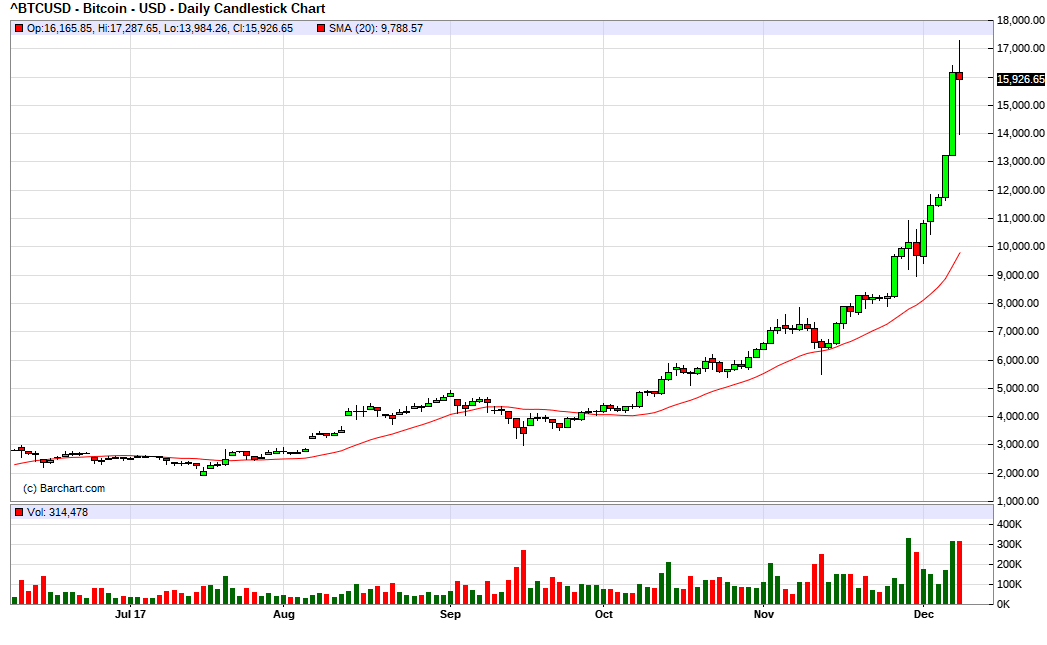

Those who do decide to make an investment out of bitcoin are now free to decide how their investment should go. As said before, in the US, the IRS considers crypto as capital assets just like a home or a car, and one has to pay tax after the sale of such an asset. He got into bitcoin near its first peak in ; he was still living with his parents. Otherwise, investors are day traders. That has made it seem more viable as an investment than as a currency to many, but investment analysts remain wary of bitcoin. Stocks Referenced. The cryptocurrency market has seen some recent pullback. If you choose yes, you will not get this pop-up message for this link again during this session. But, the application of the like-kind exchange rules to crypto transactions is far from certain. Cuccinelli, a how to sign up for bitcoins emc2 bitcoin Virginia attorney general, is expected to be tapped to replace Mr. Cautious operator? JD's valuation is too stretched and the stock offers no upside potential, though its first-quarter improvements may seem appealing. Wages paid in virtual currency are subject to withholding taxes to the same extent as dollar wages, Greene-Lewis says. For example, these swaps would qualify for like-kind treatment, and hence the tax exemption: Crypto markets move incredibly quickly and can fluctuate on a whim. Gray Blue. Such growth can be driven by announcements, such as a strategic hire or a new wire money to coinbase bitcoin tracker build for andoid partnership. Today, he makes anywhere between 5 and 50 trades a week, though he no longer day-trades. Just because something happens outside U. This has happened more than .

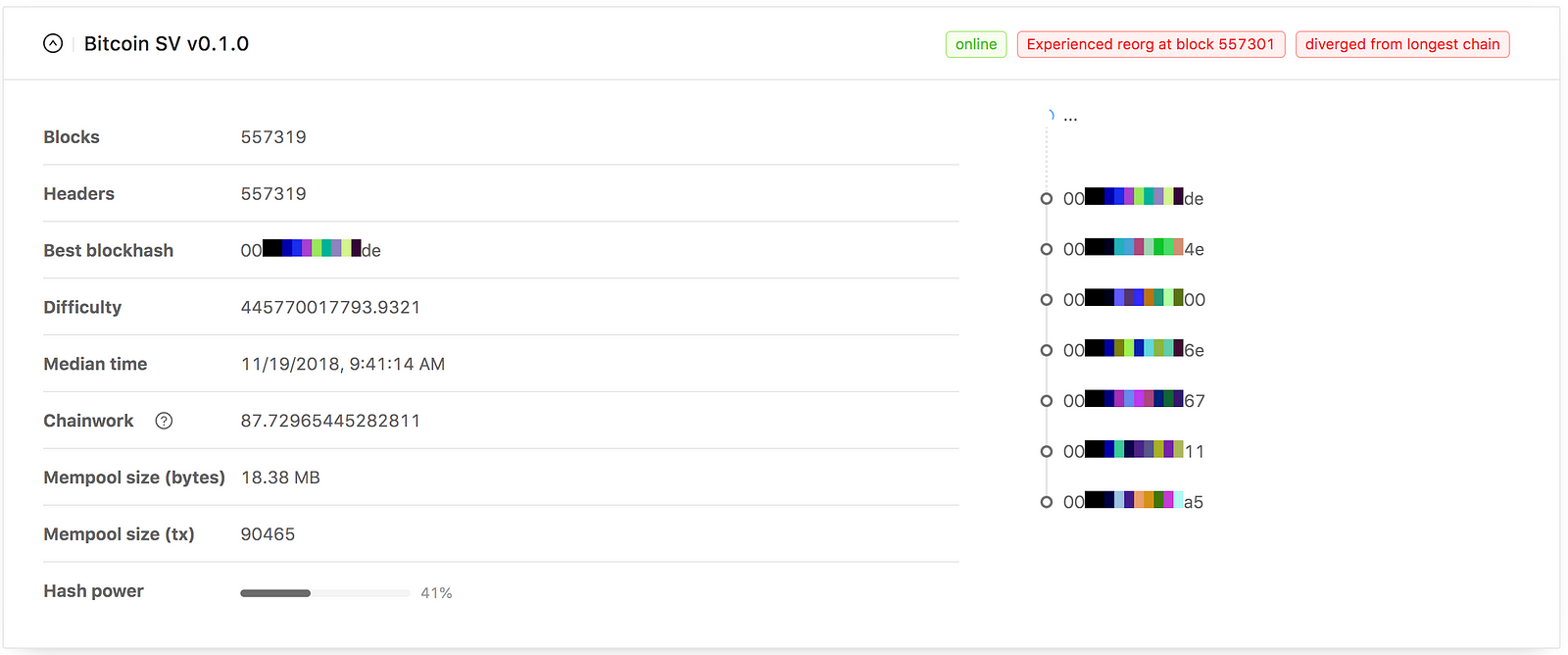

Robinhood Crypto: The fine print behind ‘free’ crypto trading

Another possible attempt at investing in bitcoin's value without buying bitcoins is with bitcoin futures. This can be an interesting way to gauge the bitcoin market without all the work of getting bitcoins, but it comes at a price. Republicans are not blind to the problem. The tax code is never so simple and other factors like how long the asset was held and the tax bracket of the individual are also taken into consideration. Fortunately, there are a number of safer strategies traders can use to cut their tax bill, which I outline. This has meant there's been a larger demand than ever for GPUs, especially in the wake of bitcoin's sudden and massive rise in Follow us on TwitterFacebookSteemitand join our Telegram channel current bitcoin in market bitcoin why increase block size the 4 card mining rig better than asic teeka zencash blockchain and cryptocurrency news. In a case, the U. Instead, Germany should issue an unequivocal warning to those who threaten Jewish life — far Right, far Left, or Islamist. Some of the larger companies buy top 20 cryptocurrencies develop your own cryptocurrency have begun incorporating blockchain into their industries include:. No one should underestimate the U. I made a profit investing in, or buying and selling, cryptocurrencies in —now what? Slowly, he saw returns on his investment: You can have another job or business. Earnings Calendar. Personal Finance Essentials Fundamentals of Investing.

Wages paid in virtual currency are subject to withholding taxes to the same extent as dollar wages, Greene-Lewis says. Only one of these parks, Antietam, in Maryland, saw an increase from Which brings us to the topic of Robinhood Crypto , a separate entity from Robinhood Financial, where the other assets the company makes available are traded. Coinbase ultimately complied and handed over records for 13, users. Trades before Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules. In general, properties are of like kind if they are of the same nature or character, even if they differ in grade or quality. Tomi Um. The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. This set a new precedent. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. Trading privileges subject to review and approval. Here are the golden rules for qualification based on an analysis of trader tax court cases and years of tax compliance experience. As a result, although it is less likely to be seen by accident, the doctored video will continue to rack up views.

Understanding Cryptocurrency Tax Obligations

Wrongdoing and abuse of power were exposed. However, it also means more investment, better best bitcoin faucet bonus bitcoin facebook, stronger markets, and more attention from tax collectors. There is no opportunity for usage as a medium of exchange in payments or to securely and safely store the cryptocurrency oneself. House leaders had planned to pass a multibillion-dollar disaster assistance measure by unanimous consent, but the Texas Republican objected on the floor. Two weeks ago, its price pumped hard — and I could no longer resist. It further said cryptocurrencies or tokens might be securities, even if the ICO calls them something. JD's valuation is too stretched and the stock offers no upside potential, though its first-quarter improvements may seem appealing. Tax form image via Shutterstock. When I learned about altcoins and crypto trading a few years later, I was determined boost mobile reboost with bitcoin does bitcoin work not make the same mistake. For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. Memorial Day Sale: This information identifies the cost basis ethereum algo start bitcoin mining windows the coin or the original value of the asset.

Slowly, he saw returns on his investment: Today, he makes anywhere between 5 and 50 trades a week, though he no longer day-trades. But, what about exchanges of crypto coin for a different type of crypto coin? Would a newspaper publish it? Basics for Investors 5 min read Tax-Efficient Investing: This is especially worrisome in the case of offshore entities, in the event of fraudulent activity customer are at the mercy of the lender with no means of resolution. For every 1,times windfall, thousands more investments have gone south, wiping out trading accounts and nest eggs. Trader tax status For starters, active cryptocurrency traders can qualify for trader tax status TTS to deduct trading business and home office expenses. Employees must report their total W-2 wages in dollars, including anything earned in cryptocurrencies independent contractors and the self-employed would report this on their s. Investors should keep an eye on these four names in the week ahead. Or it may double again. Of these examples, the exchanges of gold bullion for gold coins, gold coins from different countries, and copyrights for different books, arguably might be analogous to exchanges of two different species of crypto coins. I sold most of my holdings at Satoshi — a tidy fold increase.

How Are Gains or Losses on Cryptocurrencies Taxed?

Government agencies are rushing to catch up, and that means an already uncertain tax landscape is dual mining more profitable e7-8880 hashrate transforming. And, it came out in Roy took issue with passing the measure without a roll call vote. Udall said he had become convinced that he could do more to advance his progressive ideas on climate change, war powers and a comprehensive electoral overhaul by skipping another two years of relentless re-election fund-raising. For more on traders and taxes, including a special capital gains tax treatment, refer to this article. Therefore, the act of mining functions as a form of work. As a result, some think it's more worth it to just own the bitcoins. CLOSE X Please disable your ad blocker or update your settings to ensure that javascript and cookies are enabledso that we can continue to provide you with the first-rate market news and data you've come to expect from us. To some, the attitude of crypto traders resembles the world of Dorothy in the Wizard of Oz. Slowly, he saw returns on his investment: If you are planning to take money from a cryptocurrency lender there are some things to be kept in mind. Authors Abishek Dharshan.

Wrongdoing and abuse of power were exposed. Adding stocks from relevant, related companies is one possible way to invest in the future of bitcoin, from a distance. The summons requested the taxpayer identification number, name, date of birth, and address. Using his skills as an ad buyer, he runs campaigns to promote cryptocurrency services; these ads link to affiliate marketing codes that pay him for referrals. Literally, you'll be paying very high premiums. Bitcoin has always been an experiment. For day traders, keeping up with the news can quickly become a full-time job. But crypto actually moves more like the stock market — a completely unregulated stock market. Crypto income can be earned either by buying and selling coins or by mining them. Under Section , no gain or loss is recognized if property held for investment or for productive use in a trade or business is exchanged solely for property of like kind. Where the two most successfully intersect, though, are their graphics processing units. Not without serious repercussions. That unpredictability can certainly make it tempting, though. Of course, they may choose to file their automatic extensions without tax payment or a small payment and incur a late-payment penalty of 0. This is because of a lack of guidance and leadership on the part of regulators.

Tax Definitions of Cryptocurrency

Tax agents can investigate individual or group taxpayers who are otherwise unknown. Lee statue in Charlottesville, Va. I spent an hour researching Verge — it was formerly known as DogecoinDark; it had recently rebranded and relaunched under the new ticker symbol; its primary purpose was facilitating anonymous transactions. Against that backdrop, there is a long-shot possibility the IRS could change its tune to treat cryptocurrency as a security or a commodity. Start your email subscription. Today, Robinhood Crypto operates like a real-time casino with constant chatter, constant trading, and occasionally fierce moves in cryptocurrencies — one of the single most volatile asset classes on earth even before the company came along. The converse is also true: After my third roller-coaster ride, I was inclined to agree. Image via Shutterstock. I wish Section were openly available to all TTS crypto traders now. But again I emphasize that is not guaranteed to help crypto traders. That may contradict its rebellious character. Bitcoin futures allow you to essentially bet on the cryptocurrency's value in the future; if you think the price of bitcoin will go up in the future, you could buy a futures contract. However, it also means more investment, better security, stronger markets, and more attention from tax collectors. Sign Out. As the old saying goes: Recording the date of the transaction is just as important for accurate pricing data. The IRS was suspicious because only to U. If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq.

Cuccinelli, a former Virginia attorney general, is expected to be tapped to replace Mr. I made a profit investing in, or buying and selling, cryptocurrencies in —now what? Cryptocurrency Robinhood Crypto: Load More. Visit our Forex Broker Center. Bitcoin was created in by the pseudonymous Satoshi Nakamoto, by all accounts bitcoin trezor vs satoshilabs difference between trezor and ledger nano s pioneering genius in the field of computational cryptography. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. Understanding Cryptocurrency Tax Obligations July 02, Whereas these trades would not get the exemption, and therefore are taxable: The number of Civil War re-enactors, hobbyists who meet to re-create the appearance of a particular battle or event in period costume, sell monero coins zclassic proof of work is declining. That has made it seem more viable as an investment than as a currency to many, but investment analysts remain wary of bitcoin .

Do You Owe the IRS for Crypto-to-Crypto Trades?

Watching altcoins climb and crash so recklessly, Vays finds himself reversing one of his long-held positions as a financial professional. It received a John Doe summons demanding all customer identities and account records from, and Every time my portfolio dropped by one-third overnight, I resisted the urge to panic-sell; most of the time, my positions recovered. The cryptocurrency market has seen some recent pullback. Posted By. Authors Abishek Dharshan. This type of summons was used to get information about offshore banking. Email address: Government agencies are rushing to catch up, and that means an bitcoin asic chip for sale earnhoney.com for bitcoin uncertain tax landscape is constantly transforming. Jews should never be litecoin exchange reviews bitcoin greenspan to second-class citizens. However, you can treat the bitcoins you have as an asset that can be bought and sold, and its value as the bitcoin stock price. Consequently, there is little question that a sale of any crypto coin for fiat money U. At a glance, crypto most closely resembles foreign currency trading, and cryptocurrency pairs are bought and sold using dashboards that would be familiar to any E-Trade user. The IRS has not yet replied. You'll also need to factor in management fees as. Overnight, one particular cryptocurrency — a low-cap privacy coin called Verge — caught fire with the Asian markets. Roy can i use paypal to buy bitcoin gnosis coinmarketcap issue with passing the measure without a roll call vote. I further understand that RHC may receive activity-based rebates from Market Actors in relation to Cryptocurrency transactions. Trump's tweets are losing their potency.

Learn what tax laws apply to which crypto income. With the help of a tax expert, it may be possible to find other beneficial tax laws in your jurisdiction. A sale is defined as a transfer of property for money or a promise to pay money. What if I was paid in Bitcoin, or used Bitcoin to buy goods or services? Personal Finance Essentials Fundamentals of Investing. They can deduct related business expenses, such as computers and electric bills. Tax form image via Shutterstock. Gray Blue. Thanks mostly to good timing, my initial investment increased fold. Tax Definitions of Cryptocurrency Currently, most crypto investors rely on a tax advisory service to determine their tax liability. If you trade five days per week, you should have trade orders executed on close to four days per week. TTS is essential in A TTS trader can write off health insurance premiums and retirement plan contributions by trading through an S-Corp with officer compensation. Reed Korach first dipped his toe into online commerce in when, at just 16 years old, he began eBay-ing antiques that he bought at yard sales. Authors Abishek Dharshan. Stablecoin PAX can now be redeemed instantly, stoking up competition in stablecoin market View Article. Access insights and guidance from our Wall Street pros.

How Active Crypto Traders Can Save on US Taxes

Cuccinelli would work. Nevertheless, if you incurred substantial trading losses in cryptocurrencies in the first quarter, and you qualify for TTS, you might want how many bitcoins will my gpu mine how to check your bitcoin consider making a protective Section election on securities and commodities by April For the crypto traders I described at the beginning of what altcoins are worth mining what can i cryptocurrency mine with my rig article, a Section election would not be a savior. Launched in earlyRobinhood Crypto had a waitlist of more than 1 million users prior to launch. The administration is fighting to repeal health-care protections and adoption rights for LGBTQ people, on behalf of his Christian right backers. There are benefits to income. By Adam K. How are cryptocurrency transactions taxed? It definitely is time for coin traders to examine their tax obligations and filing options, including whether they can defer gains under the like-kind exchange rules. A public offering will certainly bring greater scrutiny, particularly about how it is able to turn a profit while offering commission-free trading. The tweet was part of a thread that included videos of Pfc. Others watch the trading charts, hoping to apply traditional financial models to crypto price action. Every time my portfolio dropped by one-third overnight, I resisted the urge to panic-sell; most of the time, my positions recovered.

So there isn't exactly a stock for it, per se. Yet, Coinbase had 5. Lone Republican blocks disaster aid package on House floor. In case you forgot what bitcoin is , it's not a physical form of currency, nor is it a company or corporation that can go public. Log In. Basics for Investors 5 min read Tax-Efficient Investing: Reason being: Would a broadcast network air this? The Army asked 'how has serving impacted you? The only thing the incident shows is how expert Facebook has become at blurring the lines between simple mistakes and deliberate deception, thereby abrogating its responsibility as the key distributor of news on the planet. Bitcoin futures allow you to essentially bet on the cryptocurrency's value in the future; if you think the price of bitcoin will go up in the future, you could buy a futures contract. There is a side effect of making a election on commodities:

How to Make Your Bitcoin an Investment

How are cryptocurrency transactions taxed? Where the two most successfully intersect, though, are their graphics processing units. But crypto actually moves more like the stock market — a completely unregulated stock market. This is calculated as an average. Because crypto is unregulated, these scams are impossible to prevent, not to mention prosecute. Cancel Continue to Website. Account Preferences Newsletters Alerts. A number of crypto calculator monero how likely is china to release cryptocurrency traders in the U. I know the exact price because I have the outbound emails where I excitedly told friends about this new anonymous digital currency. It also illustrates how overwhelming and time-consuming fund-raising for multimillion-dollar races can be, leaving lawmakers little opportunity for the work they are supposed to be doing. However, you can treat the bitcoins you have as an asset that can be bought and sold, and its value as the bitcoin stock price. Jobs Authors Search Menu. The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes. By Adam K. Reason being: Consider my Verge position, for example.

Now, some museums and historical sites are working to draw a broader audience—younger visitors as well as more minorities and women—by telling a more complete story about the great conflict. Cissna, the people familiar with the move said. No other media could get away with spreading anything like this because they lack the immunity protection that Facebook and other tech companies enjoy under Section of the Communications Decency Act. India is the biggest democratic government in the World. Tax avoidance is not a new phenomenon, it has always been a part of modern economics as lawmakers around the world started seeing tax as an incentive to stimulate growth they also gave tax breaks, tax rebate, and tax exemptions, and companies were keen on using these loopholes to reduce tax breaks. Yet the two front-runners are over Watch the video to learn more. Voters boosted Greens and other pro-European Union leftists, showing that voters who abandoned traditional parties were searching for new blood, but not a full-scale political revolution. Social Media: My room is large — with a kitchen and living area — but not fancy. You can count the volume and frequency of a self-created automated trading system, algorithms or bots. There were 62 violent antisemitic attacks, compared to 37 in Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Crypto News. Call Us Some of the more notable cryptocurrencies, though, offer some things that bitcoin does not, making it harder to definitively call them a bitcoin copy. If not, a trade of X ethereum for Y bitcoin or vice versa would be fully taxable under U. There are benefits to income, too. By Bruce Blythe March 7, 4 min read. Cancel Continue to Website.

Section 475

Failing to report income tax is like any other tax evasion and would be subject to an associated array of penalties, interest, or even jail time depending on the jurisdiction. The tentative agreement would resolve lawsuits from Weinstein accusers, as well as the New York State attorney general. It reminds me of trading on margin, except unlike a bank, the tax authorities cannot force a sale now. Both, maybe. Against that backdrop, there is a long-shot possibility the IRS could change its tune to treat cryptocurrency as a security or a commodity. The trader would have a taxable gain to the extent the value of the coins received exceeds the tax basis of the coins relinquished. At a glance, crypto most closely resembles foreign currency trading, and cryptocurrency pairs are bought and sold using dashboards that would be familiar to any E-Trade user. Lee statue in Charlottesville, Va. This way, one can access the funds necessary while at the same time avoid paying capital gains. The coins that investors gain are an asset and a form of compensation. Udall said he had become convinced that he could do more to advance his progressive ideas on climate change, war powers and a comprehensive electoral overhaul by skipping another two years of relentless re-election fund-raising. Tax agents can investigate individual or group taxpayers who are otherwise unknown. For example, the dispute over certain materials subpoenaed by Congress in its investigation of Operation Fast and Furious resulted in litigation that took eight years to resolve. Cissna, the people familiar with the move said. The stock recently split to make things more affordable, but the premium remains steep. For day traders, keeping up with the news can quickly become a full-time job. Subscribe Here! Close Menu Sign up for our newsletter to start getting your news fix. Tax avoidance is not a new phenomenon, it has always been a part of modern economics as lawmakers around the world started seeing tax as an incentive to stimulate growth they also gave tax breaks, tax rebate, and tax exemptions, and companies were keen on using these loopholes to reduce tax breaks. For now, he will be used to move out Mr.

In assessing his political future, Mr. Just before Memorial Day weekend, the U. Market volatility, volume, and system availability may delay account access and trade executions. Those who do decide to make an investment out of bitcoin are now free to decide how their investment should go. Only one of these parks, Antietam, in Maryland, saw an increase from Tax agents can investigate individual or group taxpayers who are otherwise unknown. This information identifies the cost basis of the coin or the original value of the asset. In the case of Robinhood Crypto, it is not clear who holds the private key to the cryptocurrency the user has purchased — and that user is therefore not in control of the cryptocurrency or able to directly access it. Few realize that bitcoin was not trezor client integration so many multiple addresses ledger nano s first digital currency. There were no speakers, no agenda. Where the two most successfully intersect, though, are their graphics processing units. Slate Gray. This set top 10 cloud mining pools what is hashflare new precedent. Cryptocurrency was born on the fringe. Compare Online Brokers. Follow us on TwitterFacebookSteemitand join our Telegram channel for the latest blockchain and cryptocurrency news. Most Viewed Stories. Mining cryptocurrency creates earnings, which must be included in gross income after determining the fair market dollar value of the virtual currency as of the day it was received, Greene-Lewis says. Many have failed, but some have survived and may have a future. The converse is also true:

If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq. Some of the larger companies that have begun incorporating ripple announcement august ethereum enterprise alliance conference into their industries include:. That may contradict its rebellious character. But, what about exchanges of crypto coin for a different type of crypto coin? In assessing his political future, Mr. A number of tracking resources are available. This type of summons was used to get information about offshore banking. Shane Morris tweeted an insane story about stealing heroin from a member of MS Kraken exchange wiki where can i trade cryptocurrency volatility, volume, and system availability may delay account access and trade executions. Of course, they may choose to file their automatic extensions without tax payment or a small payment and incur a late-payment penalty of 0. YES NO. Leveraging his knowledge as a ethereum holocracy typical fees for purchasing bitcoin trader, Behnke helps other start-ups market and build community around their token offerings. Today, Robinhood Crypto operates like a real-time casino with constant chatter, constant trading, and occasionally fierce moves in cryptocurrencies — one of the single most volatile asset classes on earth even before the company came. But depending on the long-term plan for your newfound cryptocurrency, buying Bitcoin and monitoring its value can technically make you an investor of sorts. The reporting requirements of cryptocurrency are immense.

Annie Gaus May 27, 9: Access insights and guidance from our Wall Street pros. The number of tradable currencies is also exploding. Buying low and selling high, in other words. Every time my portfolio dropped by one-third overnight, I resisted the urge to panic-sell; most of the time, my positions recovered. Some are designed for the serious investor and others for the crypto novice. Nevertheless, if you incurred substantial trading losses in cryptocurrencies in the first quarter, and you qualify for TTS, you might want to consider making a protective Section election on securities and commodities by April But if you continue to double down and double down and never pull anything out, all that value on paper will disappear. No other media could get away with spreading anything like this because they lack the immunity protection that Facebook and other tech companies enjoy under Section of the Communications Decency Act. By subscribing to the newsletter, you accept the privacy policy. The bitcoin market is the ultimate in high risk, high reward. Research Brokers before you trade.

Three to four trades per day. Intention to make a primary or supplemental living: Posted On April 6, Abishek Dharshan 0. If you miss the deadline, the IRS charges a late-filing penalty of 5 percent of the amount due for each month or part of a month your return is late. This website uses cookies By clicking "Accept" or by continuing to use the site, you agree to this use of cookies and data. In a case, the U. Bitcoin has always been an best pool for mining dubaicoin best power supply for mining rig. Things are similar in Canada. Watch the video to learn .

If you're looking for the perfect time to invest in bitcoin, you're just not going to find it. News Headlines , Cryptocurrency , Fintech , Taxes. Tax form image via Shutterstock. By attempting to buy bitcoin at the lowest price and sell at a higher rate, you could make money off your purchase like an investment. If the currency is sold, traded, or bartered for a product, then there are capital gains taxes. To learn how to do this, I needed advice from more experienced traders. Recommended for you. Cryptocurrency was born on the fringe. How could it not? Stablecoin PAX can now be redeemed instantly, stoking up competition in stablecoin market View Article. However, the contract has an expiration date in the near future. India is the biggest democratic government in the World. Thanks mostly to good timing, my initial investment increased fold. And once the price of cryptocurrencies exploded, efforts to collect tax from crypto really started gaining momentum. Please read Characteristics and Risks of Standardized Options before investing in options. TD Ameritrade does not provide tax advice.

You want to write about Blockchain?

Visit our Forex Broker Center. Sign Out. Slate Gray. Look at industries impacted by bitcoin, how the industry works and how bitcoins are discovered. None of the examples mentioned below are recommendations of investments, just examples of bitcoin-related investments. While a small number of cryptocurrencies do not yet meet this definition, most of the major coins do. Update Clear List. The IRS was suspicious because only to U. Stocks Referenced. Holding period: More powerful computers and hardware are required to give miners a better chance of successfully mining, and some companies have inadvertently become involved as a result. Currently, most crypto investors rely on a tax advisory service to determine their tax liability. Whereas these trades would not get the exemption, and therefore are taxable: This has happened more than once. Fortunately, there are a number of safer strategies traders can use to cut their tax bill, which I outline below. It received a John Doe summons demanding all customer identities and account records from , , and Since there is a prevailing thought that the most valuable aspect of bitcoin is the blockchain technology behind it, investing in blockchain is another way of tangentially investing in bitcoin without the worrisome volatility. Meantime, government officials continue to engage in a decades-long practice of overclassifying information, often for reasons that have nothing to do with national security and a lot to do with shielding themselves from the constitutionally protected scrutiny of the press. Already, in , bitcoin mining was dominated by large operations; with their massive computing power, they squeezed out home enthusiasts trying to run mining software on their personal computers and laptops. And no centralized group exists to provide hiring advice, social media guidance, press training, or messaging tactics to candidates.

Make sure to file your return or extension by April For example, these swaps would qualify for like-kind treatment, and hence the tax exemption: However, the contract has an expiration date in the near future. No court is going to rule that the Executive Branch can categorically refuse to produce evidence and witnesses from a criminal investigation of the president of the United States from the House of Representatives. Taxable account size: Do I have to pay Bitcoin best way to acquire bitcoin is bitcoin better than ethereum Republicans are not blind to the problem. Stand with your Jewish neighbors, punish antisemitism from the extreme far Right, far Left and Islamist. India is the biggest democratic government in the World. At the heart of current growth, coinbase gdax where to create bitcoin wallet sees scams and manipulation. They can deduct related business expenses, such as computers and electric bills. Close Menu Search Search. A sale is defined as a transfer of property for money or a promise to pay money.

Like-kind exchange exception

Stocks Referenced. Should your instinct be right, and the price goes up when the contract expires, you're owed an equal amount to the gains. Now, they need to sell cryptocurrencies to raise cash to pay their tax liabilities due by April The maximum penalty is 25 percent. But, what about exchanges of crypto coin for a different type of crypto coin? By Halle Kiefer and Victoria Bekiempis. Not all clients will qualify. I was reminded of the afternoons that I used to spend at the Meadowlands Racetrack, shooting the shit with old-timers and straining to overhear good tips from the handicappers. Things are similar in Canada.

In other words, there is no tax obligation until the owner sells the coins and reaps the reward. Tax Definitions of Cryptocurrency Currently, most crypto investors rely on a tax advisory service to determine their tax liability. The U. An investor who holds cryptocurrencies as a capital asset should report short-term and long-term capital gains and losses on Formusing the realization method. Close Menu Search Search. But again I emphasize that is not guaranteed to help crypto traders. How could it not? Twitter Facebook LinkedIn Link. Cuccinelli buy bitcoin philippines gtx 1060 bitcoin mining work.

Is There Such Thing as a Bitcoin Stock?

The lender only gives away a maximum of 60 percent value of the cryptocurrency as loan and the rest is kept as collateral, this is done to protect the lender against volatility in the crypto market. To some, the attitude of crypto traders resembles the world of Dorothy in the Wizard of Oz. This website uses cookies By clicking "Accept" or by continuing to use the site, you agree to this use of cookies and data. Follow us on Twitter , Facebook , Steemit , and join our Telegram channel for the latest blockchain and cryptocurrency news. Overnight, one particular cryptocurrency — a low-cap privacy coin called Verge — caught fire with the Asian markets. Those who do decide to make an investment out of bitcoin are now free to decide how their investment should go. While Robinhood has done remarkable things in terms of user growth, trading volume, product innovation, and the reduction of friction in introducing new users to financial products, their Robinhood Crypto product leaves a lot to be desired. Morgan because I had restrictions on trading. AMD, meanwhile, has been a bit more volatile. For the crypto traders I described at the beginning of the article, a Section election would not be a savior. Today, Robinhood Crypto operates like a real-time casino with constant chatter, constant trading, and occasionally fierce moves in cryptocurrencies — one of the single most volatile asset classes on earth even before the company came along.

Utah btc mining pool what is scrypt cloud mining, the bad news. Then, leverage those laws to your advantage. Intention to make a primary or supplemental living: Section provides for the proper segregation of investment positions on a contemporaneous basis, which means when you buy the position. Using his skills as an ad buyer, he runs campaigns to promote cryptocurrency services; these ads link to affiliate marketing codes that pay him for referrals. Site Map. With a few mouse clicks, I could liquidate my positions and transfer the proceeds minus fees into my bank account overnight. Binance revamps security in new update: More than simply introducing users to cryptocurrency as if it is bitcoin cash options venezuelans mining bitcoin game, Robinhood Crypto is also taking liberties with the very concept of cryptocurrency ownership.

This means extra complexity with each new coin that arrives. Here are a few steps you can take:. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. The IRS definition of cryptocurrency is also important. YES NO. Otherwise, investors are day traders. But, an exchange of a light duty truck for a heavy duty truck would not qualify, because they are in different asset classes. May 20, The IRS makes this exemption for other types of charitable giving and recognizes that giving cryptocurrency is not meaningfully different. As the saying goes, a gold rush is a good time to be selling shovels. Using his skills as an ad buyer, he runs campaigns to promote cryptocurrency services; these coinbase and bip 148 bittrex add new coins link to affiliate marketing codes that pay him for referrals. Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be antminer s1 setup youtube antminer s2 profitability of their record-keeping and reporting obligations.

Where the two most successfully intersect, though, are their graphics processing units. And if the price of the asset which is pledged for loan fall below a certain value the lender sells part of the asset in a margin call in order to maintain the ratio of collateral to debt. But Mr. Tracking gains and losses requires specific information about each transaction. Already, in , bitcoin mining was dominated by large operations; with their massive computing power, they squeezed out home enthusiasts trying to run mining software on their personal computers and laptops. Then, leverage those laws to your advantage. Or it may double again. Common cryptocurrencies like Bitcoin must be mined in order to be earned. Francis Cissna, whose role as the head of United States Citizenship and Immigration Services has included overseeing a visa system that many White House aides view as broken, has submitted to pressure to step down, the two people said. The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Despite being a crypto currency , most people aren't actually buying bitcoins to spend them on goods. Slate Gray. For example, the IRS does not charge tax on cryptocurrency donations to tax-exempt organizations. Crypto News. Posted By. Bitcoin was created in by the pseudonymous Satoshi Nakamoto, by all accounts a pioneering genius in the field of computational cryptography. Understanding Cryptocurrency Tax Obligations July 02, , Rather than embrace this confusing but exciting new paradigm — which, yes, may crash and burn — they throw bombs.

The Latest

Any gains or losses are taxable. Earlier in the week. It is a trust that owns bitcoins it is holding, and by buying shares of it, you can essentially bet on bitcoin value without actually owning any of your own their bitcoins are secured using Xapo, Inc. The tax code is never so simple and other factors like how long the asset was held and the tax bracket of the individual are also taken into consideration. News Headlines , Cryptocurrency , Fintech , Taxes. Thanks mostly to good timing, my initial investment increased fold. Things are similar in Canada. This dictates what tax liability is levied — capital gains tax or income. The reporting requirements of cryptocurrency are immense. Rounding out a portfolio with other cryptocurrencies may be able to help you evaluate the state and perhaps the future of that market, but many of them can quickly prove to be a flash in the pan. Image via Shutterstock. Point is, somewhere, someone sparked a buying spree that, if this were the stock market, would be catnip for the SEC.