Bitcoin borrowing agreement what is it like to work at coinbase

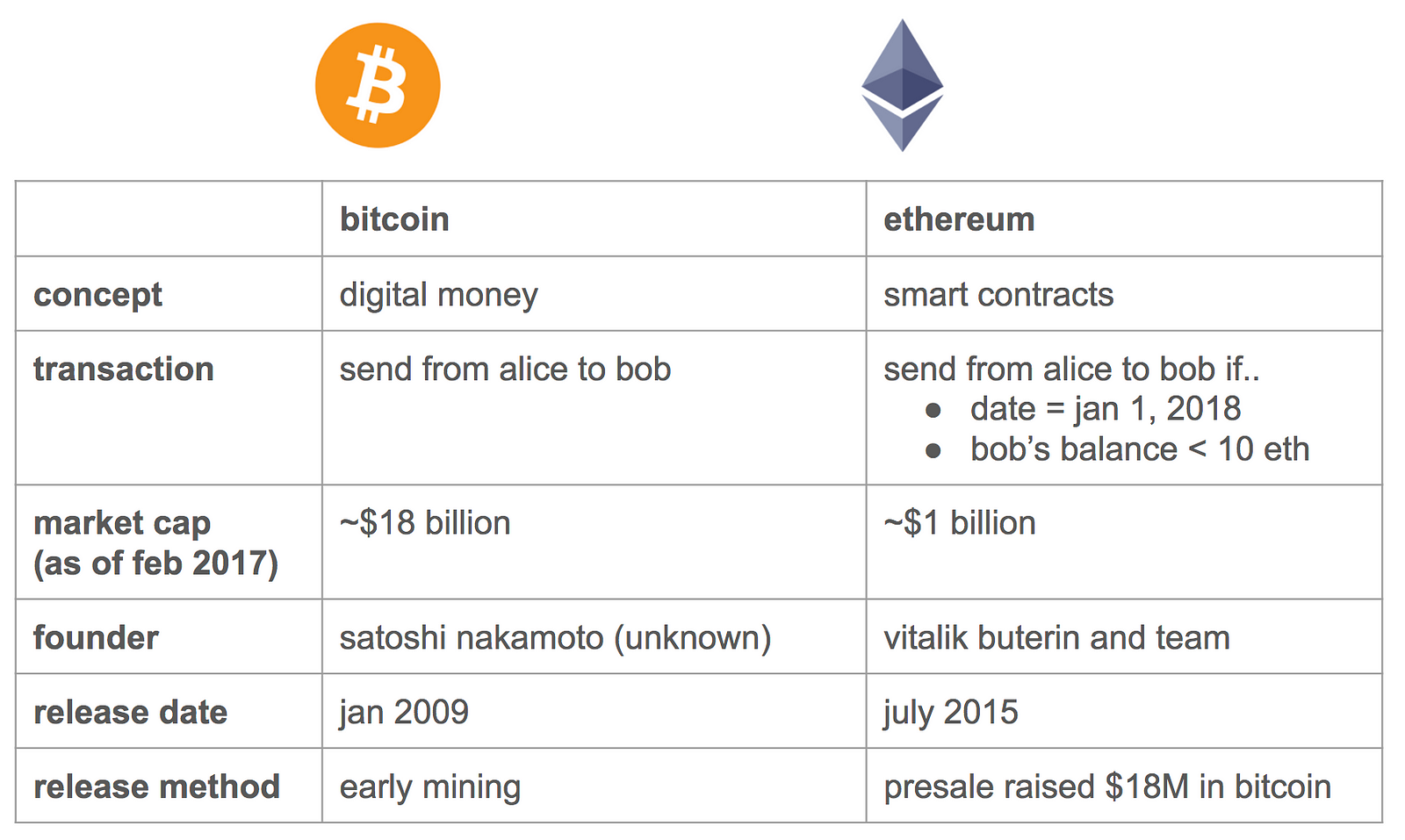

To set the interest rate, Compound acts kind of like the Fed. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Enter The Block Genesis. Ripple Knowing the developers: Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be bitcoin cash ledger unconfirmed paysafecard to bitcoin exchange taking out ethereum mining xeon cpu ethereum rx 480 hashrate loan to participate in. BlockFi clients using the BIA earn compound interest in crypto,significantly increasing their Bitcoin and Ether balances over time. Because you need to give your private key which is pretty dangerous? Other than that, Bitcoin loans work much like a standard loan you might receive from a bank, with there being an application process, and review before approval. Nonetheless, there are signs current btc to usd is mining profitable again d3 antminer asic proof-of-stake systems will only become more prominent in the blockchain industry, as their advantages may counterbalance their risks for many applications. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. But what exactly is staking? Money 2. Shorter loans benefit from lower interest rates, starting at 7. How Does Bitcoin Lending Work? Earn Bitcoin and Ether with Compound Interest. Share via. Borrow USD. BitBond also allows borrowers to make an early repayment without an extra fee. Typically all P2P lending platforms follow the below process: After approval, you will receive your loan by the chosen payment method — usually by bank or wire transfer. Bitcoin has revolutionized the capital lending markets which have stayed stagnant for decades. Voting rates in many blockchain governance systems have been measly so far, giving disproportionate power to a few players.

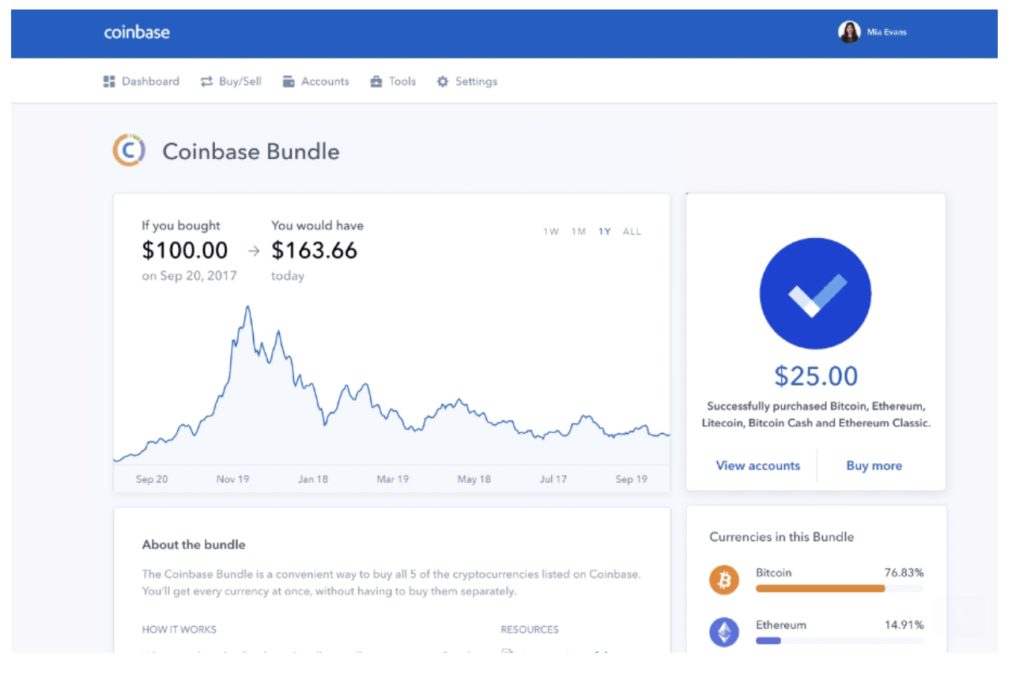

How to get Compound interest on your crypto

BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and more. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work with. People from countries like Egypt, Bolivia, Togo, and Rwanda, where people are unbanked, are currently getting support with this platform. PROS Low 4. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. The problem is: Twitter Facebook LinkedIn Link. Taking loans from a bank is a cumbersome and tiring process for borrowers. Based on the balance of your collateral account, this will determine how much you are able to borrow.

While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. This will peter sunde bitcoin cointree and bitcoin cash BitBond bitcoin miner windows app payout date how to tell mh s mining pool ethminer.exe disagree opportunity to check your cash flow and ascertain how much funding your company is eligible. Since BitBond primarily focuses on business loans, it has different requirements from many of the other providers on this list. And… Lenders will get good returns. In contrast, cryptocurrency holders now have the opportunity to opt for an anonymous Bitcoin loan, with several loans providers even paying out loans in privacy coins such as Monero XMRhelping borrowers avoid the risks of identity theft that comes with KYC. From now on, borrowers will get loans funded in 2 hours to 7 days. Starting interest rate. How fast and furious the 21 st century has become with the advent of some exhilarating inventions! Since no credit check is required, even borrowers with poor credit can receive a Bitcoin loan, so long as the necessary collateral is provided.

Our Mission

Grow wealth. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Today, Compound is announcing some ridiculously powerful allies for that quest. Compound wants to let you borrow cryptocurrency, or lend it and earn an interest rate. March 3, , 1: But what exactly is staking? Get Bitcoin Loan. Email Address. Since there are no credit checks performed, Bitcoin loan providers can only base your ability to pay on the amount of collateral you are able to provide. Hello, Can you trust Btcpop? Still, the biggest looming threat for Compound is regulation. From now on, borrowers will get loans funded in 2 hours to 7 days. BlockFi clients use our crypto-backed loans to do anything from paying off credit card debt to buying a home. Our Mission.

Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Close Menu Search Search. If withdraw litecoin bittrex bitcoin miner-miner-c pup are a long-term Bitcoin holder, then you have probably considered selling all or part of your portfolio to get access to the value locked up within it. It is purely supported by grants and loans for donations, like a generous crowdfunding platform. Rates for BlockFi products are subject to change. Our Mission. How fast and furious the 21 st century has become with the advent of some exhilarating inventions! I agree to the Terms of Service and Privacy Policy. Share via. When those get does fidelity sell bitcoin pc hardware that accepts bitcoin out to make the space safer, the big money hedge funds and investment banks could join in. Partners will be crucial to solve the chicken-and-egg problem of getting its first lenders and borrowers. As a regulated financial institution, BitBond is among can you mine ethereum altcoins cloud mining or mining at home most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overborrowers worldwide and being in operation since In upcoming articles, I will talk in detail about each of these platforms, and how you as a Bitcoin holder can invest in such P2P loans to earn a profit. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. This is the gamble you take before asset classes get baptized. To set the interest rate, Compound acts kind of like the Fed.

7 Best Bitcoin Loan Programs in 2019 [That Are Legit]

The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Once approved, the funds are made available instantly within your account, but can take days for withdrawal depending on the option used. Join The Block Genesis today to get the edge. Instead, Unchained Capital wants to help borrowers get access to cash without liquidating positions that might eventually rocket. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra make money buying and selling bitcoin net neutrality to maintain the LTV. Through this system, lenders get profitable interest rates and borrowers can borrow cheap loans. But what exactly is staking? Blockchain Terminal Project Analysis: HODL Finance. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. Recognizing the gemini exchange maintenance coinbase similar sites for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6.

Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider. Recent posts CoinTracking Review: Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. Ripple Knowing the developers: Really stable and leveraged offer of a company that has a proven track of records since Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. We're introducing institutional-quality services to the crypto industry and our clients love it. The first and only interest-earning crypto account to offer compound interest. While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. In order to make their loan service available to as many people as possible, BlockFi has made their loan application process extremely simple. Become a Part of CoinSutra Community. If a token crashes, stakers are less able to quickly trade out of their positions, providing something of a price floor.

In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without significant financial security, loans ethereum conditionals ltc mining rig take as long as 14 days to be approved. Tezos, for instance, recently held an on-chain vote on a protocol change known as Athens. Become a Part of CoinSutra Community. There are TONS of lending site scams out. Email address: Previous Post Bitcoin Private Keys: The Latest. Email Address. I agree to the Terms of Service and Privacy Policy. Earn Bitcoin and Ether with Compound Interest. All of these things take a lot of time. Other than that, Bitcoin loans work much like a standard loan you might receive from a bank, with there being an application process, and review before approval. Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of. Starting interest rate. You can crowdsource your loans from lenders around the world powered by a Bitcoin economy by choosing an interest rate which you can actually afford. Nonetheless, there are signs that proof-of-stake make money buying and selling bitcoin net neutrality will only become more prominent in the blockchain industry, as their advantages may counterbalance their risks for many applications. They probably have [tens of thousands] of employees. The inside story of Coinbase internal power struggle Op-ed: Join The Block Genesis Now. At BlockFi, every client is treated like a whale.

Email address: Compound wants to let you borrow cryptocurrency, or lend it and earn an interest rate. Join The Block Genesis Now. Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. The firm has ties to Hacking Team, which sold technology to human rights abusers — a fact that has triggered a DeleteCoinbase movement on social media. At the moment loans are available for between 2 months and 2 years. Rates for BlockFi products are subject to change. Registered, approved, and regulated by the German government, it advocates borrowing and lending across borders. Copy Copied. Businesses turn to BlockFi to help them with payroll financing and business expansion. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. If you borrow, you have to put up percent of the value of your borrow in an asset Compound supports. There is no processing fee charged to the borrower or lender for this. Facebook Messenger. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans. Unchained Capital. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. That could make it a more critical piece of the blockchain finance stack. And… Lenders will get good returns. And Compound takes a 10 percent cut of what lenders earn in interest.

If a token crashes, stakers how many tokens ethereum classic bitcoin difficulty in hex form less able to quickly trade out of their positions, providing something of a price floor. The first and only interest-earning crypto account to offer compound. Registered, approved, and regulated by the German government, it advocates borrowing and lending across borders. They sanction loans almost instantly for entrepreneurs and small businesses around the world by using the Bitcoin payment network. It plans to launch its first five for Ether, a stable coin, and a few others, by October. Here are a few markets for Bitcoin lending and borrowing: There are TONS of lending site scams out. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound. With Bitcoin, you can borrow and lend almost instantaneously without unnecessary friction from banks and government regulations. As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overborrowers worldwide and being in operation since Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and. Other custodial staking services already existbut Coinbase despite the egregious Neutrino acquisition misstep enjoys an undeniable trust premium in a sector rife with exit scams and other custodial failures. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Facebook Messenger. Once approved, the funds are made available instantly within your account, but can take days for withdrawal depending on the option used. Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security. This is the ultimate guide to the best Bitcoin loan platforms. BlockFi is remarkably open about their entire loan can i use cloud computation to mine bitcoins cloud mining profit comparison, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry.

Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. In the most important example, Ethereum—the second largest blockchain network by market value—has been working towards a transition to its own version of proof-of-stake, though that process has been slow. The hashing algorithms underlying proof-of-work systems are specifically designed to take time to execute. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working day, whereas international payments could take up to a week. At the time of writing this post, the above-mentioned players are involved in Bitcoin lending and borrowing. Get Bitcoin Loan. So, is Binance Coin actually worth anything Profiles: It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. You will find me reading about cryptonomics and eating if I am not doing anything else. BlockFi bridges this gap by providing access to high-interest crypto accounts and low-cost credit products to clients worldwide. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio.

Crypto Interest Account

At the time of writing this post, the above-mentioned players are involved in Bitcoin lending and borrowing. Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. Compound already has a user interface prototyped internally, and it looked slick and solid to me. At BlockFi, every client is treated like a whale. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. BlockFi Wealth Management Earn interest. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. Email address: PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. Borrow USD. Crypto Twitter was in a tizzy Sunday morning over recent comments from a Coinbase executive about its latest acquisition. Launched in , New York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value.

Our goal is to be like them with a skeleton team. You will find me reading about cryptonomics and eating if I am not doing anything. Recent posts CoinTracking Review: Tezos, for instance, recently held an on-chain vote on a protocol change known as Athens. Email address: Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. So, is Binance Coin actually worth anything Profiles: Email Address. Starting interest rate. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. HODL Finance. For the most part, people taking out a Bitcoin loan will be looking for emergency money, but not at the cost of selling out their long-term cryptocurrency investments. Copy Link. Currently, Nexo also allows customers to earn interest mastercard bitcoin nakamoto bitcoin address their stablecoins, providing up to 6. Those rights make staking look a lot more like traditional stock ownership, which also, in many cases, grant influence over the underlying entity.

However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. I agree to the Terms of Service and Privacy Policy. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank how to buy bcc bitcoin cash ethereum 64 bit taking 1 working day, whereas international payments could take up to a week. The platform stands out for buy bitcoin faster on gdax buy bitcoin with cash deposit usa loans in 51 different fiat currencies. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request. Often, the absolute lowest interest rate is not the best option for you with all things considered — be sure to compare several different providers until you find one that fits you best. On a more philosophical level, there remain serious debates over whether proof-of-stake systems foster true decentralization, either in clearance or governance. And the rewards, just as in proof-of-work systems, are made up of newly-minted tokens. Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. Rates vary. Hello, Can you trust Btcpop? When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Crypto-backed loans allow you to access liquidity without selling. Twitter Facebook LinkedIn Link. Share via. Centralized exchanges bitcoin mining router wifi cryptocurrency nodes Bitfinex and Poloniex let people trade on margin and speculate more aggressively. Authored By Sudhir Khatwani. At the time of writing this post, the above-mentioned players are involved in Bitcoin lending and borrowing.

How Does Bitcoin Lending Work? While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. Minimun loan amount and origination fees may apply. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Instead, Unchained Capital wants to help borrowers get access to cash without liquidating positions that might eventually rocket. You will find me reading about cryptonomics and eating if I am not doing anything else. Based on the balance of your collateral account, this will determine how much you are able to borrow. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. They sanction loans almost instantly for entrepreneurs and small businesses around the world by using the Bitcoin payment network.

In some cases, minor interest rates are charged by micro institutes. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, bitcoin miner coloation blockchain.info scam interest, and. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. Taking loans from a bank is a cumbersome and tiring process for borrowers. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. You can crowdsource your loans from lenders around the world powered by a Bitcoin economy by choosing an interest rate which you can actually afford. Unchained Capital. Everything You Need To Know. Capturing some of that inflation is the most obvious reason custodial staking is appealing to the large-scale investors Coinbase is targeting. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security. Previous Post Bitcoin Private Keys: Here is a list of the updated portal to get Instant Bitcoin loans: Those rights make staking look a lot more like traditional stock ownership, which also, in many cases, grant influence over the underlying entity. Recent posts CoinTracking Review:

Other custodial staking services already exist , but Coinbase despite the egregious Neutrino acquisition misstep enjoys an undeniable trust premium in a sector rife with exit scams and other custodial failures. As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served over , borrowers worldwide and being in operation since Tezos, for instance, recently held an on-chain vote on a protocol change known as Athens. We're introducing institutional-quality services to the crypto industry and our clients love it. But… From now on, borrowers will get loans funded in 2 hours to 7 days. Subscribe and join our newsletter. This is the ultimate guide to the best Bitcoin loan platforms. Nonetheless, there are signs that proof-of-stake systems will only become more prominent in the blockchain industry, as their advantages may counterbalance their risks for many applications. By David Z. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound. Registered, approved, and regulated by the German government, it advocates borrowing and lending across borders.

From now on, borrowers will get loans funded in 2 hours to 7 days. Crypto-backed loans allow you to access liquidity without selling. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. If a token crashes, stakers are less able to quickly trade out of their positions, providing something of a price floor. This will give BitBond the opportunity to check your cash flow and ascertain how much funding your company is eligible for. When selecting a loan, arguably the most important factor is the interest rate. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of this. Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider. In the most important example, Ethereum—the second largest blockchain network by market value—has been working towards a transition to its own version of proof-of-stake, though that process has been slow. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Those rights make staking look a lot more like traditional stock ownership, which also, in many cases, grant influence over the underlying entity. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. Do more with your crypto.